Consumer credit scores rise as Americans find ways to pay down debt: NY Fed

Debt reduction during the pandemic improved credit reports for most Americans

Consumers utilized extra cash windfalls to pay down debt during the pandemic, which built momentum for higher median credit scores, according to a New York Fed report. (iStock)

The COVID-19 pandemic has had a significant financial impact on many Americans who may have dealt with changes in employment, increased child care expenses and soaring consumer prices. But despite the challenges, most consumers have improved their credit reports in the past three years, according to a new report from the Federal Reserve Bank of New York.

"Borrowers benefited substantially from the federal government’s fiscal transfers and debt-related payment moratoria, and many saw increases to their credit scores despite the recession," the authors said.

Through an analysis of Equifax credit data, New York Fed researchers determined how the pandemic has changed the finances of American consumers:

- Consumers paid down credit cards, while other debt balances grew

- Student loan borrowers saw the highest credit score boost

- Bankruptcies have declined among Americans of all incomes

Read more about each takeaway in the sections below. You can also enroll in free Experian credit monitoring services on Credible to see a detailed breakdown of your credit score.

WHAT TO DO IF YOU CAN'T MAKE THE MINIMUM PAYMENTS ON YOUR CREDIT CARDS

Consumers paid down credit cards, while other debt balances grew

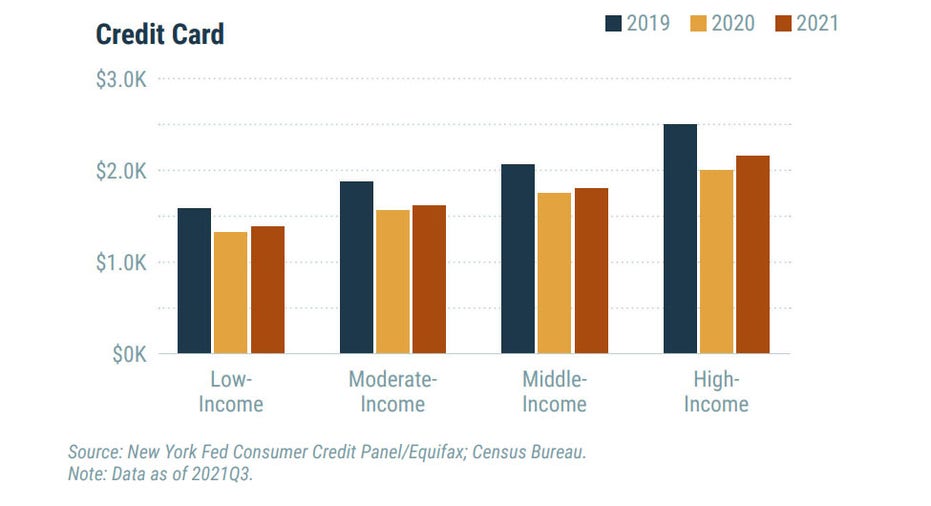

The New York Fed found that credit card debt is the most commonly held debt among Americans of all incomes. Over the course of the pandemic, many consumers were able to pay down high-interest credit card balances with help from federal relief measures, such as stimulus checks.

Student loan debt is also prevalent across all income groups, although mortgage debt is more common among borrowers in higher-income areas. Student loan balances stayed relatively steady during the pandemic due to the federal student loan moratorium, which temporarily froze the interest and payments on some types of loans.

Notably, auto loan debt grew significantly among all Americans between 2019 and 2021 driven by "sharp increases in the cost of new and used cars," the authors said. A recent report from Edmunds found that the vast majority (82%) of car buyers paid above sticker price for new vehicles in January. Experts attribute this cost increase to limited inventory and ongoing supply chain issues.

HOW TO GET A BALANCE TRANSFER CREDIT CARD

Although credit card balances fell at the onset of the pandemic, recent New York Fed data shows that credit card debt ballooned in the fourth quarter of 2021. Revolving credit debt with high interest rates can throw off your credit utilization ratio, which can have a negative impact on your credit score.

If you're searching for ways to pay down your credit cards, you might consider opening a fixed-rate personal loan. Credit card consolidation has the potential to save borrowers thousands of dollars in interest charges over time. You can visit Credible to compare personal loan rates for free without impacting your credit score.

