Biden's 2023 budget would expand Medicaid, lower prescription drug costs: CBPP

The president's budget may reduce the cost of care by closing the health insurance coverage gap

Personal health care spending in the United States could be reduced if the federal government adopts Biden's budget proposal for the 2023 fiscal year, the CBPP said. (iStock)

The White House recently unveiled President Joe Biden's budget proposal for the 2023 fiscal year. Among other things, it would fund legislation to reduce the cost of prescription drugs, lower health care premiums and continue the enhanced Child Tax Credit (CTC).

The Biden administration estimates the budget would cut the deficit by more than $1 trillion over the next decade by increasing taxes on corporations and the wealthy, without raising taxes for households earning less than $400,000 per year.

This claim was endorsed by the Center on Budget and Policy Priorities (CBPP), which said in a new report that Biden's 2023 budget "would fully pay for" policies aimed at closing the Medicaid coverage gap and reducing health care costs for low-income households.

"President Biden’s 2023 budget calls for a range of policies that would boost opportunity and reduce poverty, improve health and well-being, and advance widely shared prosperity, funded by proposals to make the nation’s tax system stronger and fairer," CBPP President Sharon Parrot said in a statement.

Keep reading to learn more about how Biden's budget proposal may impact your health care costs in 2023. And if you're struggling to keep up with unpaid hospital bills, consider your options like interest-free payment plans and debt consolidation. You can visit Credible to compare debt consolidation loan interest rates for free without impacting your credit score.

HOSPITAL PRICE TRANSPARENCY RULE TAKES EFFECT TO REDUCE SURPRISE HEALTH CARE BILLS

CBPP analysis of Biden's 2023 budget finds expanded health coverage

The White House said that the president's budget for the 2023 fiscal year would include investments in health, education and economic opportunity.

This first goal is the focus of many U.S. adults who are burdened by the cost of health care expenses — medical debt is the leading cause of bankruptcy in America. The CBPP found that Biden's budget proposal would:

- Reduce the price of prescription medications by giving Medicare the authority to negotiate with drug companies and capping annual cost increases.

- Extend the current Affordable Care Act (ACA) premium tax credit to keep health insurance premiums from rising for millions of policyholders when it expires in December.

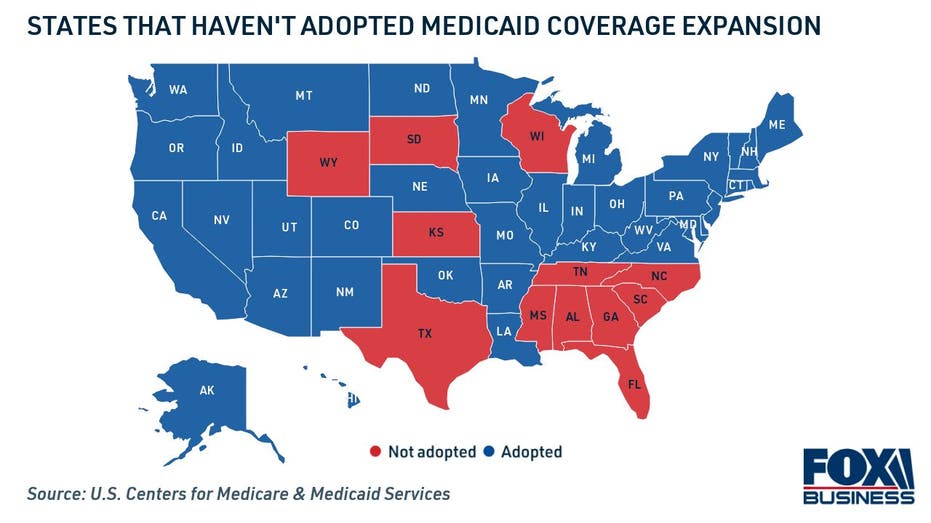

- Provide health insurance plans for more than two million uninsured Americans who live in states that haven't adopted the Medicaid expansion.

WHAT IS A HOMEOWNERS INSURANCE DEDUCTIBLE?

Economists at the CBPP previously called on the Biden administration to include these policies in this year's economic package, adding that it's "critical to avoid going backward on health coverage rates, especially as high inflation is straining families’ budgets."

If you're struggling to afford health care costs while inflation is at a 40-year high, you might consider consolidating medical bills and other high-interest debt into a fixed-rate debt consolidation loan. You can learn more about debt consolidation by getting in touch with an expert at Credible.

SENIORS ARE LOSING OUT ON MEDICARE SAVINGS DURING OPEN ENROLLMENT, STUDY SHOWS

How to cope with unpaid medical bills

While Biden's proposed budget may potentially lower health spending, the CBPP estimates, it doesn't offer help for the 18% of Americans who already have medical debt resulting from out-of-pocket costs. Here are a few ways that patients can get rid of unpaid medical debt:

→ Negotiate with the provider or debt collector. Nonprofit hospitals are required by federal law to offer financial assistance programs for low-income patients, which may include reduced-cost care or interest-free installment plans. Depending on your creditor, it may be possible to settle your medical debt for less than you owe. The Consumer Financial Protection Bureau (CFPB) offers tips for negotiating medical bills in collections.

→ Utilize medical financing plans. Some health care providers offer payment plans that allow you to pay your hospital bill over time in fixed monthly payments. Other physicians may provide interest-free or reduced-interest financing through medical credit cards. Keep in mind that these types of credit cards typically come with high purchase APRs, and you may be charged deferred interest if you miss a monthly payment.

→ Consolidate bills into a fixed-rate loan. Unsecured personal loans offer lump-sum funding that you repay in fixed installments over a set period of time, typically a few years. This type of loan is commonly used to consolidate higher-interest debt into a single monthly payment. It's important to note that applicants with very good credit will see the lowest rates possible, while those with fair or bad credit may see prohibitive interest rates.

If you're thinking about borrowing a personal loan for debt consolidation, it's important to compare rates across multiple online lenders. Shopping around ensures you're getting the most competitive offer for your financial situation. You can compare personal loan rates in the table below and by getting prequalified on Credible's online financial marketplace.

FINAL ESTIMATE REDUCES Q4 2021 GDP TO 6.9%: BUREAU OF ECONOMIC ANALYSIS

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.