Homebuyers struggle with affordability amid rising prices and interest rates: report

The portion of wages required for homeownership surged at its fastest rate in 15 years

Housing affordability continues to worsen as home prices and interest rates rise, according to a recent report. (iStock)

Being able to afford buying a home has grown more difficult as home prices and interest rates rise, according to a new report from ATTOM Data Solutions.

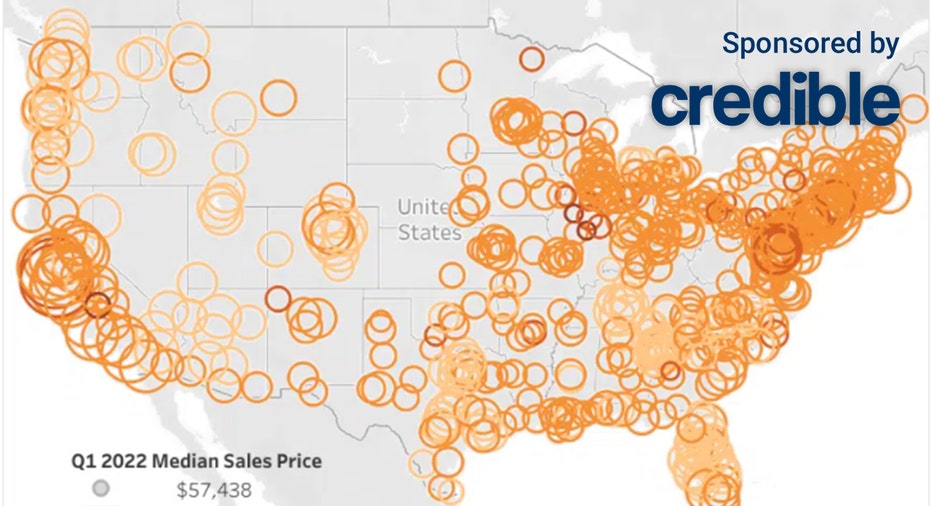

This comes as median-priced homes in 79% of counties across the U.S. have become less affordable than their historic averages, according to ATTOM’s 2022 U.S. Home Affordability Report. This is an increase from just 38% in the first quarter of 2021. In fact, housing affordability has reached its worst point since mid-2008 as home price growth continues to outpace wages.

"It’s certainly no surprise that affordability is more challenging today for prospective homebuyers than it was a year ago," Rick Sharga, ATTOM executive vice president of market intelligence, said.

As home prices and interest rates continue to rise, "more consumers are going to struggle to find a property they can comfortably afford," he continued.

Comparing multiple mortgage rates and lenders can potentially help you offset these affordability challenges. To see your options, you can visit Credible to find your personalized rate without affecting your credit score.

HOME PRICE GROWTH HITS ALL-TIME HIGH IN FEBRUARY: BLACK KNIGHT

Home price growth outpacing wages

In the first quarter of 2022, median home prices in 461 counties (out of 586) were less affordable than they were in the past, according to the report. This is up from 449 counties at the end of last year and 224 counties in the first quarter of 2021. The increase is because the median national home price surged 16% annually to a record high of $320,000 while wages increased just 7%.

The cost of buying a home in 2022 would take up about 26% of the average national wage, which is $66,560, the report said. This is up from nearly 25% in the fourth quarter of 2021 and nearly 22% in the first quarter of 2021. While the percentage of wages needed to purchase a home is moving up, it is still below the 28% ceiling that common lending standards consider "affordable."

"Throughout the pandemic, a glut of buyers has flooded the market, chasing a historically limited supply of homes for sale," the report stated. "This high demand was due in [part] to mortgage rates hovering around 3%, and in part because of the flight of urban renters leaving congested virus-prone areas for the perceived safety of a house and yard and the space for growing work-at-home lifestyles. As demand has spiked, prices have jumped beyond wage increases, damaging affordability."

If you are looking to make your home purchase more affordable, comparing multiple mortgage lenders can help ensure you get the best interest rate available. Visit Credible to compare multiple lenders at once and choose the one with the best mortgage rate for you.

FED CONSIDERS REDUCING BALANCE SHEET BY $95B PER MONTH, BUT WHAT COULD IT MEAN FOR YOUR WALLET?

Rising inflation creates further challenges for households

While the housing market is still considered to be "affordable," rising inflation could impact affordability even further, according to the report. This would make it harder for renter households to save for a down payment or be able to meet monthly mortgage payments, reducing home sales.

"The good news is that in almost half the counties we reviewed, homeownership costs remained below 28% for households with average income," Sharga said. "But the x-factor is what impact 8% inflation rates will have on these households, and their ability to meet their financial obligations. Rising food and energy prices could be a hidden factor that makes affordability even more of a challenge for homebuyers and makes it more difficult to make ends meet for current homeowners."

Inflation hit yet another new 40-year high in March, rising 8.5% annually, which is the fastest pace since December 1981. This was even higher than economists expected and shows that the rate of inflation has yet to slow down, despite the Fed’s efforts to control it by raising interest rates. Not only does high inflation make it harder to save, but the Federal Reserve also plans to continue raising interest rates, thereby making housing less affordable.

If you are interested in taking advantage of mortgage rates now before the next rate hike, contact Credible to speak to a mortgage loan expert and see if this is the right option for you.

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.