What is a home equity loan and how does it work?

You might take out a home equity loan to finance a major home renovation — or for anything else that requires a lump sum of cash.

A home equity loan allows you to borrow a lump sum of cash against your home’s value and repay it with fixed monthly payments. (Shutterstock)

A home equity loan allows you to borrow a lump sum of money all at once when your home’s value is higher than your mortgage debt. Similar to a first mortgage, you pay back a home equity loan at a fixed interest rate over 10 to 30 years.

Here’s an overview of how home equity loans work, the costs typically associated with them, and what requirements you’ll need to meet to qualify for one.

Credible doesn’t offer home equity loans, but you can compare prequalified mortgage refinance rates from multiple lenders in just a few minutes.

- What is a home equity loan?

- How does a home equity loan work?

- How much can you borrow with a home equity loan?

- Costs associated with home equity loans

- Pros and cons of taking out a home equity loan

- HELOC vs. home equity loan

- How to qualify for a home equity loan

What is a home equity loan?

A home equity loan allows you to borrow against a percentage of your home equity, which is the difference between your home’s market value and the balance you owe on any home loans you already have. You might take out a home equity loan when you need a lump sum of cash to cover a major expense.

Home equity loans are a type of second mortgage, and taking out a second mortgage comes with risks. For one, your home will serve as collateral for the home equity loan. If you can’t repay the loan, you could lose your home. Your home also secures the first mortgage you used to purchase your home. If you’re taking out a home equity loan on top of your first mortgage, you’ll have two loans secured by your home, increasing your risk.

Increasing your monthly payment with a home equity loan will also tighten your budget. If your income goes down, it could be harder to make your monthly housing payments compared to if you only had a first mortgage, or no mortgage at all.

How does a home equity loan work?

A home equity loan, like a cash-out refinance, allows you to borrow against your available equity. After your loan closes, you’ll have a three-day right to cancel your loan if you change your mind. Once those three business days are up, the lender will deposit the lump sum you’ve chosen to borrow into your bank account.

What you do next is entirely up to you. You could build a heated pool, replace your dilapidated roof, landscape your yard, or pay off all your credit cards. You could also finance your wedding, make a down payment on an investment property, or put your kid through college.

Whatever you do, just make sure you understand the benefits, risks, and trade-offs of your decision.

How much can you borrow with a home equity loan?

How much you can borrow with a home equity loan depends on the amount of equity you have in your home, your credit history, your income, and your existing debt. The more equity you have, the better your credit history, the higher your income, and the lower your debt, the more you’ll be able to borrow — and the better your interest rate will be.

Here’s how to calculate how much home equity you have:

Home value − Existing home loan balances = Home equity

For example, if your home is worth $400,000 and you owe $150,000 on your first mortgage, your equity is $250,000.

Lenders will often let you borrow up to 80% of your home’s value, or $320,000 on a $400,000 home. Your combined loan-to-value (CLTV) ratio is the sum of your first mortgage and the home equity loan you want to take out. After subtracting your first mortgage of $150,000 from $320,000, you’d have $170,000 in available equity to borrow.

HOW TO REFINANCE A HOME EQUITY LOAN

Costs associated with home equity loans

The costs to take out a home equity loan vary by lender, but here are the charges you can expect to pay:

- Origination or administration fee — A flat fee or percentage of the loan amount to compensate the lender for underwriting and originating your home equity loan

- Credit report — A nominal charge for the lender to purchase a copy of your credit history and score

- Appraisal — A charge for establishing your property’s value to determine how much you can borrow

- Document preparation — A minor charge to cover the cost of putting together your closing paperwork

- Government recording fees — Costs your local government charges to formally document the new lienholder when you close on your home equity loan

- Title search and report — A charge to ensure that no one else has a claim to your property besides you and your existing lender

- Notary — A professional service fee for someone to verify your identity and witness your signature on your loan documents

- Flood certification — A small fee to research whether your home is located in a high-risk flood zone. If it is, the lender may require you to purchase flood insurance.

