Housing vouchers urgently needed to address rent inflation and surging energy costs, economist says

Rising consumer prices are putting a strain on financially vulnerable households

Price inflation is leading to higher housing costs for low-income renters, according to an economist at the Center for Budget and Policy Priorities. (iStock)

The cost of living for U.S. adults has risen sharply in recent months, led by higher rent and utility costs, according to economists at the Center for Budget and Policy Priorities (CBPP). To address the financial impact on American households, one expert has urged the Biden administration to make Housing Choice Vouchers more widely available.

"Providing more housing vouchers could help many additional renters cope with higher costs and hold on to their homes," CBPP Senior Director for Housing Policy and Research Will Fischer said in a recent blog post.

The voucher program is an effective way to reduce homelessness and help low-income consumers afford housing costs, Fischer said. But due to lack of funding, federal rental assistance only reaches about a quarter of households who qualify, according to CBPP data.

Keep reading to learn more about the CBPP proposal to offset rising housing costs. And if you're looking for ways to cut expenses amid record-high inflation, you could consider consolidating higher-interest debts into a fixed-rate personal loan. You can visit Credible to compare debt consolidation offers for free without impacting your credit score.

THE 10 BEST HOUSING MARKETS FOR FIRST-TIME HOMEBUYERS IN 2022

Current inflation rate doesn't fully reflect rising rent costs

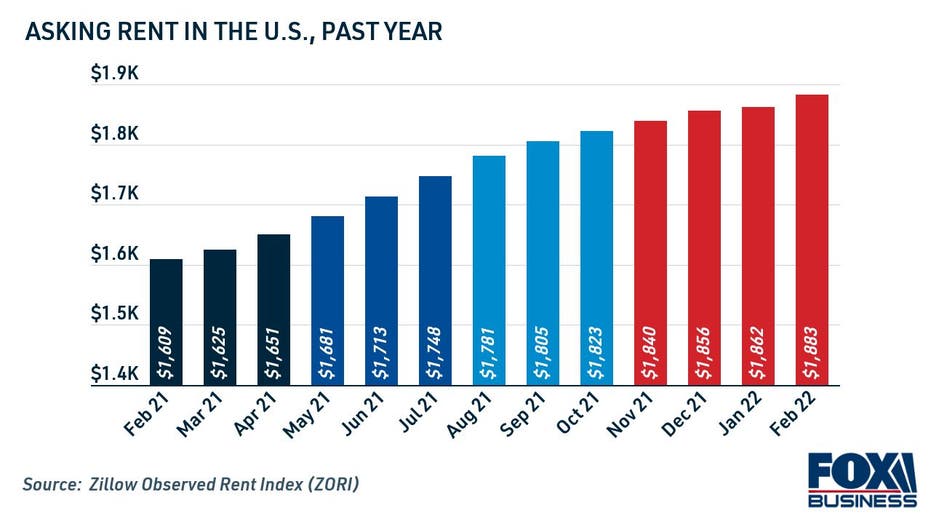

The Consumer Price Index (CPI) showed rents rising by 4.2% annually in February, but Fischer said that's because it's calculated using "an average of rents paid by renters in a survey sample whether or not they recently leased their unit." According to the Zillow Observed Rent Index (ZORI), rents for newly leased units surged 17% in the past year.

Monthly rent ballooned by $274 in the past year to $1,883 in February, with the increase in rent prices nationally attributed to tight housing supply, Zillow research found. And some cities reported even steeper rent hikes.

LANDLORDS CAN CONSIDER THESE ALTERNATIVES TO EVICTIONS AMID NEW MORATORIUM

Rent isn't the only household expense that's rising — consumer inflation set another 40-year high last month, with the price of residential fuel and utilities increasing 11% annually, the CBPP reported.

Energy costs rose substantially for heating oil (44%) and utility gas (24%), which many people rely on for household heating and cooking. What's more, the CBPP predicts that utility costs will continue to rise due to the Russian invasion of Ukraine.

Separately, credit card debt surged in the fourth quarter of 2021, according to the New York Federal Reserve, signaling that many Americans are becoming reliant on high-interest credit card spending. One way that consumers with outstanding debt can save money and lower their monthly payments is through credit card consolidation. You can learn more about this debt management strategy on Credible.

HOMEOWNERS GAINED OVER $55K IN EQUITY IN 2021: CORELOGIC

Average household waits 2.5 years to receive housing vouchers

Federal housing vouchers offer cash assistance to help renters afford their monthly payments. Recent funding legislation enacted by Congress will provide about 30,000 new housing vouchers, the CBPP estimates. But it said this isn't sufficient to help all families in need.

And while housing vouchers may provide necessary relief for some low-income households, they don't necessarily provide immediate relief. Data analyzed by the CBPP showed that eligible beneficiaries wait nearly two and a half years to receive their housing vouchers, on average.

"Additional vouchers should be accompanied by measures to ease pressure on housing costs by building more homes, but this won’t happen quickly enough to help people who are having difficulty paying their rent and utility bills right now," Fischer said.

Fischer also urged policymakers to allocate more state funding for affordable housing and ease construction barriers on multifamily housing. But even with these measures in place, it could take years to stabilize housing costs.

If you're searching for short-term ways to cut expenses, you might consider borrowing a personal loan to consolidate higher-interest debt payments. You can visit Credible to browse current personal loan rates and see offers tailored to you.

WHAT THE FED'S NEW ECONOMIC POLICY MEANS FOR MORTGAGE RATES

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.