Study finds the top 5 bachelor's degrees that pay off — and 5 that don't

A new study from the Texas Policy Center examined the college degrees that have the most potential for paying off — and which ones leave students saddled with unmanageable student loan debt. Here's how to find student loan debt relief. (iStock)

Many students see higher education as an investment in the future. While certain college degrees pay off in the form of higher earnings, that's not always true.

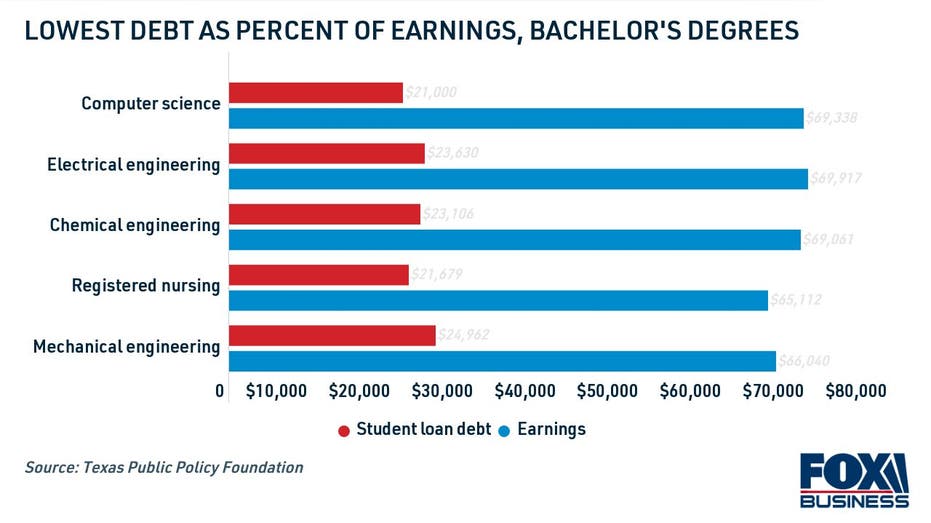

A recent study by Dr. Andrew Gillen of the Texas Policy Center compared the average student loan debt of recent graduates to their salaries upon graduation. The purpose of the analysis was to provide clear economic guidance for rising college students who are choosing a field of study.

As expected, some of the most profitable Bachelor's degrees were in the science, engineering and medical fields. Here are the top five undergraduate degrees that pay off with high earnings:

- Computer Science

- Electrical, Electronics and Communications Engineering

- Chemical Engineering

- Registered Nursing, Nursing Administration, Nursing Research and Clinical Nursing

- Mechanical Engineering

A degree in computer science took the top spot for profitability, with graduates earning nearly $70,000 annually while paying off $21,000 worth of federal student loan debt.

EVICTION MORATORIUM UPDATE: WARREN, DEMOCRATS INTRODUCE BILL AIMED AT EXTENDING BAN

In addition to examining the fields of study that lead to higher salaries, Gillen also discovered the degrees with the lowest earning potential in relation to student loan debt:

- Drama/Theatre Arts and Stagecraft

- Film/Video and Photographic Arts

- Fine and Studio Arts

- Music

- Psychology, General

Most of the undergraduate degrees that lead to the lowest salaries are in the fine arts, with the exception of psychology. Students who graduated with a general psychology degree made under $30,000, despite choosing a medical field of study. One possibility is that aspiring psychologists never went on to earn their graduate degrees, which are necessary to practice in the field.

WHAT TO DO IF YOUR STUDENT LOAN SERVICER IS SHUTTING DOWN

It can feel like an impossible task to pay off your student loans on a paltry salary, but you have options for taking control of your student debt. If you're searching for student loan debt relief, consider your options like deferment, student loan forgiveness programs and refinancing.

Visit Credible to learn more about how to manage student loan debt and compare refinancing offers without impacting your credit score.

EDUCATION DEPARTMENT EXTENDS $1B OF ADDITIONAL STUDENT LOAN DEBT CANCELLATION

What to do if you can't afford your student loans

Student loan payments can keep borrowers from achieving their financial goals. A recent study found that 35% of millennials say their student loan debt is preventing them from buying a house.

Here are a few student loan debt relief options, so you can start working on other aspects of your financial well-being.

WHAT ARE THE FEDERAL STUDENT DEBT LIMITS FOR THE 2021-22 SCHOOL YEAR?

Apply for forbearance or income-driven repayment

Federal student loans are in administrative forbearance through January 2022, thanks to a "final extension" from the Biden administration. Interest doesn't accrue during this time, and there are no penalties for failing to make payments. But since this deferment period is set to expire in just a few months, here are some things you can do to prepare:

- Enroll in income-driven repayment (IDR). Federal student loan borrowers may be able to reduce their monthly payments to 10-20% of their disposable income by enrolling in an IDR plan on the Federal Student Aid (FSA) website.

