What to know if you live in one of these top 10 auto theft hotspots

A new report from the NICB found that auto theft is increasing nationally, and the problem is even worse in select "hot spots." With auto thefts on the rise, it's important to ask: Does your auto insurance cover a stolen vehicle? (iStock)

Car theft is a widespread crime — and it's on the rise across the U.S., according to an annual report from the National Insurance Crime Bureau (NICB). In fact, one vehicle is stolen every 36 seconds nationwide.

Auto thefts saw a dramatic increase in 2020 versus 2019 in part due to the pandemic, an economic downturn, law enforcement realignment, depleted social and schooling programs, and, in still too many cases, owner complacency.

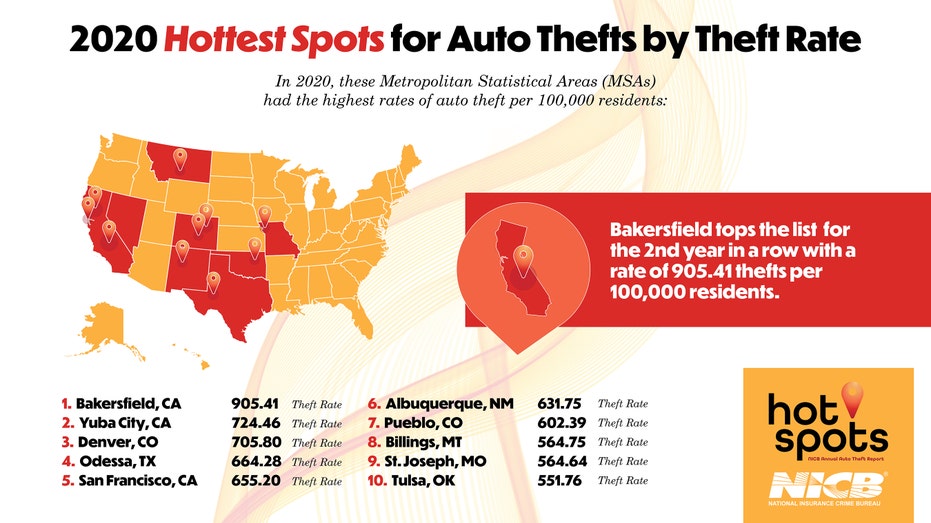

Auto theft is even more prevalent in select "hot spots," the report found. Bakersfield, Calif. has the highest rate of auto theft, with more than 900 thefts per 100,000 residents. It is one of three California cities that rounded out the top five; the others are Yuba City (No. 2) and San Francisco (No. 5). Denver ranked third, followed by No. 4 Odessa, Texas.

"For many people, a car is the second-largest investment they will ever make behind a home," Glawe said. "As such, it is important to take simple steps to protect your investment lock your car and take your keys, no matter where you live."

In addition to taking common-sense precautions to protect against car thieves, you should also prepare for the worst by having a comprehensive auto insurance policy. You can compare rates across multiple insurers at once on Credible to ensure you're getting a fair price.

HOMEOWNERS INSURANCE SHOULD ADEQUATELY COVER THESE 5 ITEMS

Does car insurance cover theft?

Auto insurance covers theft, typically, but it depends on the type of insurance you have. Drivers are required to carry a certain amount of liability insurance covering bodily injury and property damage, depending on the state. But the vast majority of drivers opt to purchase additional coverage in the form of comprehensive auto insurance.

Comprehensive car insurance will cover losses and damages in the event of auto theft. It's typically optional to add comprehensive coverage to your auto insurance policy, but it can be a financial lifeline if you live in a city that's impacted by high rates of auto theft.

If your car is damaged during the break-in, your insurer will cover the cost of repairs. If your vehicle is stolen, you'll receive a payout worth the car's actual cash value, minus the deductible.

You can learn all about the different types of auto insurance and compare quotes for comprehensive policies on Credible.

EVICTION FREEZE PROTECTS SOME RENTERS, BUT LANDLORDS FACE 'VERY DIFFICULT TIME,' SAYS EXPERT

3 devices that protect against auto theft

Protecting your car from conspiring thieves can be as simple as common sense: Park in a well-lit area, lock your doors and hide your valuables. But in addition to these obvious protective measures, also consider installing an anti-theft device in your car:

- Warning devices, such as a car alarm.

- Immobilizing devices, which prevent your car's engine from being hotwired.

- Tracking devices, to keep tabs on where your car is at all times via GPS.

As an added bonus, some auto insurance companies will give you a discount for installing an anti-theft device in your car.

Of course, even if you take all the necessary precautions, you can still be a victim of auto theft. That's why it's important to check your auto policy to see if you're covered in the event of a stolen car. If your car is stolen, it's important to get a police report and file an insurance claim as soon as possible to make sure you get the payout you deserve.

You can also browse comprehensive insurance policies that cover theft on Credible. It's free to browse companies and compare auto insurance quotes, so you can protect your personal property.

DO THESE 5 THINGS BEFORE CHOOSING A PERSONAL LOAN LENDER

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.