Some lenders will waive all or part of your closing costs on a home equity loan to earn your business. However, if you refinance or pay off the loan within three years of closing, you may have to reimburse the lender for some of those costs.

You won’t find home equity loans at Credible, but if you’re looking for a great rate on a mortgage refinance, you can compare rates from various lenders.

Pros and cons of taking out a home equity loan

Every financial product has its benefits and drawbacks. Here’s what you should know about the pros and cons of a home equity loan:

Pros of a home equity loan

- Relatively low fixed interest rates

- Opportunity to borrow a large sum

- Flexibility to use the money however you want

- Potentially deductible interest, if you itemize

- Long repayment period

Cons of a home equity loan

- Requires home as collateral, increasing foreclosure risk

- Can take several weeks to get the money

- Interest rates are typically higher than the initial rates on home equity lines of credit (HELOCs)

- Tax savings probably won’t apply

- Interest payments for a decade or more

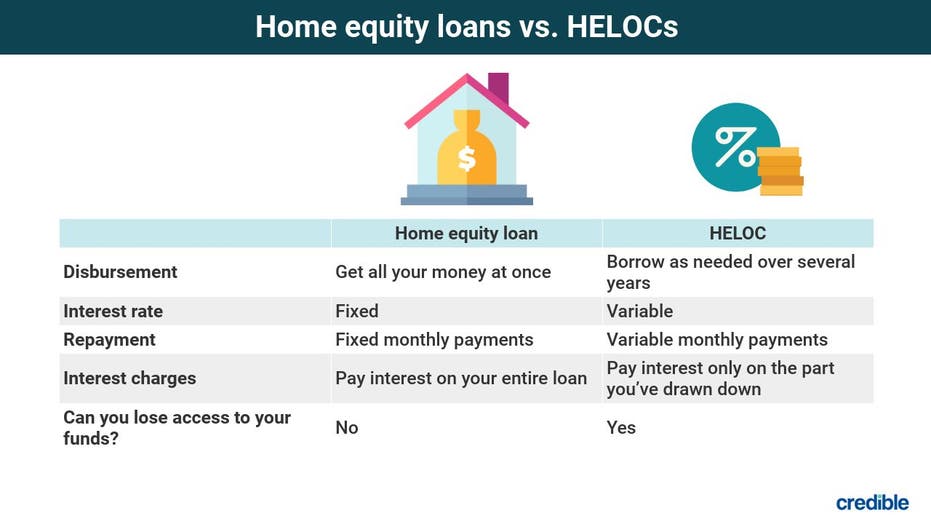

HELOC vs. home equity loan

Home equity loans and home equity lines of credit are both types of second mortgages, but they work differently and serve different needs.

A home equity line of credit, or HELOC, gives you access to a certain amount of money that you can borrow against as needed until you reach your credit limit. Your loan term begins with a draw period that typically lasts up to 10 years, followed by a repayment period that typically lasts an additional 10 to 20 years. You might use a HELOC to gradually remodel your home over time.

During a HELOC’s draw period, you can borrow against and pay down your line as you please. Once the draw period ends, you can no longer borrow against your credit line.

The interest rate is variable throughout the draw period and the repayment period. However, some lenders will let you lock in the interest rate on part or all of the money you’ve borrowed from your HELOC, similar to a home equity loan.

Depending on your needs, one loan may suit you better than the other. Here’s how the two compare:

How to qualify for a home equity loan

Qualifying for a home equity loan is similar to qualifying for a refinance.

You’ll need to submit detailed information about your income, assets, and liabilities and back it up with information from account statements and tax returns.

A loan underwriter will review and verify everything to determine whether you qualify.

Each lender has its own approval criteria, but typical requirements often include:

- Credit score — At least 680

- Debt-to-income ratio — No higher than 43%

- Home equity — At least 20%

If you decide a refinance is a better fit for your financial goals, you can compare mortgage refinance rates from multiple lenders in minutes using Credible.