What's loan-to-value ratio and how does it affect your mortgage refinance?

To avoid private mortgage insurance and lock in the best rates, you need a loan-to-value (LTV) ratio lower than 80%

Your loan-to-value (LTV) ratio plays a large role in determining whether or not you qualify for a mortgage refinance. Find out what it is and how it works. (Shutterstock)

A mortgage refinance replaces your current home loan with a new one. Several factors affect your refinance rate and monthly payment, including your loan-to-value (LTV) ratio.

Here’s a look at what LTV is, how to calculate it, and how it can affect your mortgage refinance.

Credible makes it easy to research your mortgage refinance options and compare rates from multiple lenders.

- What is a loan-to-value (LTV) ratio?

- How to calculate your LTV ratio

- How does your LTV affect refinancing?

- How to improve your LTV ratio before refinancing

- Factors that can worsen LTV ratios

- High-LTV mortgage refinances

What is a loan-to-value (LTV) ratio?

Your LTV ratio compares the market value of your home against your mortgage balance. Mortgage lenders often use this ratio to determine your eligibility for a loan.

If you take out a conventional loan and your LTV ratio is higher than 80% — meaning you have less than 20% equity in your home — you’ll be on the hook for private mortgage insurance (PMI) until your LTV ratio falls to 80%.

A higher LTV could position you as a riskier borrower since you have less money invested in the home, while a lower LTV can increase your chances of approval and securing a great rate.

HOW TO REMOVE PMI FROM YOUR MORTGAGE

How to calculate your LTV ratio

To calculate your LTV ratio, divide your mortgage balance by your home’s appraised value and multiply that value by 100.

Loan balance ÷ home appraisal value x 100 = LTV ratio

Let’s say you owe $200,000 on your mortgage and your property is worth $300,000 — you’d have an LTV ratio of 66%.

You can determine your home value through a professional home appraisal, or get an estimate from a real estate agent or an online valuation tool.

How does your LTV affect refinancing?

When it comes to your ability to refinance, your LTV ratio is one of the most important factors. If a lender receives your application and learns you have an LTV above 80%, they may charge you mortgage insurance and higher fees — or deny your application outright.

Your LTV will also help determine your interest rate. If you have a higher LTV, you’ll likely receive a higher rate. Other factors that may affect your mortgage rate and monthly payment include your credit score, debt-to-income (DTI) ratio, employment history, repayment period, and type of refinance (standard or cash-out).

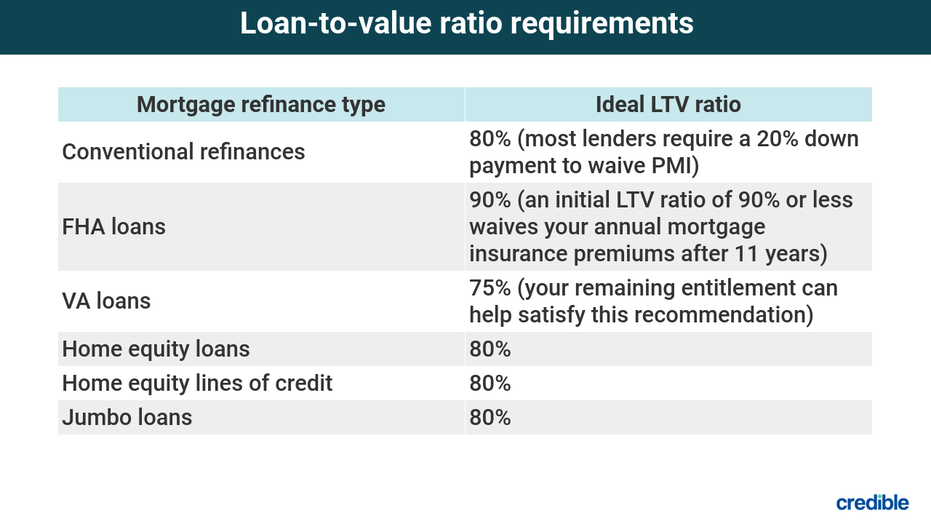

LTV ratio requirements

You have a number of refinancing options at your disposal. The requirements, including maximum LTV, vary by program. Here’s an overview of the most common refinance programs and their ideal LTV ratios.