DEBT SNOWBALL METHOD VS. DEBT AVALANCHE METHOD: CHOOSING A DEBT REPAYMENT STRATEGY

Student loan borrowers saw the highest credit score boost

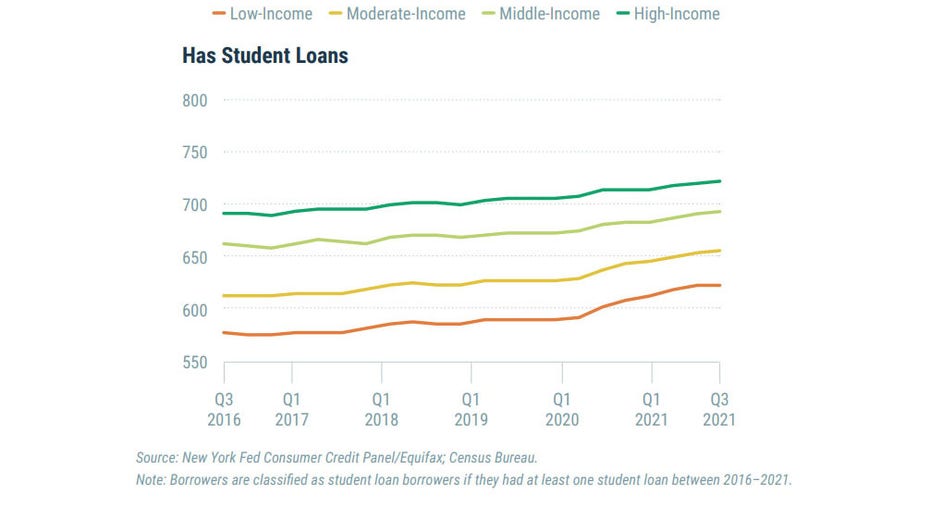

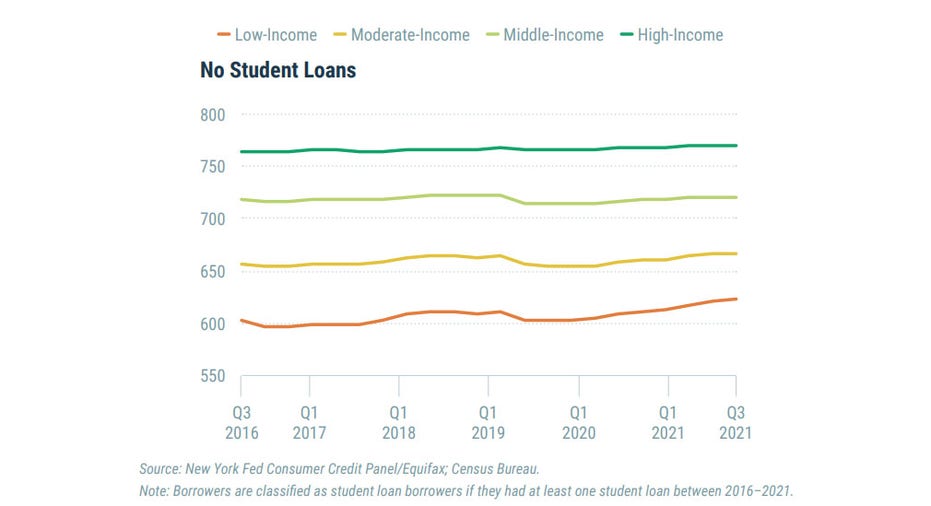

While median credit scores rose for all Americans over the course of the pandemic, consumers with student loans saw the most significant credit score increases due to the federal student loan payment pause. During the forbearance period, student loan borrowers have been reported as current on their payments to the credit bureaus.

"This temporary removal of delinquencies lifted the credit scores of previously delinquent borrowers, particularly in the low- and middle-income areas where delinquency and default were higher pre-pandemic," the authors said.

HOW YOUR TAX REFUND CAN IMPROVE YOUR CREDIT

However, borrowers will be expected to resume payments on their federal student loans starting in May, unless the Biden administration extends forbearance for a fourth time. New York Fed economists have previously warned that many borrowers are at risk of becoming delinquent when the payment pause expires. After a prolonged period of delinquency, some borrowers may see their credit scores plummet.

