Personal loans are the fastest-growing product at credit unions, data shows

Here's how to get a low rate on an unsecured loan

Unsecured personal loans are the fastest-growing products offered at credit unions, according to a new industry report. (iStock)

Personal loans are in high demand among credit union members, according to a new report from the Credit Union National Association (CUNA).

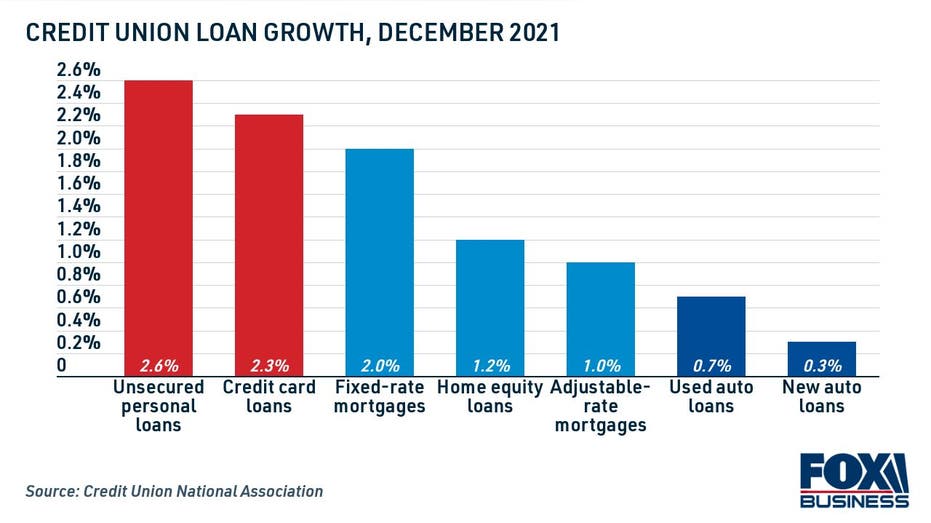

During the month of December, unsecured personal loans grew 2.6% and credit card consolidation loans grew 2.3%. Other loan products, such as mortgages and auto loans, saw more modest growth during that time period.

BEST PERSONAL LOANS FOR BORROWERS WITH A COSIGNER

This is part of an industry-wide trend that's driven by high consumer demand for personal loans. TransUnion predicts explosive personal loan growth as borrowers search for ways to repay growing credit card balances.

Whether you're considering borrowing a personal loan to pay off high-interest credit card debt, finance a home improvement project or cover a large purchase, it's important to shop around for the lowest possible interest rate for your financial situation. You can compare personal loan rates on Credible for free without impacting your credit score.

WHAT IS A GOOD ANNUAL PERCENTAGE RATE (APR) ON A PERSONAL LOAN?

How to get a good personal loan rate

Personal loan interest rates are currently at historic lows, according to the Federal Reserve. However, this doesn't necessarily guarantee that you'll get a good rate on a personal loan. Here's how you can lock in a low personal loan rate:

Read more about each strategy in the sections below.

Build your credit score

Since personal loans are typically unsecured and don't require collateral, lenders determine your eligibility and interest rate based on creditworthiness. Applicants with a strong credit history and good credit score will see the best possible loan terms, while those with poor credit may see high interest rates — if they qualify at all.

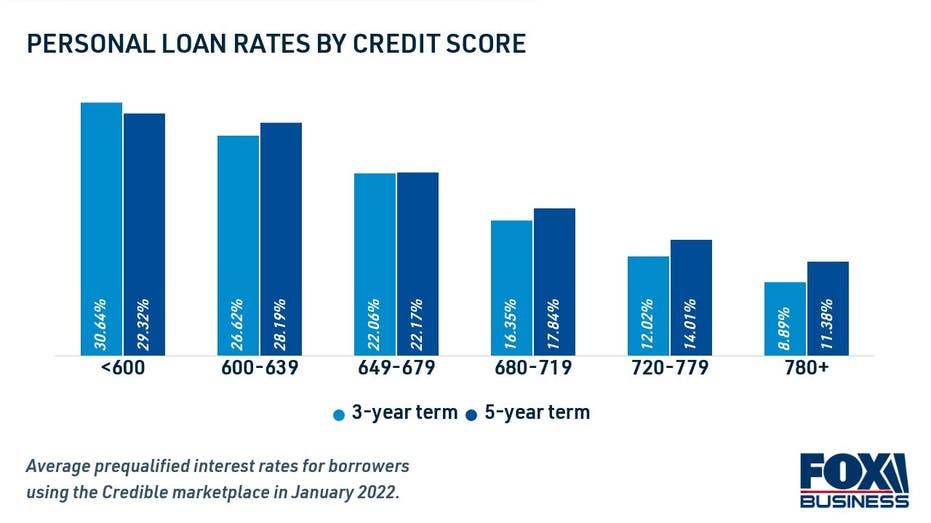

Recent data from Credible showed that borrowers with higher credit scores who applied for personal loans with shorter terms were able to get the lowest interest rates offered. On the other hand, borrowers with fair or bad credit saw much higher interest rates, regardless of the loan length.

