Have bad credit? You might be overpaying for homeowners insurance, study finds

Consumers with poor credit paid 29% more for their home insurance premiums than consumers with exceptional credit, according to a new report. (iStock)

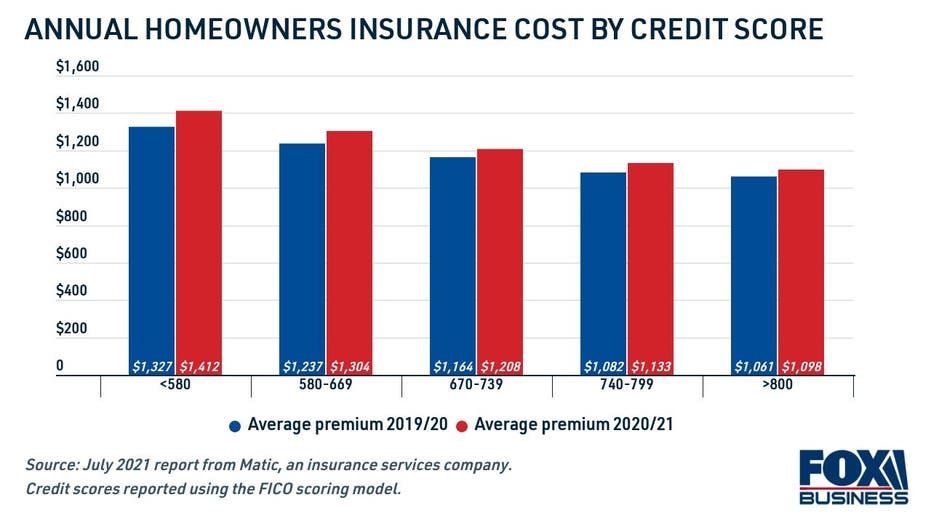

Homeowners insurance premiums have risen in the past year due to soaring home values, pricey materials and a labor shortage. But homeowners with bad credit were disproportionately impacted by rising costs, according to a July 2021 report from insurance platform Matic.

Consumers with a poor credit score — one that's below 580 as defined by the FICO model — paid the most for homeowners insurance. They saw an average home insurance premium of $1,412 for the 2020-21 year, which is 29% more than the average premium for a homeowner with an excellent FICO score of 800 or higher, at $1,098.

The average home insurance premium for consumers with poor credit rose faster than it did for those in higher credit bands. Poor-credit homeowners paid 6.4% more for home insurance in the 2020-21 year than they did in 2019-20, compared to a 3.5% increase for consumers with excellent credit.

- Poor credit (<580): 6.4%

- Fair credit (580-669): 5.4%

- Good credit (670-739): 3.8%

- Very good credit (740-799): 4.7%

- Exceptional credit (800+): 3.5%

With rising home insurance rates, it's more important than ever to shop around with multiple insurers to compare premiums — especially if you have a low credit score. That way, you know you're getting the lowest premium possible for your financial situation.

You can get free quotes from multiple home insurance companies at once on Credible.

COMPARING AUTO INSURANCE QUOTES CAN SAVE YOU HUNDREDS OF DOLLARS PER YEAR

How to get homeowners insurance with bad credit

Your credit score is based on your credit utilization, how much debt you have and your on-time payment history as reported to the three credit bureaus (Experian, Equifax and Transunion). Having a poor credit history won't necessarily prevent you from qualifying for homeowners insurance, but it will likely result in higher insurance premiums. That's because most homeowners insurance companies use your credit score to determine your insurance score, which then impacts your premium.

In most states, an insurance score, which is partially driven by a credit rating, represents the probability of a claim being filed, and affects the premium a homeowner will pay for coverage.

In fact, 85% of home insurers use a credit-based insurance score in states where it's legally allowed, according to the National Association of Insurance Commissioners (NAIC). Some states, including California, Hawaii, Maryland, Michigan and Massachusetts ban or limit insurers from using credit scores when determining home insurance eligibility.

Even if you have a few dings on your credit report, though, certain insurance carriers may weigh your credit history differently than others. Homeowners insurance rates vary between insurance companies, which means it's important to get an insurance quote from multiple insurers, even if you have a high credit score.

You can shop around for homeowners insurance policies on Credible to make sure you're getting a fair deal.

DO YOU NEED MORTGAGE INSURANCE?

5 other factors that impact your home insurance premium

While your credit score is likely to impact how much you pay for home insurance, it's not the only factor — and it's actually not the most important thing that insurers consider when setting premiums. Here are a few other factors that affect the cost of your homeowners insurance policy:

- Your coverage amount. The higher your coverage amount, the higher your insurance premiums will be.

- Your deductible. A lower deductible amounts to lower home insurance premiums.

- The condition of your home. Older homes may have outdated structures that are considered a liability. You'll get a break on your home insurance premiums if you have safeguards like smoke detectors or a home security system. The type of home you have is also taken into account. Manufactured homes, for example, are built with cheaper materials and will be more expensive to insure.

- Where you live. You'll pay higher insurance premiums if your home is in a zone that's impacted by natural disasters like floods, hurricanes and tornadoes (although you may have to purchase separate policies to cover these events). Insurance companies will also consider local crime statistics to determine the likelihood of theft or vandalism.

- Your previous claims history. If you've filed claims in the past, your premiums will likely be more expensive.

But even if you have excellent credit, a newly built home and a limited claims history, you might still expect your home insurance premiums to increase 3-4%, according to Matic. That's why it's important to check your coverage and compare homeowners insurance quotes every few years, just to make sure you're not overpaying.

Take a look over your current home insurance policy, and compare quotes and coverage on Credible's online financial marketplace.

PAYING OFF CREDIT CARD DEBT WITH A PERSONAL LOAN CAN SAVE YOU $700 IN INTEREST

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.