Many consumers carrying a credit balance know it's a bad idea: survey

Credit card debt is derailing savings goals

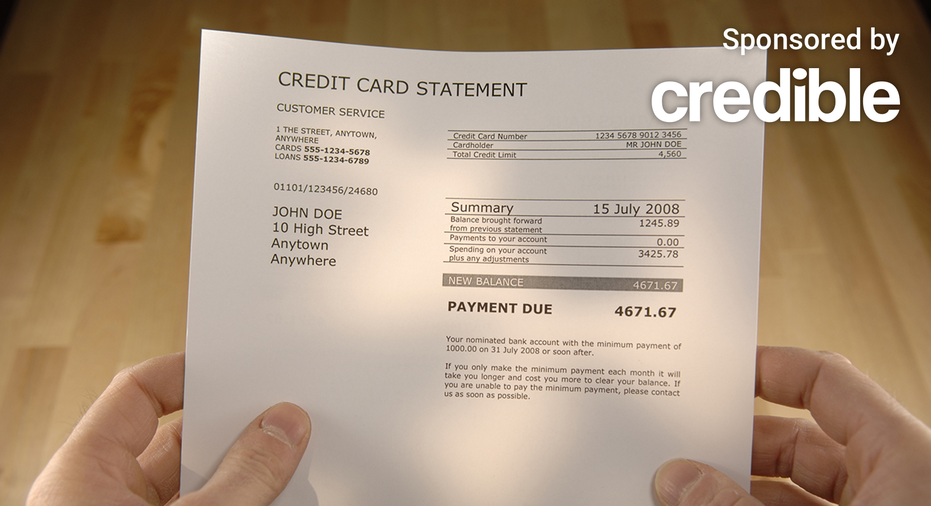

45% of Americans typically carry a balance month-to-month, a recent survey said. (iStock)

Americans know that carrying a credit card balance is a bad idea, but 45% typically do so anyway, a recent survey said.

Consumers of all ages and financial backgrounds are amassing credit card debt, and struggling to live within their means, and these behaviors are only getting worse, the Quicken survey said. Roughly 77% said they owned a credit card. Half (50%) of the consumers earning an annual income between $50,000-$99,000 said they relied on credit cards, rather than cash, for the bulk of their purchases.

Americans now owe $1.08 trillion on their credit cards after racking up a collective $48 billion in new spending during the third quarter of 2023, according to a recent report on household debt from the Federal Reserve Bank of New York.

Most Americans (81%) said paying off credit cards was essential and 64% said carrying a credit card balance was not a good idea. However, 45% typically carry one month-to-month. Even more concerning, over 52% of Gen Z and Millennial Americans say their credit card balance has been steadily growing over the past three to five years, with almost half (48%) admitting to this in America's middle class and over a third (35%) in the highest income bracket of those making more than $200,000.

"Even with people knowing what they should and shouldn't do with credit cards, they often make the mistakes anyway," Quicken CEO Eric Dunn said. "This suggests that many consumers don't feel they have a choice.

"But credit card debt is costly, so as that debt rises, it really hurts people's financial health," Dunn continued.

If you're worried about the state of the economy, you could consider paying down high-interest debt with a personal loan at a lower interest rate. Visit Credible to speak with a personal loan expert and get your questions answered.

SOCIAL SECURITY: COLA INCREASING BUT MEDICARE COSTS RISING TOO IN 2024

Credit card debt derails saving goals

Consumers' growing debt burden means they have less cushion for emergencies and less funds to put away in savings. Fifty-four percent of middle-class Americans and 56% of younger Americans said their current savings wouldn't last over three months if they were to lose their source of income.

It's not just middle class America feeling the impact of growing debt, according to the survey. Over one quarter (28%) of those making over $200,000 a year said their savings would last only three months if they were to lose their source of income. Financial experts recommend that consumers have roughly three to six months' worth of living expenses in emergency savings, but inflation and rising costs have made this target a challenge.

Inflation and rising costs were listed as the top financial concerns for over 50% of respondents and the most significant reason Americans cannot build savings in a recent TaxAct survey. This concern has even impacted Americans in higher tax brackets – 55% of consumers with household incomes between $50,000 and $99,999 also cited inflation as their top financial worry, the survey said.

If you are struggling to pay off debt, you could consider using a personal loan to consolidate your payments at a lower interest rate, saving you money each month. You can visit Credible to find your personalized interest rate without affecting your credit score.

AMERICANS LIVING PAYCHECK TO PAYCHECK OWN 60% OF CREDIT CARD DEBT: SURVEY

Americans more optimistic about finances

The good news is that Americans are growing more confident about their finances. WalletHub 2024 Economic Index increased by 15% between December 2022 and December 2023. This means consumers are more optimistic about their financial outlook this month than they were at the same time last year. Moreover, their six-month outlook on their finances reached the highest level of optimism recorded since December 2020.

The index said that the share of consumers who expected to have less debt after the next six months increased by 4.4% in December 2023 compared to last year. In addition, consumers' confidence in reducing their debt over the next six months has hit the highest level recorded since December 2020.

"The 15% increase in consumer sentiment over the past year is an encouraging sign that our economy is recovering from the damage it suffered as a result of the pandemic and inflation," WalletHub Analyst Cassandra Happe said.

If you're interested in paying off high-interest debt with a personal loan, you could visit the Credible marketplace to learn more about your options and speak with an expert to get your questions answered.

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.