WHAT TO DO IF YOU CAN'T MAKE YOUR MINIMUM CREDIT CARD PAYMENTS

To qualify for the most competitive rates, personal loan borrowers should have a credit score that's considered very good or better, defined by the FICO scoring model as 740 or higher. It's also helpful to have a low debt-to-income ratio (DTI), which is your monthly debt payments divided by your income.

You can request a free copy of your credit report from all three major credit bureaus (Equifax, Experian and TransUnion) to get a better picture of where you stand. If you need to improve your credit score before applying for a personal loan, you can enroll in free credit monitoring services by visiting Credible.

HOW TO PLAN FOR UNEXPECTED EXPENSES — AND STILL SAVE

Check with your credit union

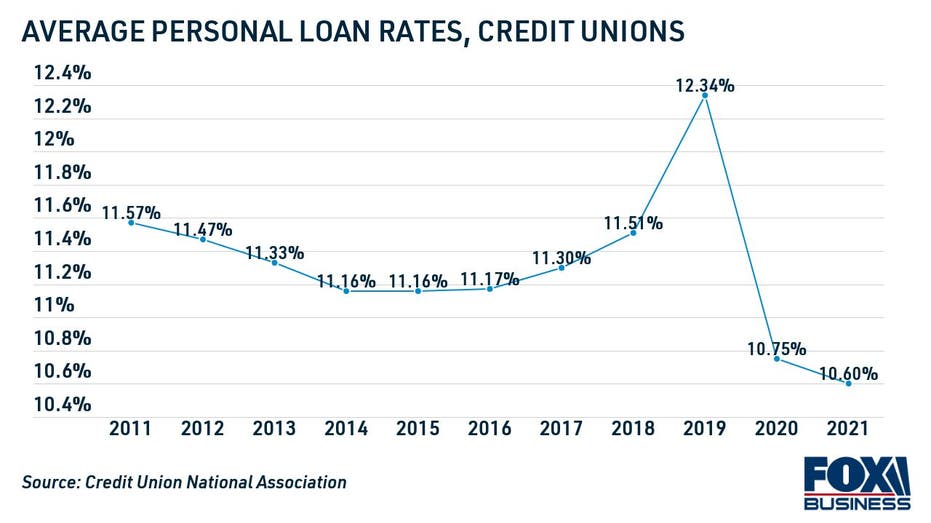

Credit unions tend to offer their members lower interest rates on borrowing products, and that includes personal loans. The average rate for an unsecured loan from a credit union was 10.6% in December 2021, according to CUNA.

Since credit unions offer their products exclusively to their members, you'll have to meet the eligibility requirements in order to borrow a credit union loan. Credit unions typically offer membership to consumers based on where they live or work, but some have looser eligibility restrictions.

You can visit Credible to see a list of credit unions that offer personal loans.

5 BENEFITS OF HAVING EXCELLENT CREDIT

Compare rates across multiple lenders

Personal loan rates vary from one lender to the next, so it's important to shop around to find the best offer for your financial situation. Most lenders let you prequalify to see your estimated loan terms with a soft credit inquiry, which won't affect your credit score.

You should also consider rates based on term lengths, such as a 3-year loan versus a 5-year loan. The rate you get will also depend on the maximum loan amount — larger loans tend to come with higher rates, while smaller loans may come with lower rates.

Personal loan lenders may also charge a one-time origination fee upon loan approval, or a prepayment penalty for paying off the loan early. Some lenders don't charge any fees at all, while others offer an autopay discount for setting up direct deposit from your bank account. Be sure to read the loan agreement in full to understand your repayment terms.

You can browse current personal loan rates from online lenders in the table below, and visit Credible to see your interest rate with a soft credit check. Then, you can use a personal loan calculator to estimate your monthly payments.

THE AVERAGE WEDDING COSTS $28K: HERE ARE 3 WAYS TO PAY

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.