How to automatically save more money

Depending on how you manage your money, there are a variety of apps out there that help you save more money.

Bankrate gathered a list of five apps that sets aside your cash without you having to think about it every day. Here's a breakdown of the best app for you depending on your financial personality:

1. If you're more of a spender than a saver

Have a major case of FOMO? Have trouble limiting your spending, but know you need to save more? Often feel slightly indecisive? Digit is the automated savings app for you.

Young couple doing online shopping

The app makes saving simple. It goes into your checking account, analyzes how you spend and then moves funds from your checking to your savings by calculating how much you can afford to move. It has a "no overdraft guarantee" so you don't have to worry about it taking out too much money and sending you into the red.

The app costs $5 a month, but Digit claims it saves its average user more than $2,000 a year.

2. Want to save towards a goal you've visualized

Similar to Digit, Dobot is another app that makes saving money a little mindless. But unlike, Digit, Dobot is free.

One of the neat features of the app is you can upload a photo to a savings goal you have. For instance, if you want to go to a Hawaiian resort for your anniversary, then assign a photo of that beach chair to your savings account.

Woman sitting on a long-tail boat (iStock)

It's important to note that instead of moving the small amounts of money from your checking to your savings, it takes those dollars and moves it into a savings account through Dobot's owner, Fifth Third Bank. They will cover overdraft fees as well, though.

3. Over-spenders who might need to set a few more ground rules

Speaking of visualizing your goals, Qapital is a great option for that. Like Dobot, you can assign photos of your saving goals, almost making a Pinterest-esque savings goal board.

It's a bit different than the others as it lets users set up rules for their savings.

Espresso machine making fresh cup of coffee

Let's say you have an expensive coffee addiction that needs to be fed -- you can set up a rule to the app saving money every time you buy a pricey cup o'joe. Similar to most savings apps, it will round your purchases up to the nearest dollar so the leftover change gets stashed away.

It costs about $3 a month, but it has an extensive savings plan. You can get a Qapital debit card or you can even invest your savings into an ETF portfolio to accomplish long-term goals.

4. If you're a bit of a gambler

If Vegas is your guilty pleasure and "Press Your Luck" is your favorite game show, Long Game is the savings app for you.

Gambler throws dice at a craps table at a casino

The free app allows you to do something more conservative like save money every payday. But the more fun aspect of the app is it lets users who save money win prizes. That's right, it's called prize-linked savings and the more a person saves, the greater their chance is to win.

In good news, the savings account is insured by the FDIC, so it's not quite the same as playing a hand at the blackjack table.

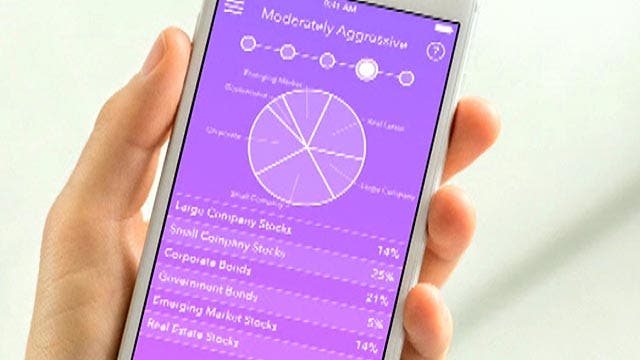

5. Charts and graphs help you understand your savings goals

The app called Tip Yourself lets people transfer small amounts from their checking account into their savings account, essentially "tipping" themselves for a job well done on various activities.

The hand of the waitress takes a tip

Whatever your goal is, whether it's to more frugal or even hitting the gym, your savings can be tied to those actions. The funds are moved to the app's bank partner: nbkc bank. However, you will not earn interest on the savings, so you should think of the cash as a little extra spending money.

CLICK TO GET THE FOX BUSINESS APP

Tip Yourself Pro costs a little under $10 annually.