Personal loan rates are much lower in 2022 than they were a year ago, data shows

Here's what you need to know about getting a low personal loan rate

So far in 2022, personal loan interest rates are lower than they were this time last year, Credible data shows. (iStock)

Personal loans offer fast, lump-sum funding that can be used to consolidate debt, pay for home renovations and finance large expenses. They're repaid in predictable monthly installments, typically over a period of a few years, at a fixed interest rate.

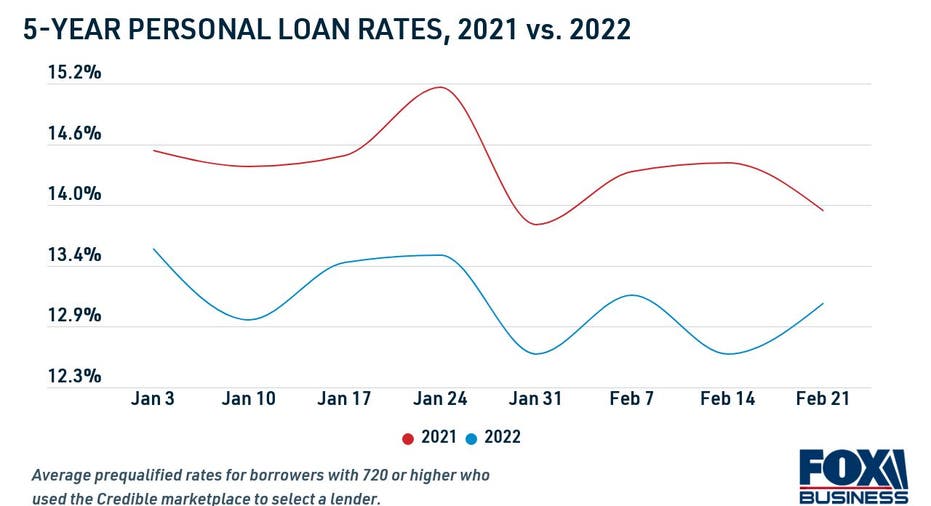

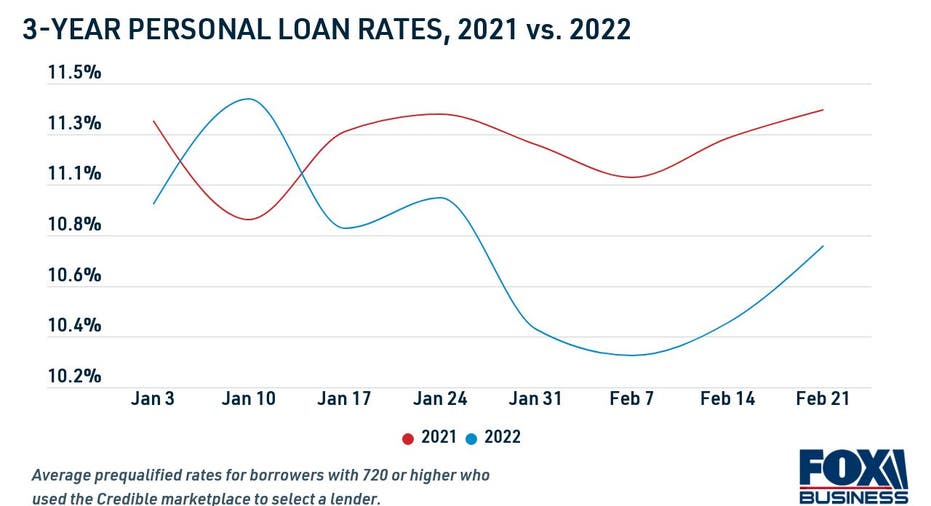

Average personal loan interest rates have been lower so far this year than they were at this point in 2021, according to data from Credible. Rates also reached all-time lows for both the three-year and five-year loan terms during the month of February 2022.

Keep reading to learn more about personal loan rates in 2022, as well as how you can get a low interest rate on a personal loan. One way is to compare rates across multiple lenders at once using an online marketplace like Credible.

ANNUAL PERCENTAGE RATE (APR) VS. INTEREST RATE: WHAT'S THE DIFFERENCE?

Personal loan rates are lower in 2022 than they were in 2021

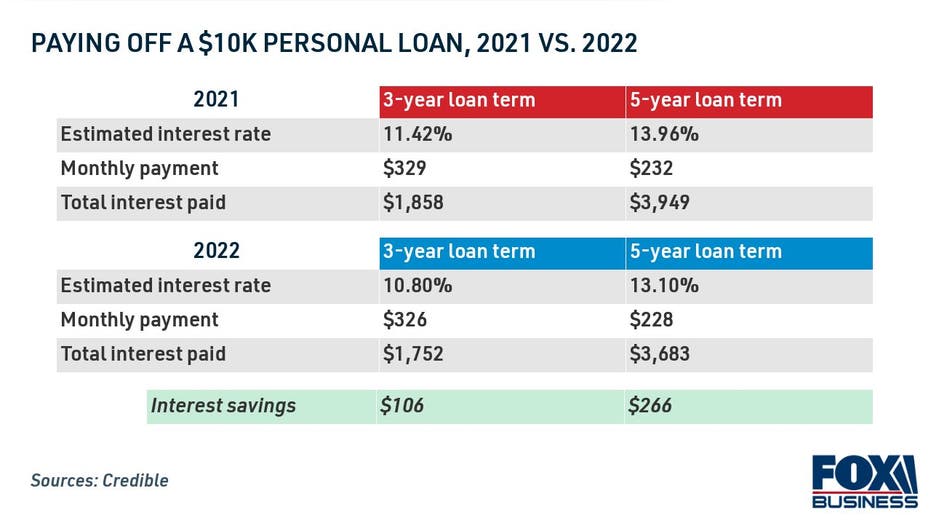

The current prequalified rate for well-qualified applicants using Credible to select a three-year personal loan is 10.80%, compared to 11.42% a year ago. For the five-year loan term, the average interest rate is 13.10% currently and was 13.96% during this time in 2021.

