Paying off $20K in credit card debt? Here's how much you can save with a personal loan

Credit card consolidation can save some borrowers nearly $15,000 in interest charges

Although credit cards can offer a way to cover unexpected expenses and emergency purchases, this type of high-interest debt can be difficult to repay. Here's how to pay off $20,000 worth of credit card balances faster. (iStock)

Credit card debt can weigh heavily on a household's finances, and it can be difficult to repay due to high interest rates. Plus, it may cost you thousands of dollars in interest charges over time to pay off $20,000 in credit card debt if you're just making the minimum payments.

One way to save money and get out of high-interest credit card debt faster is to consolidate your balances into a personal loan with a lower interest rate. The analysis below shows how some borrowers can save thousands of dollars by using this debt repayment strategy.

Keep reading to learn more about paying off $20,000 worth of credit card balances with a personal loan. You can begin the application process by comparing personal loan rates on Credible for free without impacting your credit score.

PERSONAL LOANS ARE THE FASTEST-GROWING PRODUCT AT CREDIT UNIONS, DATA SHOWS

Personal loan borrowers may save thousands by paying off $20K in credit cards

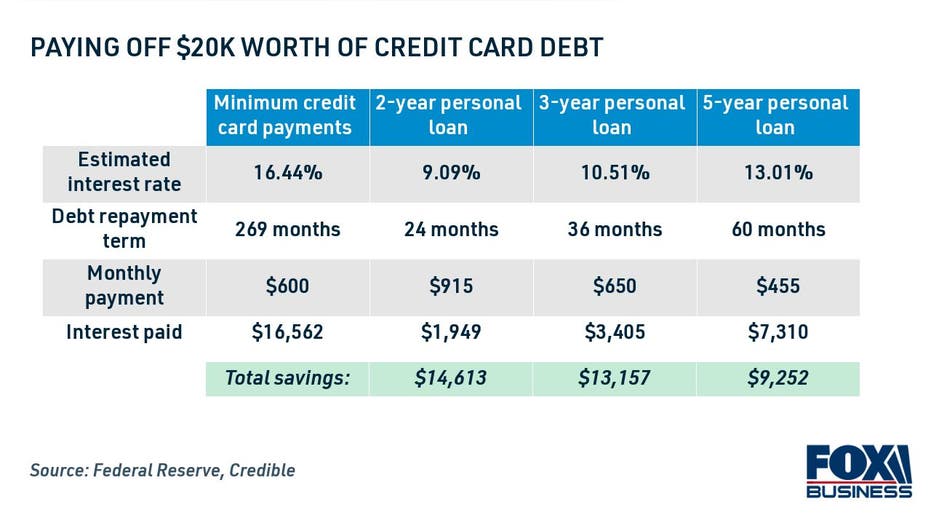

Compared with credit cards, personal loans may offer more competitive rates. The average credit card interest rate was 16.44% in the fourth quarter of 2021, according to the Federal Reserve, compared to the average two-year personal loan rate of 9.09% — a historic low for the product. Interest rates for both three- and five-year personal loans are also much lower in 2022 than they were a year ago.

Personal loans offer fast, lump-sum funding that's repaid over a set period of time at a fixed interest rate. Because they have set repayment terms, you'll know exactly when your debt will be paid off. On the other hand, making the minimum payment on your credit cards can take much longer to pay off because interest is variable and accrues daily.

Credit card issuers require borrowers to make a minimum monthly payment on their debt that's typically between 2% and 4% of the total balance owed, Experian reports. This means it could take more than 22 years to repay $20,000 worth of debt by making the minimum credit card payment.

SEEKING DEBT RELIEF? HERE'S HOW NONPROFIT CREDIT COUNSELING CAN HELP

Paying off $20,000 worth of credit card balances with a personal loan has the potential to save borrowers between about $9,000 and $15,000 in interest charges over time, all while paying off debt years faster.

By choosing a two-year loan term, well-qualified applicants may potentially save $14,613 while getting out of debt two decades faster. A five-year loan term has the potential to save borrowers $145 on their monthly debt payments and $9,252 in interest charges over the repayment period.

