Expiration of child tax credit payments reflects poorly on Democrats, poll says

Senate Democrats have been unable to restore expanded CTC without support from moderates

A new poll suggests that some likely voters lost trust in the Democratic Party to support parents with children after failing to pass child tax credit expansions in 2022. (iStock)

In 2021, parents used their monthly child tax credit (CTC) payments to cover necessary expenses and pay off debt. But the Biden administration has struggled to bring back CTC payments in 2022, which is leaving many families without the financial relief they depended on last year.

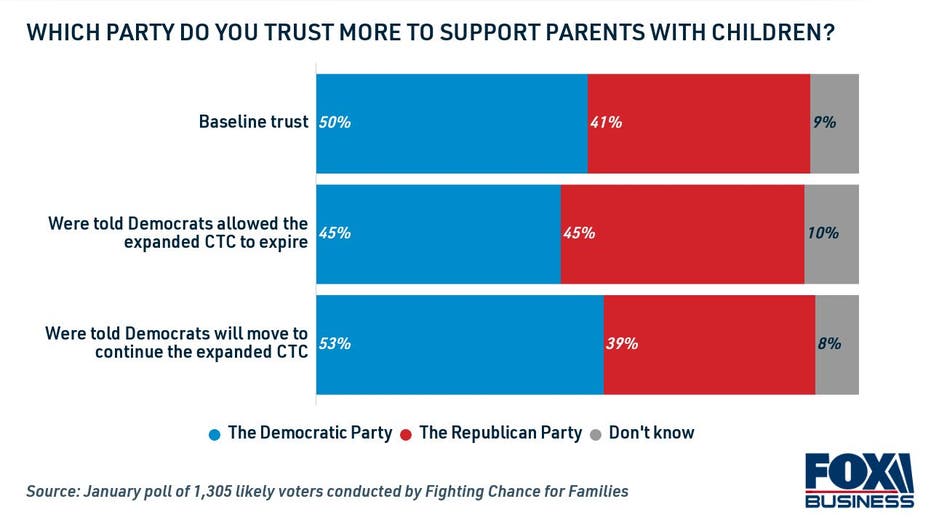

Allowing the expanded CTC to expire decreases trust in the Democratic Party to support parents with children, according to a January poll from Data for Progress. Conversely, Democrats who are moving to extend the payments are more trusted to support parents with children.

To gauge a baseline sentiment, likely voters were asked "Which party do you trust more to support parents with children?" — among them, 50% chose the Democratic Party while 41% sided with Republicans. Then, the respondents were split into two separate groups. The first sample was told "Democrats allowed the expanded CTC to expire" and the second was told "Democrats will move to continue the expanded CTC into 2022."

When asked again which party they trust more to support parents, the samples had different sentiments. Respondents who were told Democrats let the CTC expire had decreased trust in the party, while those who were told Democrats are working on a CTC extension reported increased trust.

Keep reading to learn more about the expanded child tax credit, as well as what Democrats are doing to extend the benefit this year. And if you're looking for ways to save money and pay off debt after the expiration of CTC payments, you can visit Credible to compare interest rates on a variety of financial products like credit card consolidation loans.

YOU COULD SEE A LOWER TAX REFUND THIS YEAR, AND THIS IS WHY

Will Democrats restore child tax credit payments in 2022?

The IRS child tax credit was temporarily expanded in 2021 when President Joe Biden signed the American Rescue Plan into law. The maximum credit amount was raised to $3,600 for each child up to age 5 and $3,000 per child under 18 years old — up from $2,000 previously. The credit was also issued in monthly payments worth up to $300 per child, rather than in a lump sum during tax season.

The expanded CTC expired in December 2021 after Congress failed to pass the Build Back Better Act, Biden's signature spending bill. The legislation would have continued the monthly child tax credit payments into 2022, but it didn't gain enough support from moderate Democrats like Sen. Joe Manchin of West Virginia.

Lawmakers are now looking for ways to reinstate the expanded child tax credit as they resume negotiations on Build Back Better. A group of Senate Democrats recently sent a letter to Biden urging him to prioritize the monthly CTC payments, calling them "the biggest investment in American families and children in a generation."

