Nearly half of Americans with medical debt say it lowered their credit score: survey

Compare your options for medical debt relief

U.S. adults with unpaid health care bills experience a number of financial ramifications, according to a new survey. (iStock)

Health care costs in the U.S. can be prohibitive for patients who undergo essential medical procedures, leading many consumers to borrow money to pay for hospital bills. This medical debt comes with serious financial consequences for those who carry it, according to a new survey from Healthcare.com.

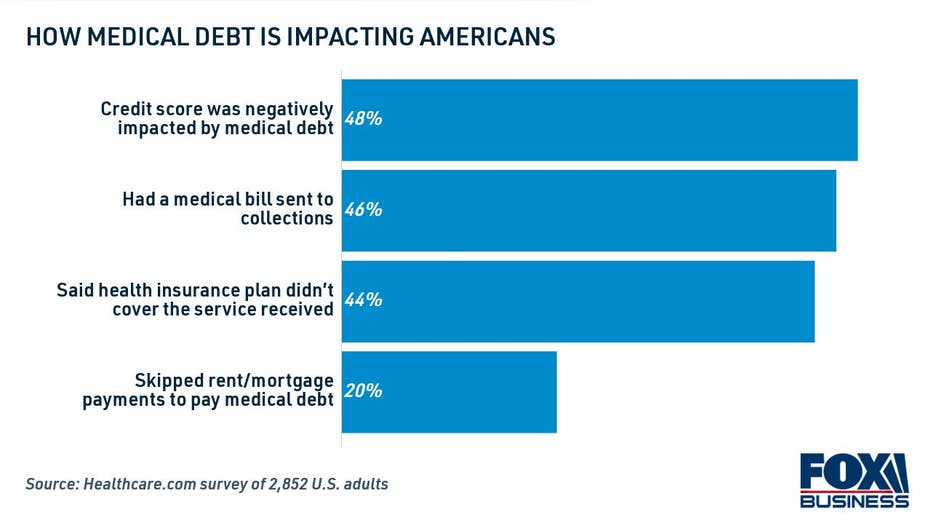

Nearly half (48%) of U.S. adults with medical debt said it has harmed their credit score. About the same (46%) have had delinquent medical bills sent to debt collectors, which can result in wage garnishment and often leads to bankruptcy.

Many patients were caught off-guard by surprise medical bills, with 44% saying that their health insurance didn't cover the service they received. Consequentially, a fifth (20%) of adults with medical debt have skipped rent or mortgage payments.

Keep reading to learn more about the repercussions of health care-related debt, as well as how you can get out of debt by negotiating medical bills. You may also consider your other debt relief options, like medical credit cards and debt consolidation loans. You can visit Credible to compare debt consolidation products, such as fixed-rate personal loans.

HOW TO GET RID OF MEDICAL DEBT WITHOUT DAMAGING YOUR CREDIT

The financial consequences of unpaid medical bills

About a fifth of U.S. adults have medical debt in collections, according to a recent study by the Journal of the American Medical Association (JAMA). From there, debt collectors can report patients as delinquent to the credit bureaus — which can have a long-lasting negative credit score impacts.

After long periods of nonpayment, collections agencies may eventually sue debtors to collect on delinquent medical debt. This is an expensive legal proceeding, and the courts may garnish your wages, claim your assets and even take money out of your bank account to repay the debt.

To stave off medical debt collectors, many consumers turn to urgent measures like bankruptcy. Medical debt is the leading cause of bankruptcy in America, the National Consumer Law Center (NCLC) found. More than half of bankruptcy filers have unpaid medical bills as a part of their discharge.

If you're considering filing for bankruptcy over unpaid medical bills, you may consider enlisting the help of a nonprofit credit counseling agency. Credit counselors can help you determine the best way to manage your debt, and they may even be able to negotiate with creditors on your behalf.

HOSPITAL PRICE TRANSPARENCY RULE TAKES EFFECT TO REDUCE SURPRISE MEDICAL BILLS

How to pay off medical debt

Unpaid medical bills can have serious financial ramifications, so it's important to find ways to repay medical debt before it's sent to collections. Here are a few strategies for paying off hospital bills:

- Negotiate with the medical provider

- Consider your credit card options

- Borrow a debt consolidation loan

Read more in the sections below.

Negotiate with the medical provider

The Affordable Care Act requires nonprofit hospitals to offer financial hardship assistance for low-income patients, the NCLC reports. This debt relief may come in the form of discounted care, zero-interest payment plans or medical debt forgiveness. However, not all patients will meet the income thresholds to qualify for financial assistance programs, and this federal law doesn't apply to private medical providers.

