With personal loan interest rates at record lows, here's how to get a good rate

The average personal loan interest rate is 9.09%, according to the Fed

Personal loans can be used to pay for anything from unexpected expenses to wedding expenses, with funding as fast as the next business day. (iStock)

Personal loans offer fast, lump-sum funding that you repay in fixed monthly installments over a set period of time. If you're considering borrowing a personal loan to pay off high-interest credit card debt or finance a home improvement project, there's never been a better time to lock in favorable terms.

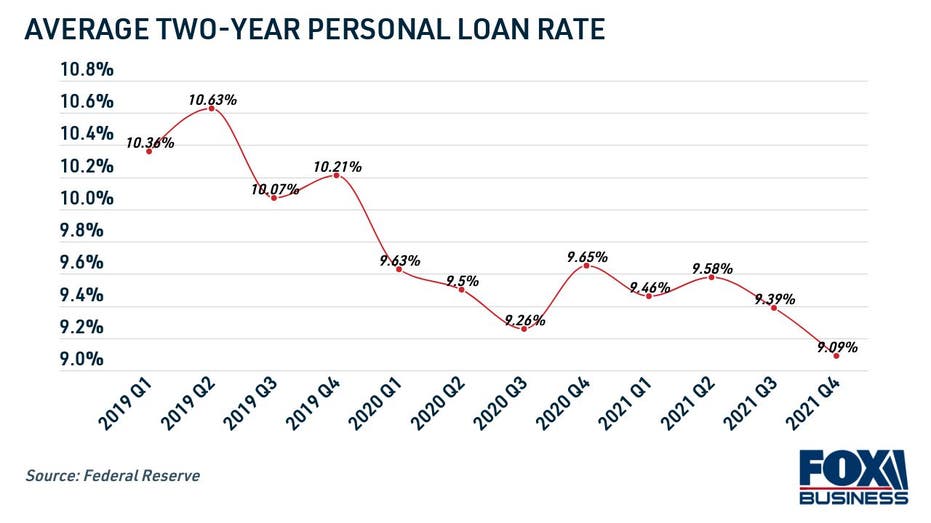

The average interest rate on a two-year personal loan fell to an all-time low of 9.09% in the fourth quarter of 2021, according to the Federal Reserve. The previous record was set in the third quarter of 2020, when personal loan rates averaged 9.26%.

BEST CREDIT CARD DEBT CONSOLIDATION LOANS

Personal loan interest rates are based on a number of factors, including a borrower's credit history as well as the loan term and loan amount. Just because the average rate is at a record low doesn't necessarily mean that all applicants will qualify for these competitive rates. Thankfully, there are several ways to improve your chances of getting a good personal loan interest rate.

Keep reading to learn more about how personal loan interest rates are determined, as well as how you can lock in a low rate on a personal loan. You can also visit Credible to compare rates across multiple personal loan lenders for free without impacting your credit score.

PERSONAL LOAN ORIGINATION FEES: ARE THEY WORTH THE COST?

How to get a low interest rate on a personal loan

Personal loan lenders determine an applicant's eligibility and interest rate based on a number of factors, including creditworthiness and debt-to-income ratio. Borrowers with good credit will qualify for the best personal loan rates, while those with bad credit may see unfavorable repayment terms — if they can qualify at all.

If you're considering borrowing a personal loan, you should aim to have a very good or excellent credit score, which is defined by the FICO scoring model as 740 or above. The higher your credit score, the better chance you have of locking in the lowest interest rate possible on a personal loan.

Personal loan applicants should also aim to have a debt-to-income (DTI) ratio of 40% or lower, according to Credible. You can calculate your DTI ratio by dividing your monthly debt payments you owe by your gross monthly income.

Since personal loan lenders have their own eligibility requirements, it's important to shop around with multiple online lenders. Most lenders let you get prequalified to see your estimated interest rate with a soft credit inquiry, which won't affect your credit score.

You can compare personal loan interest rates across multiple lenders at once on Credible's online marketplace. That way, you can find the best possible offer for your financial situation.

WHAT IS A GOOD ANNUAL PERCENTAGE RATE (APR) ON A PERSONAL LOAN?

Can you borrow a personal loan with bad credit?

Applicants with good credit will qualify for the best personal loan offers, but it may be possible to qualify for a personal loan if you have bad credit. Here are a few things to keep in mind:

- Your total costs will likely be higher. Some financial institutions and credit unions cater to borrowers with fair credit, although they will typically offer lower maximum loan amounts and charge higher interest rates. This results in a personal loan with higher monthly payments that's more expensive to repay.

- Secured personal loans can improve your eligibility. Personal loans are traditionally unsecured loans, which means they don't require you to put up collateral. But it may be easier to qualify for a personal loan that's secured by an asset you own, such as your car. Keep in mind that the lender may seize your collateral if you default on the loan.

- A co-signer may make you a better applicant. Having a co-signer with a robust credit profile, such as a trusted friend or relative, can help you qualify for a lower interest rate than if you apply on your own. Since a co-signer is equally responsible for loan payoff, be sure to make timely payments to avoid damaging both your credit scores.

You can browse current personal loan interest rates in the table below, and visit Credible to see offers tailored to you. To learn more about personal loans, get in touch with a knowledgeable loan officer at Credible.

HOW TO AVOID A MORTGAGE PREPAYMENT PENALTY

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.