Democrats will need to gain the support of moderate hold-outs in order to pass Build Back Better and make CTC payments permanent. However, Manchin has previously said that he won't support the expanded CTC unless a work requirement is added for beneficiaries.

As Congress struggles to compromise on the child tax credit, recent polling data shows that voters are losing trust in the Democratic Party to support parents with children. Of note, American families have not received monthly payments this January or February.

If you're struggling to keep up with expenses without the monthly CTC payment, you may be looking for ways to cut spending. One way to save money is by consolidating high-interest credit card debt into a personal loan at a lower interest rate. You can compare debt consolidation loans on Credible for free without impacting your credit score.

5 REASONS TO FILE YOUR TAX RETURN EARLY

The expanded child tax credit is popular among voters

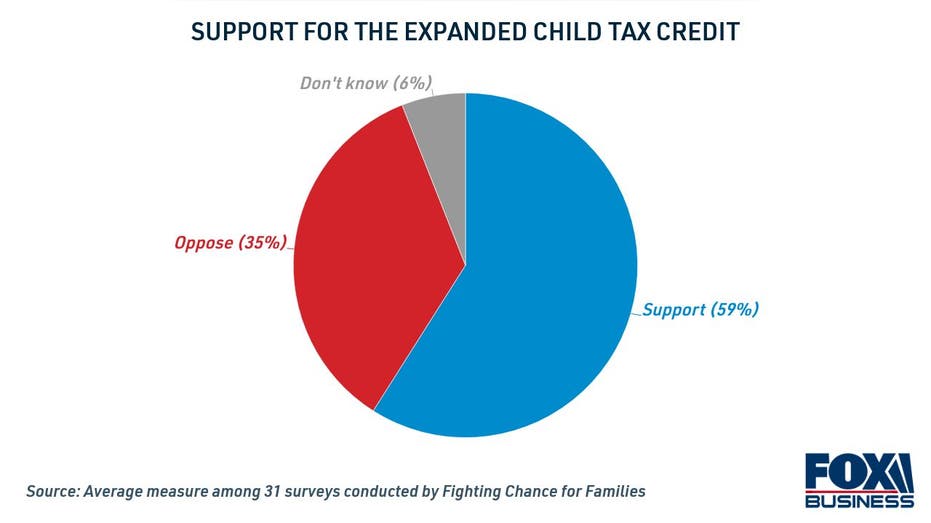

Likely voters polled by Data for Progress overwhelmingly endorsed the expanded child tax credit, with 59% in support and 35% in opposition. Support for the expanded CTC has stayed relatively consistent since last July and gained strength in January, when eligible families stopped receiving the monthly payments.

Despite the popularity of the expanded CTC, Democrats have so far been unable to reinstate monthly payments in 2022. Recent research shows that letting the expanded CTC expire may be consequential for the low-income families who depended on it the most.

The Center on Budget and Policy Priorities (CBPP) estimates that making the expanded child tax credit permanently available could reduce child poverty by more than 40%. The CBPP also found that about 9 in 10 low-income families used the monthly CTC payments to cover basic household expenses, such as food, clothing and shelter.

Low-income families who have been impacted by the expiration of child tax credit payments may be eligible for the following government programs:

- Temporary Assistance for Needy Families (TANF) offers financial aid for child care, food, housing, utilities and job placement.

- The Supplemental Nutritional Assistance Program (SNAP) issues debit cards (food stamps) that can be used to buy groceries.

- The Children's Health Insurance Program (CHIP) provides health insurance coverage to eligible children through Medicaid.

- Housing Choice Vouchers (Section 8) offer rental assistance to low-income families through Public Housing Agencies.

- Nonprofit credit counseling agencies provide free or low-cost money management services, including debt management plans (DMPs).

However, not all Americans will meet the eligibility requirements for federal benefits due to income limits. If you earn too much money to qualify for these programs, you may consider borrowing a lump-sum personal loan as an alternative to taking out high-interest credit card debt. You can browse current personal loan rates in the table below, and use Credible's personal loan calculator to estimate your monthly payments.

TAXPAYER CHECKLIST: WHAT TO KNOW BEFORE TAX FILING SEASON

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.