First-time condo buyers can get boost from government

Looking to buy a condominium? You could be eligible for a government-backed loan with a lower down payment under new rules announced Wednesday.

The Federal Housing Administration’s new regulation and policy guidance set a new condo approval process and allow for some individual condos to be eligible for an FHA mortgage even if the condo project isn’t FHA approved.

The loans only require a 3.5 percent down payment and allow for lower credit scores than conventional loans, The Wall Street Journal reported.

Officials said the new rules would make it easier for condo buyers to apply for FHA-insured financing and open up more mixed-use projects to FHA backing.

“Today we are making certain FHA responds to what the market is telling us,” FHA Commissioner Brian Montgomery said. “This new rule allows FHA to meet its core mission to support eligible borrowers who are ready for homeownership and are most likely to enter the market with the purchase of a condominium.”

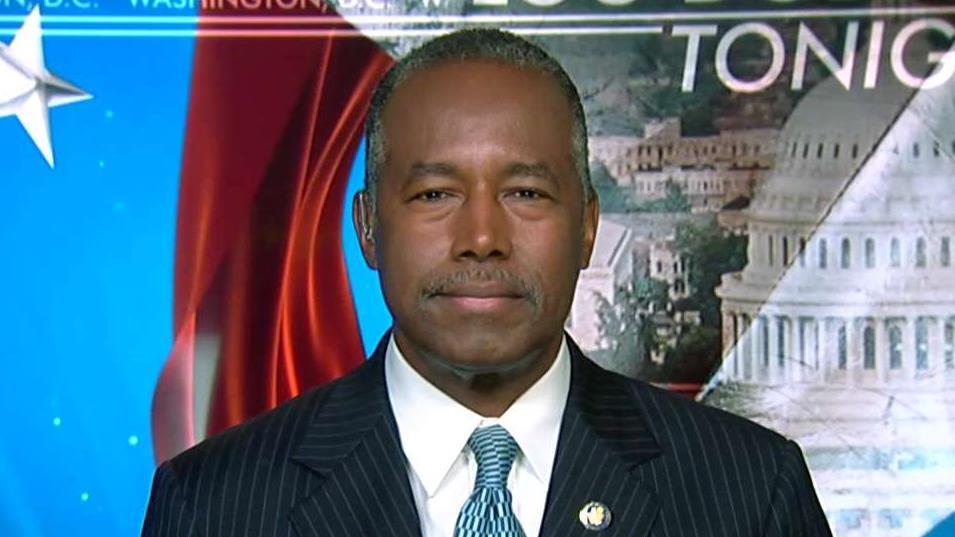

According to the FHA, 84 percent of condo buyers it backs have never owned a home before. Housing and Urban Development Secretary Ben Carson said the change will open homeownership to new first-time buyers as well as seniors.

“Condominiums have increasingly become a source of affordable, sustainable homeownership for many families and it’s critical that FHA be there to help them,” Carson said.

Only 6.5 percent of the 150,000 condo projects in the U.S. are approved for FHA’s mortgage insurance programs. Officials said the new policy, which will go into effect on Oct. 15, will open somewhere between 20,000 and 60,000 condo units to FHA-backed financing each year.

There are risks for the government, the Journal reported. By loosening the rules, the government could be exposed to a higher probability of loan default if the housing market slows and prices drop.

David Stevens, a retired chief executive of the Mortgage Bankers Association who previously ran the FHA, told the Journal that FHA “is already a higher risk program.”

“Layer that on top of a higher-risk product called the condominium and you definitely have to prepare yourself for the fact that in the next correction you’re going to take more losses at FHA than anywhere else,” he said.

Montgomery told the Journal that the FHA has still tightened its requirements since the housing crash.

For an individual unit to be eligible for approval under the new rules, officials said it will have to be located in a completed project that is not approved. For projects with 10 or more units, no more than 10 percent can be FHA-insured. Projects with fewer than 10 units can have two FHA-insured units.