'Wave of millennial buyers' flood the housing market amid record-high home prices: report

Here are some tips for buying a home when housing affordability is quickly dwindling

A new NAR report showed that amid soaring home prices and limited housing inventory, millennials are eclipsing the previous generations when it comes to home purchase trends. (iStock)

Millennials, the generation once mocked for overspending at brunch, now makes up the largest group of homebuyers in today's competitive real estate market, according to a Generational Trends Report released in late March from the National Association of Realtors (NAR).

The share of millennial homebuyers rose significantly over the past year, from 37% in 2021 to 43% currently. Millennials typically bought bigger, more expensive properties than older generations, flocking to suburbs and small towns instead of city centers.

"While the pandemic allowed many potential buyers to save for a down payment, demographics played a key role," NAR Vice President Jessica Lautz said. "There is a wave of millennial buyers who are aging into the traditional first-time buyer age range."

The data comes at a time when buying a home is a challenging endeavor. While student loan debt continues to be a significant barrier for younger millennial buyers, both mortgage rates and home values have soared in recent months.

Keep reading to learn more about buying a home in a competitive seller's market with high listing prices and low housing inventory. You can start the process by comparing mortgage rates on Credible for free without impacting your credit score.

THESE ARE THE MOST NEIGHBORLY CITIES IN AMERICA, STUDY FINDS

Median home sales prices top $400K for first time in history

Home prices set another record in March, as the national median sales price surged to $405,000, according to a housing market trends report from Realtor.com. That's a cost increase of 26.5% in the past two years, which is causing some homebuyers "to just give up."

"In this month’s data we see signs of demand moderating in response to higher costs," Danielle Hale, chief economist of Realtor.com, said. "We’re seeing at least some buyers think twice in today’s housing market, given the high costs they face as home prices and mortgage rates both climb."

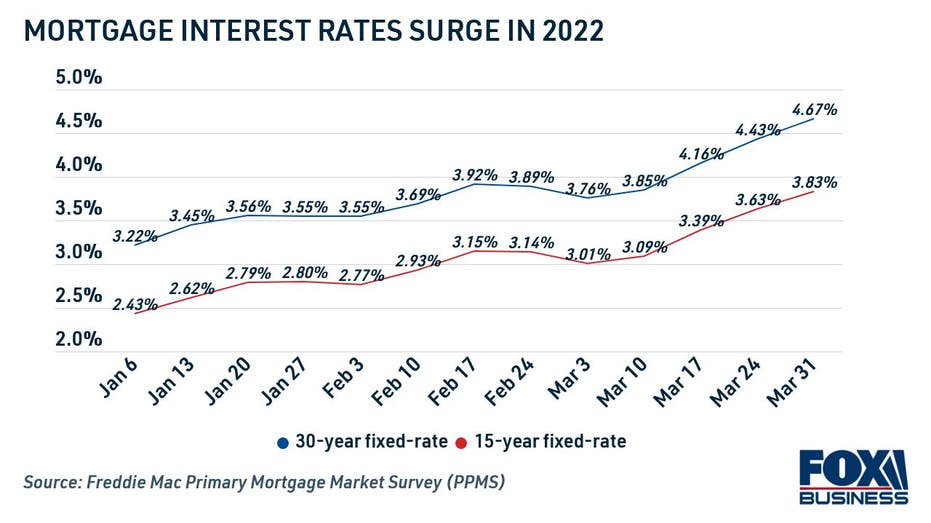

Skyrocketing mortgage interest rates can be a roadblock for prospective buyers, driving up monthly payments and adding to the total cost of borrowing. Average 30-year mortgage rates surpassed 4% in March, which is the highest rates have been since 2019, Freddie Mac data showed.

WHAT TO CONSIDER IF YOU'RE BUYING A FIXER-UPPER

But despite cooling demand, home listing prices may not be going down anytime soon. The COVID-19 pandemic only exacerbated existing housing supply shortages, Zillow research found, and inventory may not return to pre-pandemic levels until 2024. Bureau of Labor Statistics data showed that record-high inflation is also driving up American wages, which might justify increased housing costs for high-earning buyers.

"While demand has shown some signs of moderation, if buyer incomes start to rise faster because of the tight job market, that could help keep demand and home prices high," Hale said.

If you're considering buying a home or refinancing your current mortgage in this rate environment, it's more important than ever to shop around for a competitive loan offer. You can visit Credible to compare mortgage purchase and refinance rates across multiple lenders.

ARE BABY BOOMERS TO BLAME FOR THE HOUSING SHORTAGE?

Tips for buying a home in 2022

Even though they're faced with a cutthroat housing market, the vast majority (86%) of buyers surveyed by NAR still have a positive outlook on homeownership.

"A truth across all generations is that homeownership is seen as a cornerstone of the American dream," NAR President Leslie Rouda Smith said. "From building personal wealth and fostering communities, to strengthening social stability and driving the national economy, the value of homeownership is indisputable."

If you're motivated enough to buy a home in this year's real estate market, you can follow these tips to help you make the transition from homebuyer to homeowner:

- Look for homes that have been on the market for a longer period of time. Familiarize yourself with the average amount of days that houses in your area spend on the market before going under contract. The seller may be more willing to accept your offer if the home has been sitting for too long.

- Expect to pay more cash upfront in case a home doesn't appraise. Sellers can waive their obligation to meet the appraisal value, which means that buyers should be prepared to cover the difference in cash if a home doesn't appraise for the sales price.

- If you can't afford to pay more, be flexible with your closing date. While sellers typically want to close as quickly as possible, some might want a longer closing period of 60 or 90 days. This can give the sellers more time to purchase a new home or get their mortgage financing in order.

- Be prepared to wait out the market, as inventory can change greatly from one week to the next. Keeping an open line of communication with your real estate agent is key during your search. And leave your schedule open, so you can tour newly-listed properties as soon as possible.

- Get a mortgage preapproval letter to let sellers know you're a serious potential buyer. Some lenders offer signed or verified approval letters, which may help your offer stand apart from the rest. You can begin the mortgage preapproval process by visiting Credible.

You can browse current mortgage rates in the table below, and see free rate offers tailored to your financial situation by visiting Credible.

IS IT WORTH GETTING A STARTER HOME?

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.