More favorable personal loan rates result in lower monthly payments and fewer interest charges over time. Depending on the loan length, the total cost of borrowing a $10,000 personal loan amount is up to $266 cheaper now than it was a year ago.

With interest rates much lower than they were last year, there's never been a better time to borrow a personal loan to consolidate high-interest credit card debt or pay for a home improvement project. You can visit Credible to see your estimated personal loan rate for free without impacting your credit score.

PERSONAL LOAN ORIGINATION FEES: ARE THEY WORTH THE COST?

How to get a low personal loan rate

Although personal loan interest rates are currently near record lows, that doesn't guarantee that every borrower will get a good rate. Here are a few things you can do to lock in a low rate on a personal loan:

- Work on building your credit score

- Consider a shorter loan term

- Shop around across personal loan lenders

Read more about each strategy in the sections below.

Work on building your credit score

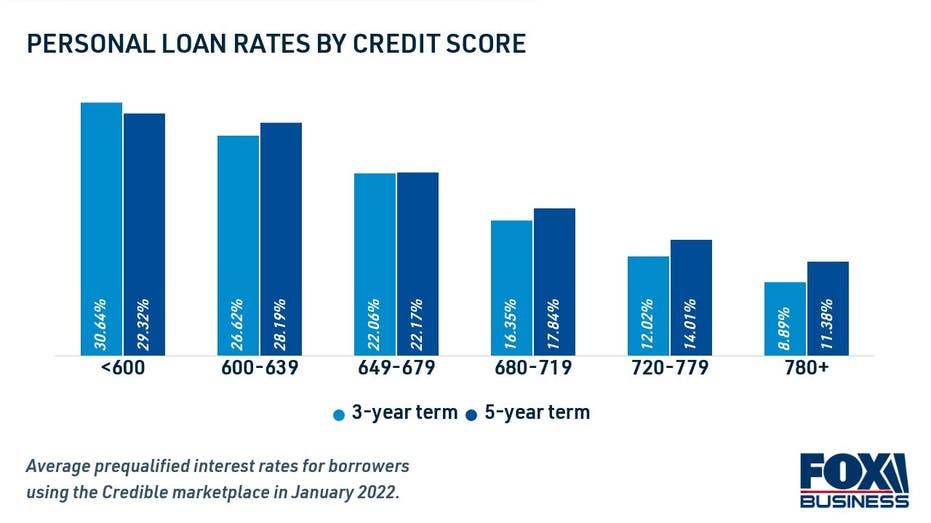

Since unsecured personal loans don't require collateral, lenders determine your eligibility and interest rate based on your credit score and debt-to-income ratio (DTI). Borrowers with good credit scores of 720 or higher will see the lowest personal loan rates available, Credible data shows. On the other hand, borrowers with fair or bad credit will see higher interest rates.

PERSONAL LOANS ARE THE FASTEST-GROWING PRODUCT AT CREDIT UNIONS, DATA SHOWS

Before applying for a personal loan, you should consider finding ways to improve your credit score. Improving your on-time payment history can help you boost your credit report over time. In the short term, look for ways to pay down your credit card balances to lower your credit utilization ratio.

Credit monitoring can help you get a better idea of where you stand and how you can improve your credit history going forward. You can enroll in free credit monitoring services on Credible.

Consider a shorter loan term

Interest rates are typically lower for short-term personal loans than they are for longer-term loans, according to data from Credible. But the interest rate may not be the only factor to consider when borrowing a personal loan. Here are a few things to keep in mind:

- Shorter personal loan terms will come with higher monthly payments than longer loan terms.

- Short-term personal loans have lower overall borrowing costs, since you're paying lower interest rates over a shorter period of time.

- Long-term personal loans are more expensive over time because you're paying higher interest rates over a longer repayment term.

While shorter loan terms can save you money over the life of the loan, it's important to consider whether you can afford the higher minimum payments. If your goal is to lower your monthly debt payments, then it may be wise to consider a longer-term loan despite higher payoff costs.

You can use Credible's personal loan calculator to estimate your monthly payments.

15 BEST DEBT CONSOLIDATION LOANS FOR FAIR CREDIT

Shop around across personal loan lenders

Personal loan lenders have unique eligibility criteria when setting interest rates, which is why it's important to shop around for rate quotes. Most lenders let you prequalify to see your estimated interest rate with a soft credit check, which won't affect your credit score. Some may offer rate discounts, such as an autopay discount for setting up direct payments from your bank account.

You can browse current interest personal loan rates from online lenders in the table below. Then, you can visit Credible to get prequalified across multiple lenders, so you can find the lowest interest rate possible for your financial situation.

BEWARE OF MORTGAGE PREPAYMENT PENALTY FEES WHEN REFINANCING

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.