Car accidents spiked nearly 8% in 2020, says DOT: How to save on insurance in the event of a crash

Car accidents have increased since the beginning of the COVID-19 pandemic, driving up insurance rates. Here's how you can save. (iStock)

Americans traveled 263 billion miles on the road in March of this year, according to the Department of Transportation, 42 billion more than March 2020. The spike indicates a near-return to pre-coronavirus levels of vehicle commuters, and roads appear to be increasingly treacherous.

In fact, despite less drivers getting behind the wheel in 2020, there were more motor vehicle fatalities in nearly 15 years. Projections by the National Highway Traffic Safety Administration indicate a 7.2% jump in deaths from 2019 to 2020. Three major factors behind the increase, noted by the agency as well, were speeding, driving while impaired and not wearing a seat belt.

Getting into a crash in which you're at fault will directly impact your insurance rates, causing them to go up. Conversely, you're likely able to get a discounted rate if you have a clean driving record. Comparing multiple insurance quotes can potentially save you hundreds of dollars per year, so don't leave money on the table. Visit Credible now to compare quotes free of charge.

MANY AMERICANS LOSING CAR INSURANCE SAVINGS BY NOT SHOPPING AROUND, STUDY SHOWS

Accidents are increasing, and so are insurance costs

"Across the country, it is being reported that drivers are receiving speeding tickets in greater numbers than before the pandemic," the American Property Casualty Insurance Association (APCIA) stated. "At the same time as drivers are going faster, telematic companies are reporting that drivers are more distracted by cell phone use and other things."

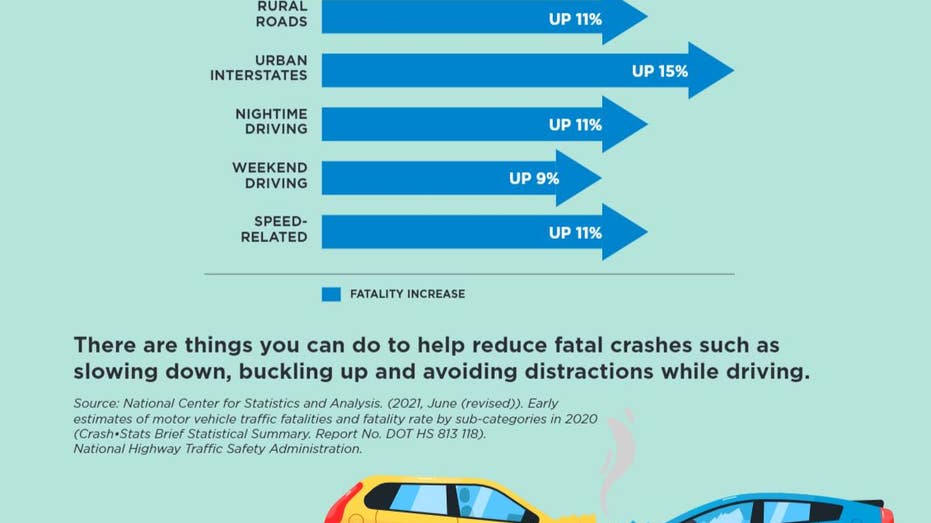

Fatal crashes were up from 2019 to 2020 by 11% on rural roads and 15% on urban interstates. Such crashes also jumped 11% in the nighttime, 9% on weekends and 11% when related to speed, the APCIA report showed.

Source: American Property Casualty Insurance Association

"These habits are making the roadways more dangerous and as a result, these habits are contributing to more accidents," the report stated. "With increasing inflation in general, and the cost of repairing cars and medical costs soaring, insurance costs are steadily increasing. As insurance costs go up so does the cost of insuring a vehicle. Insurers remain steadfast in their efforts to encourage drivers to slow down, buckle up and minimize distractions while they’re on the road."

If your insurance costs have gone up – possibly because of a crash – or you just want to check to make sure you have the best rate, visit Credible to compare multiple companies at once.

SURVEY SAYS MOST AMERICANS OVERPAYING FOR CAR INSURANCE: HOW TO LOWER YOUR RATE NOW

3 ways to save on car insurance

As auto insurance rates increase, there are still several options for drivers looking to save, especially in the event of an unexpected accident on the road. Here are a few:

Ensure you have a good credit score: Having good credit history helps improve your insurance rates, while poor credit weighs them down. Making more than your minimum payments or keeping your credit card usage below 30% can help improve your credit score as you work toward excellent credit. Use a credit monitoring service like Credible’s to help keep an eye on your FICO score.

Comparison shop: Drivers' profiles are constantly changing due to a variety of factors, such as driving history, age and credit score. The insurance that was best for drivers when they first got it may not remain the best option now, as discounts may be offered by companies for different reasons. An online marketplace allows drivers to compare multiple companies after filling out just one form. Visit Credible to get started today.

HOW TO CHANGE YOUR CAR INSURANCE POLICY

Seek out discounts: Many companies offer various types of discounts such as good student discounts, good driver or even discounts for taking a defensive driving course. Contact your insurance company to see what kinds of discounts may be available to you.

As driving becomes more dangerous post-pandemic, it is important to use seat belts and slow down to reduce fatality rates and ensure you're free of distractions. You can keep insurance costs low by making sure you have the best company for your particular driving situation. Contact Credible to speak to an auto insurance expert and get all of your questions answered.

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.