If you're financially unprepared to restart student loan payments in May, you might consider enrolling in an income-driven repayment plan (IDR), applying for additional federal deferment or refinancing to a private student loan at a lower interest rate. Keep in mind that refinancing your federal student debt would make you ineligible for certain protections like IDR and federal student loan forgiveness programs.

You can visit Credible to learn more about student loan refinancing, so you can decide if this debt repayment method is right for your financial situation.

GEN Z CONSUMERS RESOLVE TO CHANGE THEIR SPENDING HABITS IN 2022

Bankruptcies have declined among Americans of all incomes

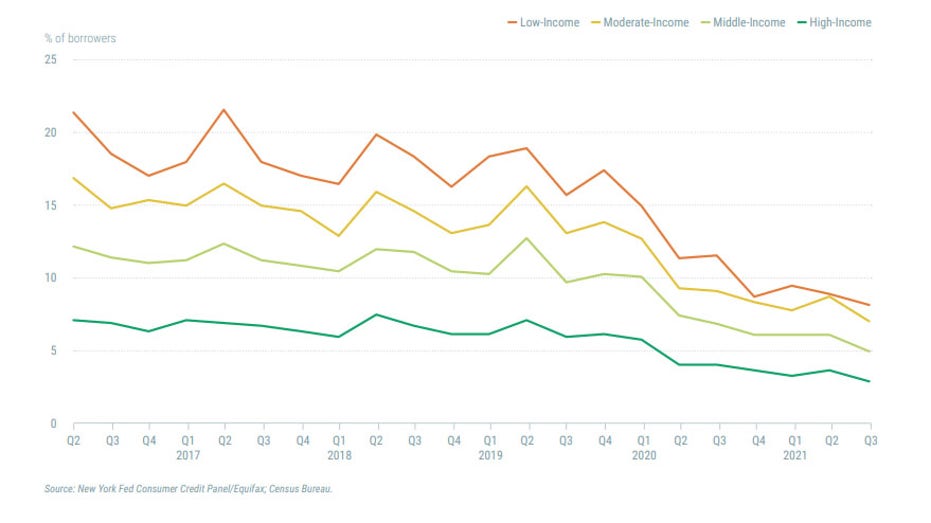

Finally, economists at the New York Federal Reserve found that bankruptcy rates sharply declined since the onset of the coronavirus pandemic. While bankruptcy filings "have historically been more prevalent in lower-income areas," the authors said, they decreased substantially among low-income Americans in recent years.

LOAN CONSOLIDATION VS. DEBT SETTLEMENT: WHAT'S THE DIFFERENCE?

This is welcome news for consumers, since filing for bankruptcy can have a lasting negative credit impact. And while there are some circumstances when declaring bankruptcy is the best strategy to eliminate unmanageable debt, that's not always the case.

If you're considering filing for bankruptcy, you may consider pursuing an alternative debt repayment plan first:

- Negotiate with your creditors. Depending on the type of debt you have, you may be able to temporarily pause your payments, request a lower interest rate or settle the balance for less than you owe. For example, mortgage forbearance may grant a short period of payment relief. Or if you owe a tax debt, you can enroll in a payment plan through the IRS.

- Seek help from a credit counselor. A nonprofit credit counseling agency may enroll you in a debt management plan (DMP) to help you repay your debts in fixed monthly installments. Credit counselors may also be able to negotiate with your creditors on your behalf to settle your debt balance, waive late fees and lower your interest rate.

- Consolidate debt with a personal loan. It may be possible to lower your monthly debt payments and save money on interest charges by paying off higher-interest debts into a fixed-rate personal loan. You'll typically need good credit to qualify for the lowest rates possible on a debt consolidation loan, although some lenders offer options for borrowers with fair credit.

You can browse current personal loan rates in the table below, and you can learn more about debt consolidation by getting in touch with a knowledgeable loan expert at Credible.

THIS IS THE BEST WAY TO LOWER YOUR MORTGAGE MONTHLY PAYMENT

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.