What the Fed's new economic policy means for mortgage rates

Mortgage borrowers will likely see higher rates in 2022 as the federal funds rate is predicted to rise

Mortgage rate predictions have changed after the latest Federal Open Market Committee (FOMC) meeting last week. Here's what you need to know. (iStock)

The Federal Open Market Committee (FOMC) met earlier this month to discuss changes to the Federal Reserve's economic policy amid record-high inflation rates. Some of these policy updates will have a direct impact on the finances of American consumers — particularly the Fed's highly-anticipated rate hikes.

Federal Reserve Chairman Jerome Powell said at a Dec. 15 press conference that the central bank will speed up tapering of its bond-buying program and is eyeing up to seven rate hikes through 2024, including up to three in 2022 alone.

The Fed has kept the benchmark rate near zero since the beginning of the coronavirus pandemic to boost economic recovery. This has kept interest rates on a number of financial products near record lows. During this time, mortgage rates set record lows in January 2021 due in part to the Fed's economic policy decisions.

But the time to lock in a historically low mortgage rate is running out. Mortgage rates tend to rise and fall with the benchmark rate, so mortgage rates will inevitably go up when the Fed implements its first post-pandemic rate hikes next year. In fact, mortgage interest rates have already started to rise following the Fed's latest meeting.

Keep reading to learn more about the Federal Reserve's impact on mortgage rates, including what you can do to combat rising rates. If you're planning on taking out a mortgage purchase or refinance loan, compare rates for free on Credible before they increase next year.

THIS IS THE BEST WAY TO LOWER YOUR MONTHLY MORTGAGE PAYMENT

Mortgage rates rise after latest Fed meeting

Mortgage interest rates set unprecedented record lows in 2021, which was due, in part, to the Federal Reserve keeping the benchmark rate near zero.

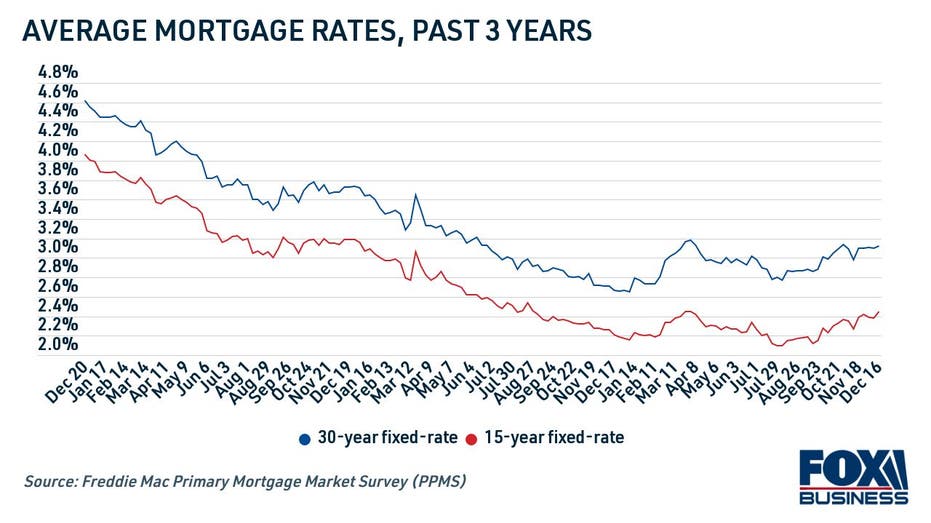

Average 30-year mortgage rates fell to an all-time low of 2.65% during the week of Jan. 7, according to Freddie Mac. For the 15-year mortgage term, which is a popular choice for homeowners looking to refinance, average rates fell to a record low of 2.10% during the week of July 19.

In the months since then, mortgage purchase and refinance rates have risen by several points, hovering at and above 3% for the 30-year fixed-rate loan term since September. Mortgage refinancing rates for 15-year fixed-rate loans are still relatively low, though, bouncing between 2.3% and 2.4% in that same time period.

SHOULD YOU PAY DISCOUNT POINTS TO LOWER YOUR MORTGAGE RATE?

When compared to the past few years, mortgage rates are still near bargain lows. This means it's still a good time for prospective home buyers and current homeowners to borrow a home purchase or refinance loan while rates are low — and before they inevitably rise.

You can compare rates across multiple mortgage lenders at once on Credible to help you shop around for the lowest rate possible for your financial situation. You can also use a mortgage calculator to estimate your monthly mortgage payment, as well as the total interest paid over the life of the loan.

VETERANS BORROWING VA LOANS AT A RECORD PACE, STUDY SHOWS

When will mortgage rates go up?

Experts forecast that mortgage rates will begin to rise significantly starting next year. The Mortgage Bankers Association's (MBA) latest mortgage rate prediction estimates that the average 30-year mortgage rate will reach 4% in 2022 and 4.3% in 2023 and 2024. That's compared with an average 30-year rate of 2.8% for 2020 and 3.1% for 2021.

In a statement following the FOMC meeting, MBA Senior Vice President and Chief Economist Mike Fratantoni said that average rates have remained low in the past year amid the Fed's increased bond purchases, but that they "may be more volatile as the Fed backs away from the market" in 2022.

"Although this will lead to a drop in refinances, we expect that the strong economy will support an increase in home sales in 2022," Fratantoni said.

This sentiment is also expressed in the latest Freddie Mac Primary Mortgage Market Survey (PMMS), which said rising mortgage rates come "as a result of economic improvement and a shift in monetary policy guidance" from the Fed.

We expect rates to continue to increase into 2022 which may leave some potential homebuyers with less room in their budgets on the sideline.

WHAT YOU NEED TO KNOW BEFORE MAKING A DOWN PAYMENT ON A HOME

With experts in agreement that mortgage rates will continue to rise as the Federal Reserve continues to update its economic policy, now is the time to lock in a low mortgage interest rate if you're planning on buying a home or refinancing your existing mortgage.

You can begin the mortgage application process on Credible by getting prequalified for a home purchase or refinance loan without impacting your credit score. You can also learn more about mortgage rates by getting in touch with a knowledgeable loan officer at Credible.

TAKE ADVANTAGE OF HOUSING MARKET NOW BEFORE RATES RISE, EXPERT SAYS

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.