What is fair rental value coverage?

Fair rental value insurance provides coverage for loss of rental income when a covered event leaves your rental property uninhabitable

If you own a rental property, consider fair rental value coverage, which covers the loss of rental income when a disaster forces your tenants to relocate. (Shutterstock)

If you own a rental property, you’ll need multiple kinds of home insurance to protect your rental — and your finances — if a disaster strikes.

One type of coverage you should consider is fair rental value coverage. This type of insurance can help compensate for lost rental income when a covered event makes your property uninhabitable and forces your tenants to move temporarily.

Let’s take a closer look at fair rental value coverage and what it covers.

With Credible, you can compare home insurance quotes from top carriers.

- What’s fair rental value coverage?

- What’s covered under fair rental value coverage and what isn’t?

- What determines the fair rental value amount?

- Is fair rental value coverage included in landlord insurance?

- How much does fair rental value coverage cost?

What’s fair rental value coverage?

If you own a rental property, chances are you’ve got a homeowners insurance policy to protect it. But what if damage to your rental property forces your tenant to relocate temporarily?

In this case, the loss of rental income can sting, especially if you rely on that money to make mortgage payments and property improvements.

That’s where fair rental value coverage comes in. It’s a type of insurance that pays your lost rental income when your rental property is uninhabitable after a covered loss. Also known as fair rental income protection, this coverage provides a financial safety net for landlords on top of dwelling and personal property coverages.

MORTGAGE INSURANCE VS. HOMEOWNERS INSURANCE: WHAT’S THE DIFFERENCE?

For example, let’s say you own an investment property that you rent out for $2,000 a month. A severe windstorm causes a tree to fall through the roof and damage a section of your rental house. As a result, your tenant must relocate for a month while contractors repair your house. If you have fair rental value coverage, your carrier will pay you the $2,000 of lost rental income while your property is fixed and your tenant is displaced.

Fair rental value is generally separate coverage in your landlord insurance policy, or it may be available as part of your homeowners insurance policy’s additional living expenses coverage.

What’s covered under fair rental value coverage and what isn’t?

Fair rental value insurance doesn’t provide coverage for specific events, or "perils," which damage your rental property — it only covers lost rental income. However, your landlord insurance should have dwelling coverage that’ll help cover this damage.

For example, your landlord insurance policy may provide coverage if a fire destroys a portion of the house. By contrast, many homeowners insurance and landlord insurance policies don’t cover flood damage.

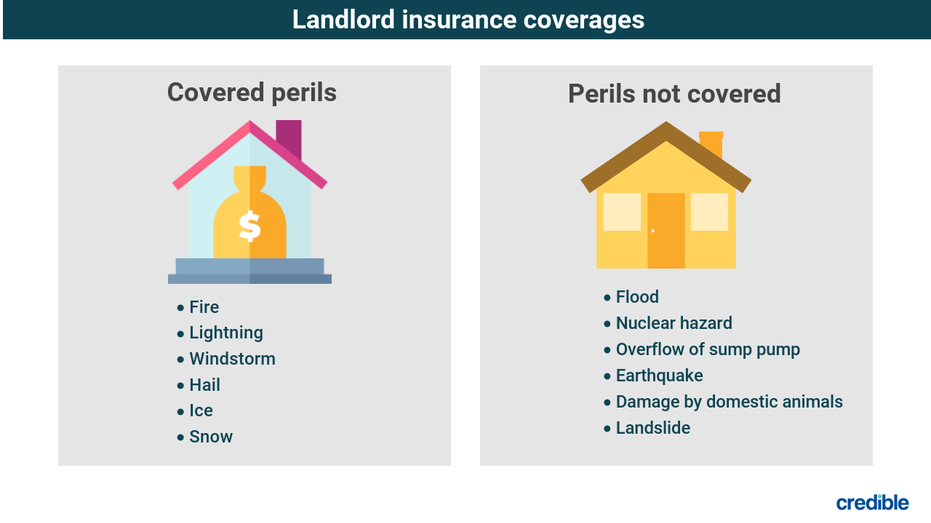

Here are some perils that are and aren’t typically covered under a landlord insurance policy:

Of course, you’ll want to check with your agent to review exactly what your policy covers and doesn’t cover to avoid an unpleasant surprise when you need to file a claim.

Credible lets you easily compare home insurance quotes from top carriers.

What determines the fair rental value amount?

An insurer considers a number of factors to determine the fair rental value of your property, including:

- Coverage limits — Your policy includes limits on how much it’ll pay out for a claim. For landlord insurance policies, the limit you may receive for fair rental value is typically 20% of your unit’s dwelling coverage. If your policy includes dwelling coverage for up to $400,000, your limit for loss of rental income coverage is $80,000.

- Time limit — Fair rental value insurance provides coverage for up to 12 months of lost rental income. Unfortunately, if your repairs take more than a year to complete, you won’t receive additional compensation.

- Rental income history — Your home insurer may rely on your current rental payment amount as a basis for assessing your property’s fair rental value.

- Current market rates — If you have a brief rental income history, your insurance company may compare rates for similar properties in your area.

- Discontinued services — Utilities and other services that you pay for as a landlord may need to be suspended while the home is uninhabitable. These costs are deducted from the fair rental value — if you charge $1,500 for rent and pay $100 per month for utilities, you may receive $1,400.

Is fair rental value coverage included in landlord insurance?

Yes, fair rental value coverage is included in landlord insurance. It may also be referred to as loss of use coverage. Additionally, this coverage may be offered as part of your additional living expenses coverage through your homeowners policy.

Remember, fair rental value insurance only covers the owner of the property. So if your tenant must relocate because of a covered loss, your coverage won’t pay for the expenses they incur. If your tenant has renters insurance, their policy’s additional living expenses coverage can pay for their temporary living costs.

How much does fair rental value coverage cost?

The cost of fair rental value coverage varies by insurer. Landlord insurance generally costs about 25% more than a homeowners policy because its coverage is more comprehensive.

The average cost for homeowners insurance nationwide in 2019 was $1,278 annually, or $106.50 a month, according to data from the National Association of Insurance Commissioners. For the extra protection landlord insurance provides — with 25% higher premiums — you might expect costs of around $1,598 per year, or $133 a month.

It’s a good idea to have enough dwelling coverage in your landlord insurance policy to pay for repairs for a covered loss. If your budget allows, consider getting enough coverage to rebuild your home if a covered peril destroys it, along with any belongings you don’t want to replace out of pocket.

Check out Credible to compare home insurance quotes from top carriers.