Using a personal loan calculator can help you estimate your monthly payment and potential savings with credit card consolidation. You can learn more about this type of debt consolidation loan by visiting Credible.

HOW DO BALANCE TRANSFERS AFFECT YOUR CREDIT SCORE?

How to consolidate credit card debt into a personal loan

Opening a personal loan to repay credit cards is a simple process that can be done completely online. Here's how to apply for a personal loan for debt consolidation:

Read more about each step of the application process in the sections below.

Check your credit score

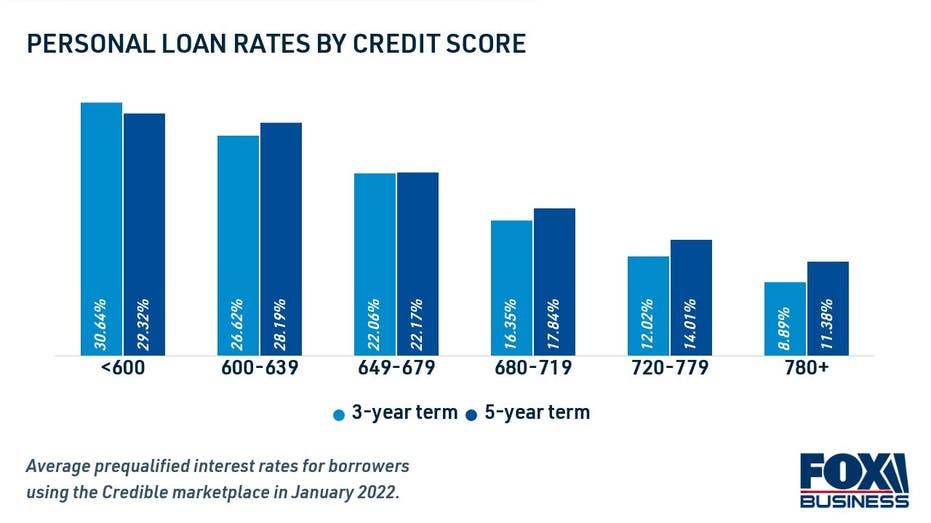

Personal loan lenders set rates based on the loan amount and repayment term, as well as the applicant's creditworthiness. Borrowers with a good credit score and a low debt-to-income ratio (DTI) will qualify for the lowest rates possible on a personal loan.

On the other hand, applicants with fair credit typically see higher interest rates, which may make debt consolidation more expensive. Some lenders have minimum credit score requirements, so borrowers with bad credit may not qualify at all.

Before you apply for a personal loan, check your credit score and get a free copy of your credit report from all three credit bureaus: Equifax, Experian and TransUnion. If you have a credit score below 720, then you may need to look for ways to improve your credit score before you consolidate debt with a personal loan.

One way to keep an eye on your progress is to enroll in free credit monitoring services on Credible.

DEBT SNOWBALL METHOD VS. DEBT AVALANCHE METHOD

Compare rates across lenders

Personal loan rates may vary from one lender to the next, since each lender has its own set of eligibility requirements. Checking rates across multiple personal loan lenders can help ensure you find the lowest rate possible for your financial situation.

Most lenders let you prequalify to see your estimated personal loan interest rate with a soft credit inquiry, which won't impact your credit score. You can get prequalified through multiple lenders at once on Credible's personal loan marketplace.

BALANCE TRANSFER CARDS WITH 0% APR PROMOTIONAL PERIODS ARE DISAPPEARING FAST

Formally apply for the loan

Once you've found the personal loan offer that's best for you, you'll need to formally apply through the lender. This requires a hard credit inquiry, which will have a minimal and temporary impact to your credit score. You'll need to get a number of documents in order for the formal application, including pay stubs, bank statements and identity verification.

If approved, funding may be deposited directly into your bank account as soon as the next business day. You can use the personal loan to repay your credit card balances down to zero. Be careful not to accumulate more credit card debt while you repay your loan, so you can begin your journey to becoming debt-free.

You can browse current personal loan rates from lenders in the table below. Then, visit Credible to begin the personal loan application process.

HOW TO GET A BALANCE TRANSFER CREDIT CARD

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.