82% of car buyers paid above sticker price for new vehicles in January: Edmunds report

Low inventory and high demand are driving up new vehicle sales prices

At a time when the majority of buyers are paying well above MSRP for a new vehicle, here's how you can save money on your car purchase. (iStock)

The auto sales market is faced with critical inventory shortages that are exacerbated by high consumer demand. This is driving up the average transaction price of new vehicles, forcing many car buyers to pay well above the manufacturer's suggested retail price (MSRP).

A record 82.2% of car shoppers paid above sticker price for a new vehicle in January, according to a new report from Edmunds. That's compared to just 2.8% one year ago, and 0.3% two years ago.

"The fact that an overwhelming majority of consumers are paying above sticker price would have been unthinkable even just a year ago," Edmunds Executive Director Jessica Caldwell said.

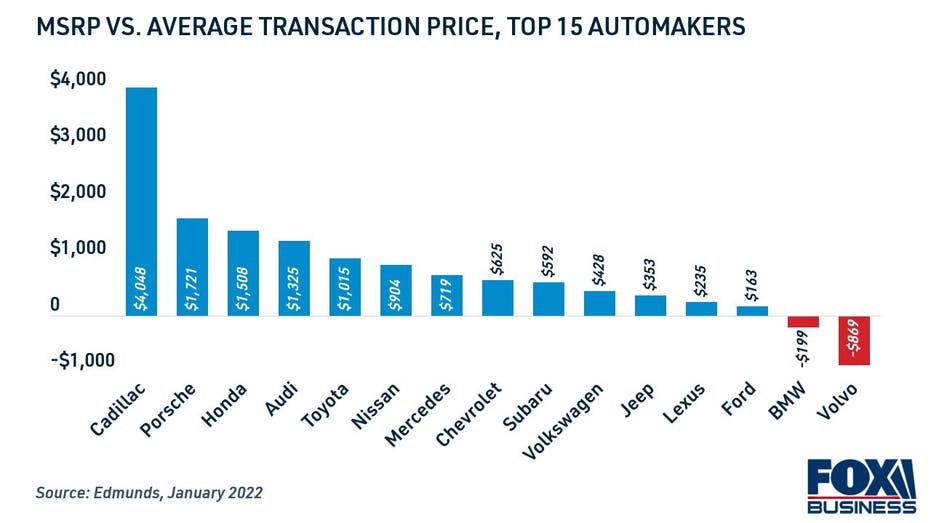

Cadillac topped the list with the highest price markup — shoppers paid more than $4,000 above MSRP, on average. Car buyers also paid above sticker price for many popular vehicle makes like Land Rover ($2,565), Kia ($2,289), Honda ($1,508), Toyota ($1,105) and GMC ($677).

Across all automakers, new-car buyers paid an average of $728 above MSRP. The average transaction price was $45,717 in January, compared to the average MSRP of $44,989.

"This is in part driven by affluent consumers being willing to shell out more cash to get the vehicles that they want, but there's also a vast population of individuals who are being forced to do so simply because they need transportation and have no other choice," Caldwell said.

Keep reading for tips on how to buy a car in this competitive sales environment, and learn how you can save money on new car prices and auto-related costs. One strategy is to get free car insurance quotes, so you can avoid overpaying. You can compare insurance rates for free across multiple insurers by visiting Credible.

REPORT: CAR INSURANCE RATES 'AREN'T SKYROCKETING' DESPITE 4% ANNUAL INFLATION

Tips for saving money when buying a car

A new car is one of the largest purchases you'll ever make, so it's important to do your research to get the best deal possible. Although many buyers are paying well above MSRP for a new vehicle, there are several ways to avoid overpaying:

- Wait until the market cools down

- Be flexible, and expand your search

- Get multiple appraisals on your current vehicle

Read more about each tip in the sections below.

Wait until the market cools down

Edmunds experts said that holding off until inventory catches up with demand would be "the most pragmatic move" for buyers in this market. However, one expert suggests that the prices may not stabilize for another year.

"Consumers might be waiting up to a year or longer if they want to hold off until the market resembles anything close to the pre-pandemic normal, but some buyers simply cannot wait," Ivan Drury of Edmunds said.

In the meantime, it may be possible to switch to a more affordable auto insurance policy for your current vehicle. You can get free car insurance quotes on Credible to see if you have any potential for savings.

CAN YOU USE A PERSONAL LOAN TO PAY OFF YOUR CAR LOAN?

Be flexible, and expand your search

Car shoppers may benefit from having an open mind in this competitive market. If you don't have your heart set on a certain vehicle make or model, think about more affordable alternatives with a lower purchase price.

"Consider alternative vehicle types, brands and colors and be willing to compromise on features," Edmunds recommends. "If you're facing markups above MSRP, try to negotiate the adjustment to include add-ons such as warranties, service contracts, protection packages or dealer-installed accessories."

Buyers who live in an area with limited inventory can also consider widening their geographic search, according to Edmunds. It may be possible to find the vehicle you want from a car dealer in another nearby city or state — just make sure to lock in an offer before you make the trip.

HOW TO GET A DISCOUNT ON CAR INSURANCE

Get multiple appraisals on your current vehicle

Your current vehicle is your "greatest asset" for offsetting the purchase price of a new car, Edmunds reports. Demand for used cars is also exceptionally high, so you may be able to negotiate with the dealer for more money when selling or trading in your vehicle.

Get your old car appraised through online tools like Edmunds and Kelley Blue Book, as well as by brick-and-mortar car dealerships. You can also leverage these offers to negotiate a better trade-in deal if you've already found the car you want.

Once you've purchased your new car, it's time to find a comprehensive auto insurance policy with the coverage you need. You can learn about car insurance and get free rate quotes by visiting Credible.

PICK-UP TRUCKS, SUVS ARE THE TOP MOST STOLEN VEHICLES IN AMERICA, REPORT FINDS

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.