WHAT’S AN FHA STREAMLINE REFINANCE AND CAN YOU GET ONE?

How to improve your LTV ratio before refinancing

A lower LTV ratio can help you get approved for a refinance and receive a better rate that saves you money over the life of your loan. If your LTV ratio is higher than you’d like it to be, you can lower it in several ways, including:

- Pay down your mortgage. As you make your mortgage payments, your LTV will go down. To speed up the process, consider biweekly payments or putting extra money from bonuses and tax refunds, for example, toward your balance.

- Wait for your home value to increase. Your home value is bound to fluctuate. Factors like a healthy economy and high demand in your neighborhood can cause your home to naturally appreciate.

- Renovate your home. Investing in home improvements may increase your home’s appraised value. Not all renovations are created equal, however, so focus on the projects that offer the best return on investment.

- Pay upfront closing costs. If you have the means, you might want to cover your closing costs right off the bat. By doing so, you can reduce your overall borrowing amount. Note that closing costs usually range between 2% and 5% of the mortgage.

- Go with a standard refinance. Even though a standard refinance won’t allow you to tap your home equity like you’d be able to with a cash-out refinance, you’ll be able to keep your mortgage balance low.

Shopping around with different lenders is one way to ensure you get a great refinance rate. Credible can help you easily compare refinance options.

Factors that can worsen LTV ratios

Your LTV ratio may increase in a number of situations and make it more difficult for you to refinance your mortgage.

Decrease in property value

If you fail to maintain your home over time or there’s a drastic drop in the local housing market, your LTV will likely rise. Your current home value may fall below your loan balance — this is known as being underwater or upside down on your mortgage. In this case, it’s unlikely that you’ll qualify for refinancing.

Poor appraisal

To refinance your mortgage, you’ll need a home appraisal. A low appraisal value instantly worsens your LTV ratio, and it can negatively affect what mortgage rate you receive. It also lowers the amount of cash you can withdraw in a cash-out refinance. If your appraisal comes in low, dispute any inaccurate remarks and invest in repairs so that your second appraisal leads to a higher value.

Second mortgage

If you have a second mortgage like a home equity loan or HELOC, you may find it more difficult to refinance your first mortgage. To achieve the right LTV ratio for refinancing, you may need to lower or pay off your second mortgage first.

Cash-out refinance

A cash-out refinance replaces your current mortgage with a new, larger loan and allows you to pocket the difference in cash. While you may land a lower rate than you would with a personal loan and can use the cash for virtually anything, your LTV ratio will rise.

READY TO REFINANCE A RENTAL PROPERTY? WHAT TO KNOW

High-LTV mortgage refinances

If you have a high LTV ratio, don’t worry. You have several refinance options to choose from, such as:

- Fannie Mae RefiNow — A RefiNow loan requires a current Fannie Mae mortgage. You’ll also need an LTV ratio of 97% or less, a debt-to-income ratio of 65% or less, an income at or below 100% of your area’s median income, and a minimum credit score of 620.

- Freddie Mac Refi Possible — Through Refi Possible, you can get approved with a LTV ratio of 97% and up to 65% DTI. You must also earn a low or moderate income and have a credit score of at least 620.

- FHA streamline refinance — There’s no minimum LTV ratio on an FHA streamline. But if your LTV is 90% or lower, you’ll be able to waive the annual mortgage insurance premiums after 11 years.

- VA streamline refinance — Also known as a VA interest rate reduction refinance loan (IRRRL), a VA streamline refinance comes with a one-time funding fee of 0.5%. The greatest benefit, however, is that you won’t have to pay mortgage insurance. This program is reserved for VA borrowers.

- USDA streamline refinance — The USDA streamline refinance is designed for USDA direct and guaranteed loan borrowers. Your new loan will need to reduce your monthly payments by at least $50. You can get approved without a home appraisal, regardless of your LTV, as long as you’ve made your last 12 payments on time.

If you’re considering refinancing your mortgage, it’s a good idea to compare offers from multiple lenders. With Credible, you can see your prequalified rates for a conventional refinance in minutes.