Biden administration considering another student loan payment pause extension

Student loan forbearance may be extended again, White House Chief of Staff said on 'Pod Save America'

President Biden is still considering canceling student loans or extending the forbearance period, a White House spokesperson said on a recent podcast episode. (iStock)

President Joe Biden did not mention the student debt crisis during his first State of the Union address, even as monthly loan payments are set to restart in May. However, the president is still considering how he can provide student loan relief before forbearance expires, according to White House Chief of Staff Ron Klain.

"I think the president's going to look at what we should do on student debt before the pause expires, or he’ll extend the pause," said Klain during an episode of "Pod Save America" that aired March 3.

Klain's comments give the Biden administration less than two months to deliver some form of student debt relief. The Department of Education has extended the forbearance period three times since Biden took office, and federal student loan payments have been paused since the COVID-19 began in March 2020.

"The question of whether or not there's some executive action student debt forgiveness when the payments resume is a decision we're going to take before the payments resume," Klain said.

This admission may spark hope among the millions of Americans with student loans, but it's not a concrete promise of debt forgiveness. Progressive Democrats have been urging the president for months to cancel student loans via executive action, but it still remains unclear whether Biden has the legal authority to forgive student loan debt. This means borrowers should plan for repayment to start as scheduled.

Keep reading to learn how to prepare your finances for the end of federal student loan forbearance, including income-driven repayment, federal deferment and student loan refinancing. You can visit Credible to compare student loan refinance interest rates for free without impacting your credit score.

POLL: MOST AMERICANS WANT STUDENT LOAN PAYMENT PAUSE EXTENDED UNTIL 2023

3 ways to prepare for student loan repayment

The vast majority (93%) of student loan borrowers aren't financially prepared to resume monthly payments in May, according to a recent survey from the Student Debt Crisis Center (SDCC). Plus, Education Department officials said that it would be a "significant challenge" for borrowers to avoid delinquency after two years of forbearance.

If you're unprepared for federal student loan repayment in less than two months, consider these strategies for managing your debt:

Read more about each student debt repayment method in the sections below.

1. Enroll in income-driven repayment

Federal student loan borrowers may be eligible to reduce their monthly payments to between 10% and 20% of their disposable income by enrolling in income-driven repayment (IDR). Federal Student Aid offers four types of IDR plans:

- Revised Pay As You Earn Repayment Plan (REPAYE Plan)

- Pay As You Earn Repayment Plan (PAYE Plan)

- Income-Based Repayment Plan (IBR Plan)

- Income-Contingent Repayment Plan (ICR Plan)

The amount of your student loan payment will depend on your income as well as your family size. Under each of these repayment plans, your remaining loan balance will be forgiven once the period expires, which is either 20 or 25 years.

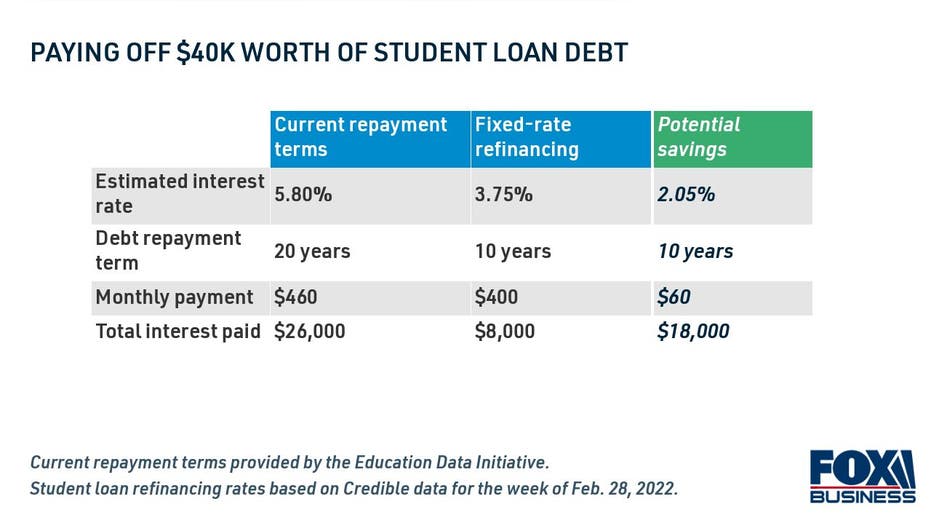

If you've enrolled in IDR and you still can't afford your monthly payments, you might consider refinancing to a private student loan. A recent Credible analysis found that borrowers who refinanced to a longer-term student loan were able to reduce their monthly payments by more than $250.

Keep in mind that refinancing your federal loans will make you ineligible for IDR plans, administrative forbearance, federal deferment and select student loan forgiveness programs. You can learn more about student loan refinancing by visiting Credible.

BIDEN ADMINISTRATION CANCELS ANOTHER $415M IN STUDENT LOAN DEBT: DO YOU QUALIFY?

2. Apply for federal deferment

It may be possible to defer your federal student loan payments for up to 36 months if you meet certain requirements. There are several types of student loan deferment based on eligibility criteria, such as unemployment or economic hardship. You can learn more about your options on the FSA website.

While deferment may temporarily pause your monthly payments, interest may accrue on your loans during this period. This can add to the overall cost of borrowing, making your student loans more expensive to repay over time.

POLL: AMERICANS DOUBTFUL THAT BIDEN WILL DELIVER STUDENT LOAN FORGIVENESS IN 2022

3. Refinance your student loans

If you're struggling to make your student loan payments, it may be possible to reduce your monthly payments by refinancing to a private student loan. Refinancing to a lower rate may also help you pay off your student debt faster and save money over the life of the loan.

It's important to remember that refinancing your federal student loan debt into a private loan would make you ineligible for certain programs, such as Public Service Loan Forgiveness (PSLF). But if you don't plan on applying for a loan discharge, or if you already have private student loans that aren't eligible for student debt cancellation, then you may be able to save money by refinancing.

You can browse current student loan refinance rates in the table below. Then, use Credible's student loan refinance calculator to estimate your potential savings and decide if this debt repayment strategy is right for your financial situation.

BIDEN SHOULD 'UNILATERALLY' CANCEL STUDENT LOAN DEBT, SAYS OBAMA'S EDUCATION SECRETARY

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.