Eviction moratorium update: Warren, progressives introduce bill aimed at extending ban

As the COVID-19 Delta variant continues to spread throughout the United States, Democratic lawmakers have introduced a bill to reinstate the expired eviction moratorium. (iStock)

Sen. Elizabeth Warren (D-Mass.) and dozens of progressive lawmakers on Tuesday introduced the Keeping Renters Safe Act of 2021, aimed at reinstating the nationwide eviction moratorium.

This pandemic isn’t over, and we have to do everything we can to protect renters from the harm and trauma of needless eviction, which upends the lives of those struggling to get back on their feet.

The Centers for Disease Control and Prevention (CDC) had previously mandated an eviction freeze in September 2020 to help stop the spread of COVID-19. Still, the Supreme Court ruled that the agency couldn't continue extending the ban without Congress' approval.

After the initial COVID-19 eviction protections expired in July 2021, the Secretary of the Department of Health and Human Services (HHS) issued another eviction moratorium under the direction of President Joe Biden. But the Supreme Court again ruled that the HHS secretary doesn't have the authority to implement a ban on residential evictions.

The Keeping Renters Safe Act would grant the HHS secretary permanent authority to implement a residential eviction ban during public health crises to help prevent the spread of communicable diseases, including at homeless shelters. The act would also direct the HHS to implement an eviction moratorium to remain in effect while the COVID-19 pandemic remains a public health emergency.

While some state and local governments have issued guidance on evictions, there's currently no eviction ban put in place by the federal government.

Whether you're a landlord struggling to keep up with unpaid rent or you're a renter at risk of eviction, you have options for managing your finances during the coronavirus pandemic. Keep reading to learn more, and visit Credible to browse several products that may help you overcome financial hardship.

LANDLORDS CAN CONSIDER THESE ALTERNATIVES TO EVICTIONS AMID NEW MORATORIUM

Alternatives to eviction for landlords

While eviction bans have been lifted in many states, evicting a tenant can be an expensive process. Here are a few alternative options that landlords have if their tenants aren't paying rent:

- Apply for financial assistance: The Emergency Rental Assistance Program (ERA) can cover up to 18 months of rent for landlords whose low-income tenants are in nonpayment. Eligibility is based on the tenant's household income and financial hardship.

- Enter mortgage forbearance: Get in touch with your mortgage lender to enroll in hardship forbearance to pause your monthly mortgage payment. Keep in mind that interest may accrue during the forbearance period.

- Refinance your mortgage: With mortgage rates holding steady below 3%, it's a good time to look into mortgage refinancing. You may be able to lower your monthly payments or even pay off your mortgage faster.

If you decide to refinance your mortgage, it's important to shop around for the lowest interest rate possible for your situation. You can get pre-qualified to see your estimated mortgage refinance rate without impacting your credit score on Credible.

3 ways for struggling renters to cut expenses

There's not currently an eviction moratorium in many parts of the country, which means renters who are struggling financially may be evicted if they don't pay rent. In addition to the rental assistance programs mentioned above, consider a few ways to trim your budget so you can keep making rent payments on time and avoid eviction.

13.4M AMERICANS BEHIND ON HOUSING PAYMENT, SURVEY SAYS

1. Download a budgeting app

Budgeting apps can help you identify areas in which you may be overspending. These apps link to your bank account to automatically categorize your spending, making the whole budgeting process more seamless than ever before. For example, you may be spending more on restaurants and entertainment than you truly realize.

You can even set up alerts that automatically notify you if you've gone over your budget in certain categories.

There are plenty of free budgeting apps that are available on both mobile and desktop platforms. You can also enroll in free credit monitoring through Credible to keep an eye on your credit score.

