Mike Trout's $430M contract: Comparing tax bills for California, New Jersey vs. no-income-tax states

It’s official. Star center fielder Mike Trout has agreed to a MLB record 10-year $360-million contract extension with the Anaheim Angels. Trout is now owed a total of $426.5 million over the next 12 years by the Angels, making him the richest athlete in North America, according to ESPN.

In 2019, Trout will be paid $16 million in salary and $20 million in a signing bonus. He will receive $36 million in 2020. From 2021-30, Trout will make $35.45 million per year. Trout’s contract has no deferred compensation and a full no-trade provision.

Let’s take a look at the different potential tax bills Trout can expect, depending on his state of residency. For purposes of these tax calculations, these projections will show Trout’s reported compensation from the Angels and also assumes that he will be required to pay the “jock tax” in most of the states he plays in.

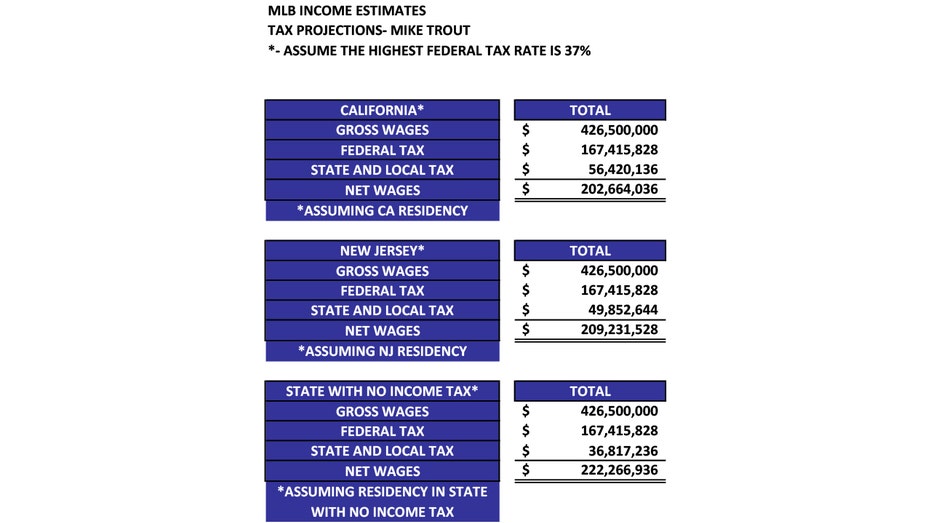

Assuming Trout is a California resident (top individual income tax rate 13.3 percent), he will net approximately $202.7 million after federal (including Social Security, Medicare and the Medicare surcharges), state and local taxes.

Assuming Trout is a New Jersey resident (top individual income tax rate 10.75 percent) he would net approximately $209.3 million after federal (including Social Security, Medicare and the Medicare surcharges), state and local taxes. (A savings of approximately $6.6 million when compared to California residency.)

CLICK HERE TO GET THE FOX BUSINESS APP

If Trout were to become a resident of a state with no income tax (Alaska, Florida, Nevada, South Dakota, Tennessee*, Texas, Washington, Wyoming and/or New Hampshire*), he will be required to pay California income tax on his duty days worked in the Golden State (approximately 45 percent of his Angels salary).

Living in one of these states, he would net approximately $222.3 million after federal (including Social Security, Medicare and the Medicare surcharges), state and local taxes. (A savings of an additional $13 million more than if he were a New Jersey resident. A savings of an additional $19.6 million more than if he were a California resident.)

*Tennessee has a flat tax on interest and dividends.

*New Hampshire does tax, at a 5 percent rate, income from interest and dividends.

Robert Raiola is the director of the Sports and Entertainment Group at PKF O’Connor Davies and has over 20 years of sophisticated tax experience in both the public and private sector. He provides tax planning strategies and business consulting to high net worth individuals and their families in the sports and entertainment field. Robert is widely known as the “Sports Tax Man” and has a following of approximately 50,000 on Twitter, where there is a lively exchange of various sports, entertainment and tax topics.

Raiola is also a contributing writer for Sports Illustrated and appears frequently on ESPN’s SportsCenter, Fox Business New, Sirius XM NFL Drive and a variety of national radio and talk show programs. He co-authored the AICPA book, Winning Tax Strategies for Athletes & Entertainers, and has lectured nationally on the topic.