Here's where flood insurance premiums are rising the most: Are you impacted?

FEMA's new flood insurance rating methodology will increase premiums for 3.9M Americans

Homeowners who live in high-risk areas prone to natural disasters may soon be paying more for flood insurance due to a new FEMA methodology. (iStock)

Homeowners insurance offers financial protection if your property is damaged by perils like theft or fire. But most home insurance policies don't protect against flooding, which can leave policyholders on the hook for expensive water damage and mold remediation.

That's where the National Flood Insurance Program (NFIP) comes in. The NFIP is a federally funded initiative that's managed by the Federal Emergency Management Agency (FEMA) as a way to reduce the socio-economic impact of floods.

The average cost of flood insurance for NFIP policies was $738 per year in 2021, according to Policygenius. But rates for many homeowners are about to increase due to Risk Rating 2.0, the new FEMA guidelines for assessing flood risk.

If you're looking for ways to save money while keeping your property sufficiently covered from damage, explore your options for homeowners insurance on Credible. You can compare quotes across multiple insurance companies for free, so you can get the lowest possible rate for your unique needs.

HOW COMMON NATURAL DISASTERS CAN IMPACT YOUR HOME & AUTO INSURANCE

Why are flood insurance rates going up?

Flood insurance premiums are rising for 3.9 million NFIP policyholders, FEMA data shows. Rates will increase by an average of $96 every year upon renewal of American homeowners with flood insurance coverage.

Two-thirds (66%) of policyholders will experience rate increases of up to $120 per year, and 11% will see their premiums increase at an even higher rate. However, about a quarter (23%) of policyholders will see a significant rate decrease amounting to $86 in monthly savings.

Previously, FEMA and insurers measured risk based on flood zones. Under the new rating system, they measure risk based on property characteristics like:

- Distance to water source or floodplain

- Flood frequency and severity

- The cost to rebuild or repair in the event of flood damage

Risk Rating 2.0 impacted new NFIP policyholders starting Oct. 1, while all remaining policies renewing on or after April 1, 2022, will be subject to the new methodology.

The NFIP limits rate increases to no more than 18% per year, but even a slight rate increase can have a negative impact on a homeowner's budget. You can find other ways to cut your home insurance costs by shopping around on Credible's online financial marketplace.

WHAT IS PRIVATE MORTGAGE INSURANCE AND HOW DOES IT WORK?

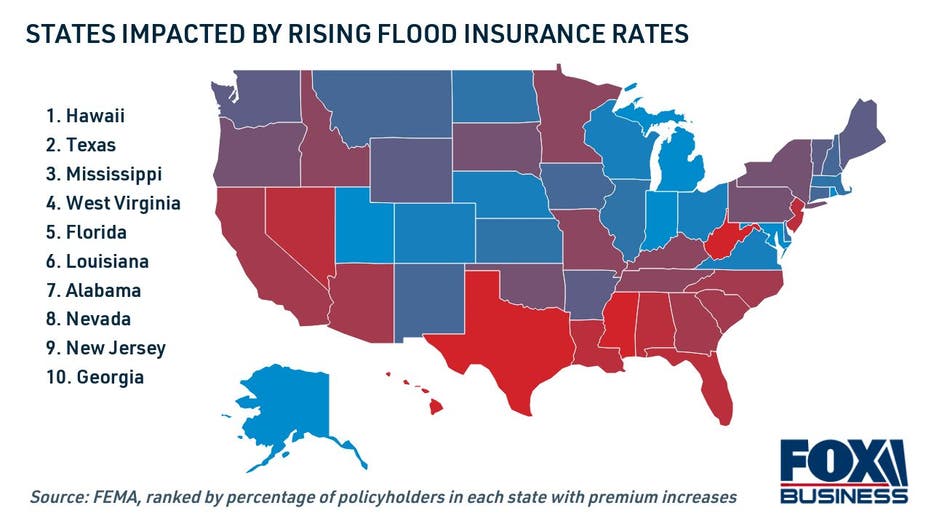

Where flood insurance costs are rising the most

Homeowners in Hawaii are most likely to be impacted by the new rating methodology. According to FEMA, 87% of NFIP policyholders in the Aloha State will experience higher premiums. Additionally, about 4 in 5 policyholders in the top Southern states impacted will see their premiums rise:

- Texas: 86%

- Mississippi: 84%

- Florida: 80%

- Louisiana: 80%

- Alabama: 79%

- Georgia: 76%

The South isn't the only region more heavily impacted by rising flood insurance rates. Homeowners in New Jersey, West Virginia and Nevada are also more likely to pay more for flood insurance with FEMA's new methodology.

HEAT WAVE RELIEF: HOW TO PAY FOR A NEW AIR CONDITIONER

States with the largest policy increases

Homeowners in some states are less likely to be affected by rising costs. But for those policyholders who will experience rate hikes, the costs may be significant.

Those who live in the Northeast will experience the largest increase in the price of flood insurance, according to an analysis by Porch.com. Homeowners in states such as Connecticut, Vermont, Maine and New Hampshire will see their premiums rise by more than $100 annually. Here are the top 10 states with the largest annual flood insurance premium increases:

- Connecticut: $130

- Vermont: $125

- West Virginia: $125

- Maine: $123

- Missouri: $120

- Pennsylvania: $116

- Iowa: $115

- Kentucky: $113

- Nebraska: $113

- New Hampshire: $113

Florida is expected to have the largest rate of increase for flood insurance, at 15%, the study found. With more than 1.7 million NFIP policyholders living in the Sunshine State, according to FEMA, that's a significant cost increase for flood insurance premiums.

Having a flood insurance policy is just one way to keep your home protected when disaster strikes. It's also important to assess your current home insurance coverage to ensure its meeting your needs. You can compare multiple insurance companies and purchase a policy on Credible, so you can rest easy knowing you have the right type of coverage.

LOOKING FOR A LIFE INSURANCE AGENT? HOW TO CHOOSE THE RIGHT ONE

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.