2. Refinance your private student loans

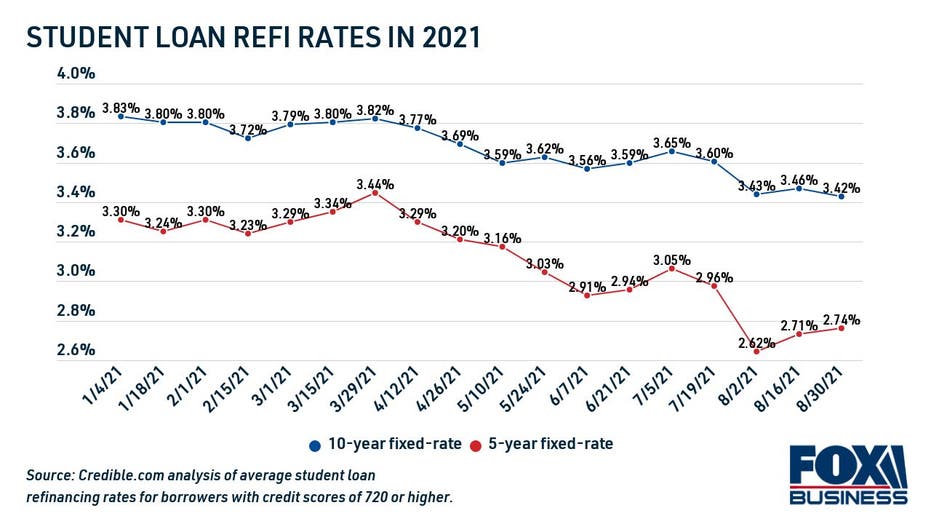

Student loan refinancing is when you take out a new loan with better terms — such as a lower interest rate — to repay your current loan. By refinancing your private student loans, you may be able to save money on interest, lower your monthly payments and even repay your loans faster.

Creditworthy borrowers who refinanced to a longer-term student loan on Credible were able to cut their monthly payments by more than $250 on average, without adding to the overall cost of borrowing.

Now may be a good time to refinance your student loan debt, because interest rates are near historic lows.

You may be able to secure a much lower interest rate on your student loan debt. However, it's important to know that refinancing your federal loans into a private student loan will make you ineligible for certain borrower protections like income-driven repayment plans and administrative forbearance.

Compare student loan refinance offers on Credible to see if you qualify for the most competitive interest rates.

3 TIPS TO HELP EASE THE BURDEN OF STUDENT LOANS ONCE FORBEARANCE ENDS

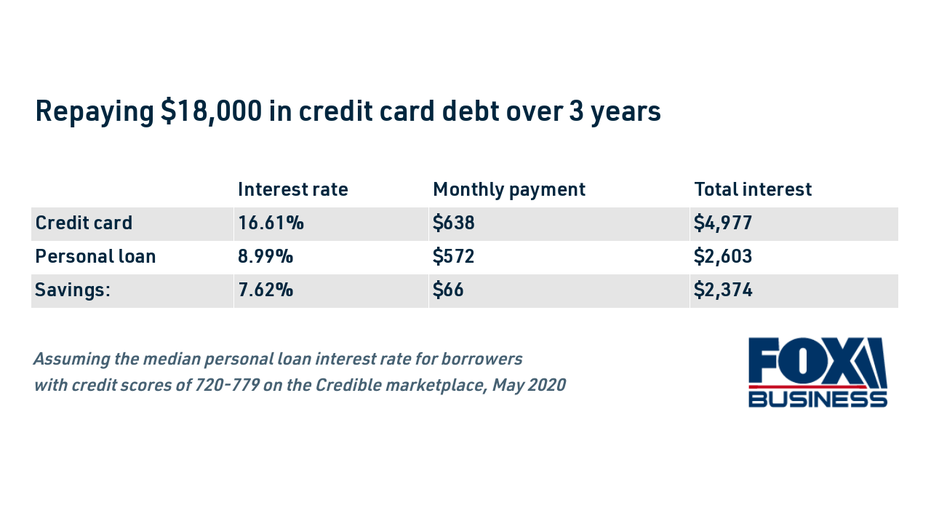

3. Consolidate credit card debt to lower your monthly payments

Revolving credit card debt is an expensive burden on your wallet that can keep you from meeting your other financial obligations, such as paying rent. Keeping track of your credit usage can be difficult as interest compounds daily, and making the minimum payment can result in a lengthy and expensive debt repayment process.

Consider consolidating your credit card debt into a personal loan at a lower interest rate. Sometimes called debt consolidation loans, personal loans allow you to pay off credit card debt in fixed monthly payments over a predetermined period of time.

Paying off credit card debt with a personal loan can help you reduce your monthly payments and save money on interest charges over time. Borrowers who refinance credit card debt on Credible have the potential to save money on their monthly payments and pay less in interest over time.

Use a personal loan calculator to estimate your monthly payment and see if consolidating credit card debt is the right option for you.

AMERICANS RANK DEBT PAYOFF AS HIGHEST FINANCIAL PRIORITY, STUDY SHOWS

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.