IRS tells nursing homes they can’t take seniors' stimulus checks

The government previously threatened enforcement action against care facilities that seize payments

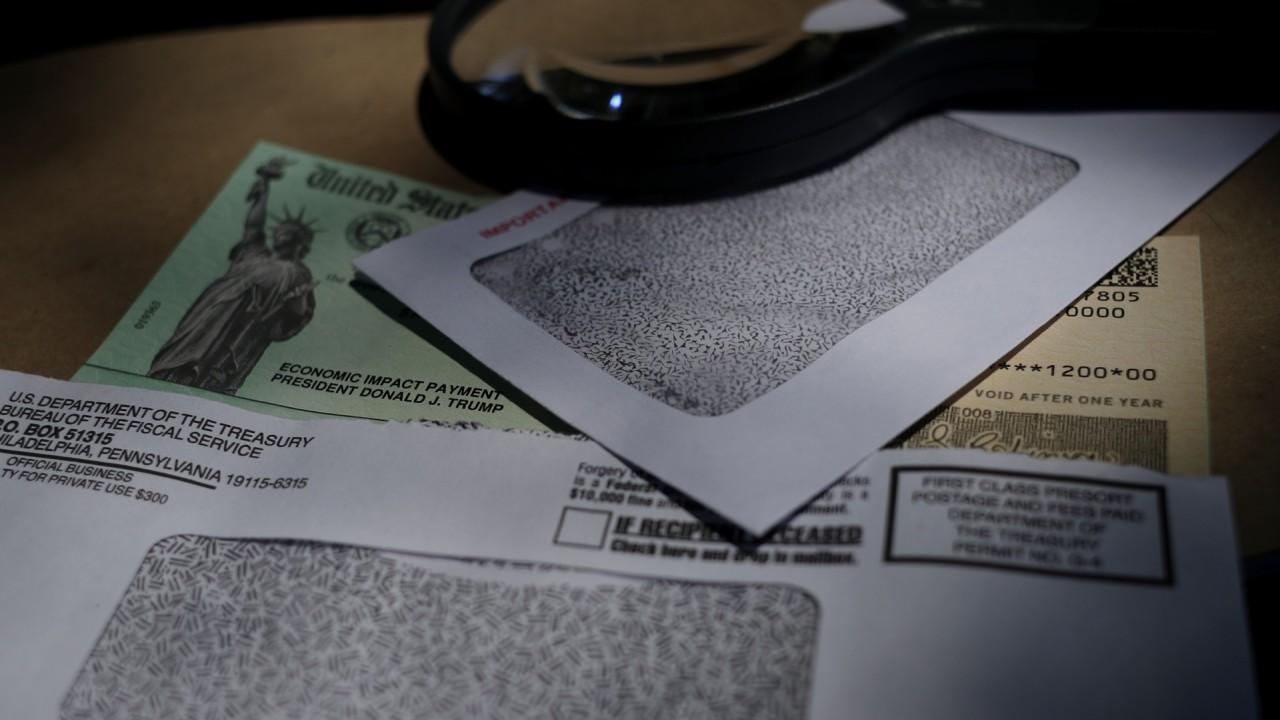

The IRS is warning nursing homes and senior care facilities that they are not able to garnish economic impact payments from seniors as a means to pay for services.

In a statement released this week, the tax agency said it had alerted nursing homes that payments are intended for the recipient – even if the cash is received by the facility.

“These payments do not count as a resource for purposes of determining eligibility for Medicaid and other federal programs for a period of 12 months from receipt,” the IRS clarified in a statement. “They also do not count as income in determining eligibility for these programs.”

The agency also reminded people to be on the lookout for businesses and people looking to take advantage of vulnerable populations' stimulus checks..

NURSING HOMES TO FACE ENFORCEMENT ACTION FOR SWIPING CORONAVIRUS STIMULUS CHECKS FROM SENIORS

Homes and senior living facilities that came under fire for requiring residents to sign over the payments as a means to pay for services.

The payments are not able to be counted as income or resources for the purpose of federal benefit programs, like Medicaid. Instead, it is considered an advance on a refund for 2020 taxes.

In a post on Twitter earlier this month, Seema Verma, administrator for the Centers for Medicare & Medicaid Services, said care centers engaging in this behavior will be subject to enforcement action.

THE IRS SAYS CORONAVIRUS ECONOMIC IMPACT PAYMENTS CAN BE SEIZED FOR THIS REASON

State officials previously raised concerns that debt collectors may try to seize payments.

Twenty-five state attorneys general requested that the government stipulate that the coronavirus relief payments would not be subject to garnishment by creditors and debt collectors.

CLICK HERE TO READ MORE ON FOX BUSINESS

The only lawful reason an economic impact payment may be offset is for past-due child support. The CARES Act did not prohibit the payments to offset for back-due child support.

The economic impact payments will be $1,200 per adult for those with adjusted gross incomes of up to $75,000. The threshold for married couples is $150,000 – they are eligible for $2,400 and $500 per child.