If you don't qualify for financial aid from your health care provider, you may still be able to reduce your medical bills or enroll in a payment plan. Here's how to negotiate your medical debt:

- Request an itemized bill from the medical provider and check it for errors, like double-billing and incorrect coding. Reach out to your health insurer to request an Explanation of Benefits (EOB) and Summary of Benefits and Coverage (SBC) to get a better understanding of your insurance coverage.

- Research the average price of the medical service you received using a cost comparison tool like Healthcare Bluebook. This can substantiate your claims during negotiations and may help you determine if you were overcharged for health care services.

- Get in touch with the hospital's billing department — the phone number should be listed on your bill. You can ask them for a discount on your medical bill, or see if you can enroll in an interest-free payment plan. Take detailed notes, and get any financial agreement in writing.

Finally, you can contact your state's insurance commissioner if you believe there was a medical billing error that you can't resolve.

9 OF THE BEST DEBT CONSOLIDATION COMPANIES

Consider your credit card options

Some health care providers offer financing options through medical credit cards such as CareCredit. This may allow you to break up your medical bill into smaller monthly installments with reduced or no interest.

However, the reduced-interest options offered by CareCredit aren't very competitive, with rates as high as 17.90% APR for long-term payment plans. And if you miss a payment, you could end up paying deferred interest at the regular purchase APR of 26.99%.

As an alternative, applicants with very good or excellent credit could consider opening a new credit card with an introductory 0% APR period. These promotional offers typically last up to 18 months, which may give you enough time to pay off the balance without incurring interest charges. Read the card agreement in full to get a picture of any annual fees or borrowing limits.

You can compare zero-interest card offers for free by visiting Credible.

HOW TO LOWER YOUR CREDIT CARD PAYMENTS BY CONSOLIDATING INTO A PERSONAL LOAN

Borrow a debt consolidation loan

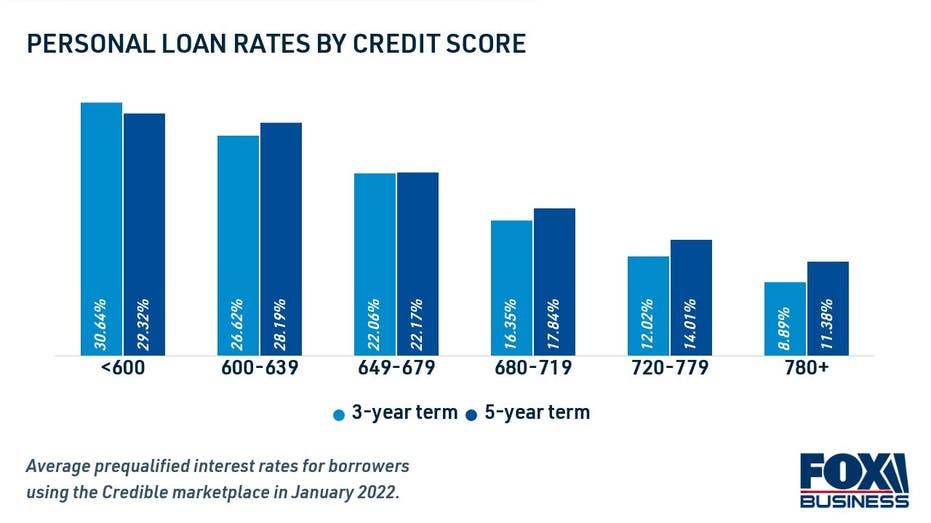

A debt consolidation loan is a type of unsecured personal loan that's repaid in fixed monthly payments over a set period of time, typically a few years. Interest rates are currently at historic lows, according to the Federal Reserve, which means you may be able to repay your medical debt at a competitive fixed rate.

Since personal loans don't require collateral, lenders determine your interest rate and eligibility based on your credit history and debt-to-income ratio (DTI). Borrowers with good credit and low amounts of debt will qualify for the best possible loan offers, while those with bad credit may not meet the eligibility requirements.

BEST PERSONAL LOANS FOR VETERANS AND MILITARY MEMBERS

Medical debt consolidation may give you the opportunity to repay delinquent medical bills over a longer period of time on a predictable payment plan. If you're approved, the lender may deposit the funding directly into your bank account as soon as the next business day.

You can compare debt consolidation loan interest rates on Credible for free without impacting your credit score. Then, use a personal loan calculator to estimate your monthly payments and repayment terms.

CREDIT CARD DEBT CONSOLIDATION MAY SAVE YOU THOUSANDS AS PERSONAL LOAN RATES ARE AT RECORD LOWS

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.