- Apply for additional federal forbearance. If you're not ready for federal student loan payments to resume in February 2022, apply for up to 36 months of additional forbearance through unemployment deferment or economic hardship deferment.

- Reach out to your private student loan lender. Borrowers with private student loan debt can consider reaching out to their lender to ask about forbearance programs to temporarily pause payments. Keep in mind that eligibility requirements vary, and interest may accrue during this period.

Now is the time to get your finances in order before the federal student loan payment pause ends. Also make sure that your student loans are on autopay, so that you don't risk missing a payment when forbearance expires.

BIDEN ADMINISTRATION LAUNCHES INQUIRY INTO PUBLIC SERVICE LOAN FORGIVENESS PROGRAM

Refinance your student loan debt

Student loan refinancing is when you take out a new student loan with better terms to repay your current one. Refinancing to a lower interest rate can help you pay off debt faster, lower your monthly payment and even save money over time.

If you're struggling to repay your private student loans, consider refinancing to a longer-term loan to spread your payments over a longer period of time. Creditworthy borrowers who used Credible's marketplace to refinance to a longer-term loan on Credible were able to lower their payments by more than $250 without adding to overall interest charges.

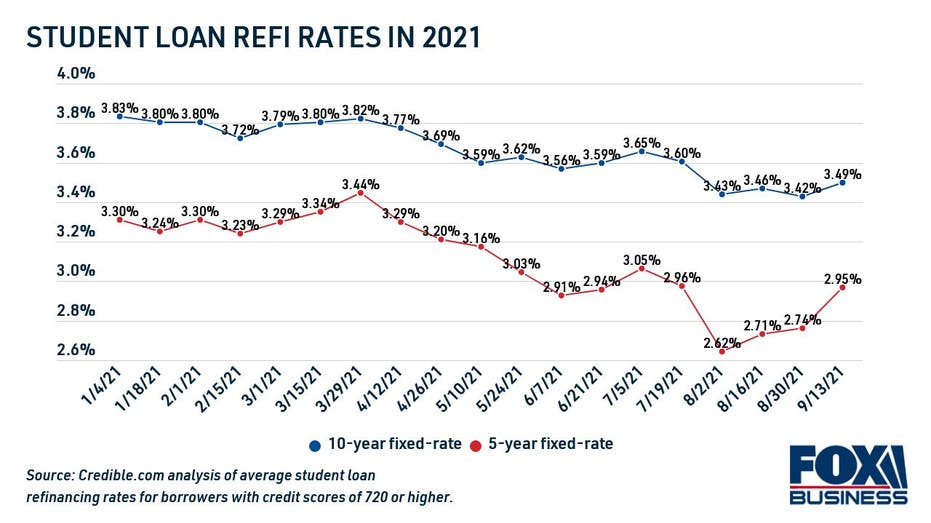

Student loan refinance rates are currently near all-time lows, according to data from Credible, which makes it a great time to refinance your private student loans to a lower interest rate.

WILL BIDEN CANCEL STUDENT DEBT WITH AN EXECUTIVE ORDER?

Federal student loan borrowers should know that refinancing to a private loan will make you ineligible for certain federal aid programs, including income-driven repayment, COVID-19 forbearance and student loan forgiveness programs.

Browse student loan rates from real private lenders in the table below, and visit Credible to see offers that are tailored to you. Use a student loan refinance calculator to see if a repayment plan is the right option for you.

98% OF PSLF PROGRAM APPLICATIONS REJECTED: WHAT TO DO WITH YOUR COLLEGE DEBT

Research student loan forgiveness programs

The Department of Education has issued $9.5 billion worth of federal student loan forgiveness since President Biden took office. Among them, borrowers qualified for the borrower defense to repayment program, total and permanent disability (TPD) discharges and closed school discharges. Here are a few student loan forgiveness programs you may be eligible for:

- Borrower defense to repayment. If your school misled you or engaged in misconduct that violated certain state laws, you may be eligible to have your federal students fully discharged through the borrower defense program.

- Public Service Loan Forgiveness (PSLF). Public servants like government employees and nonprofit workers who make 120 consecutive payments on their federal student loans may be able to have the remainder of their federal student loan debt discharged.

- Teacher Loan Forgiveness. Teachers who work at a low-income school for five consecutive academic years may qualify for up to $17,500 in federal student loan cancelation.

- Military student loan forgiveness. Different branches of the military offer up to $65,000 in student loan discharges for active-duty personnel.

Don't qualify for a student loan discharge? Visit Credible to get in touch with a knowledgeable loan officer who can walk you through your best options for managing your student loan debt.

COLLEGE TUITION IS UP 33% SINCE 2000: HOW TO COPE WITH RISING COSTS

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.