Federal student loan payments restart in 2 months: How borrowers can prepare

Consider your student debt relief options, from IDR plans to refinancing

Student loan borrowers will be expected to resume payments in May after two years of federal forbearance. Here's what to know. (iStock)

Federal student loan payments will resume in May for the first time since the COVID-19 pandemic began in March 2020. This gives borrowers just two months to start preparing their finances after two years of federal forbearance.

Democrats have warned President Joe Biden that resuming payments without student loan cancelation would be "disastrous" ahead of the 2022 midterm elections. And although polling data suggests that most Americans want the student loan payment pause extended through the end of the year, the Biden administration has not announced plans to extend forbearance again.

Keep reading to learn how to prepare for federal student loan repayment, including income-driven repayment, additional federal deferment and student loan refinancing. You can compare student loan refinancing rates on Credible for free without impacting your credit score.

STUDENT LOAN PAYMENT PAUSE HAS COST THE GOVERNMENT $100B

How to prepare for the end of student loan forbearance

Federal borrowers will be expected to resume making payments on their student loan debt in just two short months. Missed payments may be reported to the major credit bureaus, which can ding your credit score. Extended periods of delinquency make you ineligible for federal benefits like deferment or forbearance, and may eventually result in wage garnishment.

If you're not ready to resume federal student loan payments, here's how you can start preparing now:

- Check your loan repayment terms. Visit the Federal Student Aid (FSA) website to see your remaining loan balance, monthly payment amount and your payment due date.

- Re-enroll in automatic payments. Borrowers whose student debt was transferred to a new loan servicer will need to re-enroll in auto-pay to avoid missing a payment in May.

- Set up an income-driven repayment plan (IDR). Federal student loan borrowers may be able to limit their monthly payments to 10-20% of their disposable income through an IDR plan.

- Apply for additional federal deferment. Economic hardship and unemployment deferment give eligible borrowers an additional 36 months of federal forbearance, during which interest accrues.

- Refinance your student loans at a lower rate. Student loan refinancing may help you reduce your monthly payments by more than $250, according to a recent Credible analysis.

It's important to note that refinancing your federal student debt into a private student loan will make you ineligible for select protections, such as IDR plans, administrative forbearance and federal student loan forgiveness programs. You can learn more about student loan refinancing on Credible to determine if this debt repayment strategy is right for your financial situation.

POLL: AMERICANS DOUBTFUL THAT PRESIDENT BIDEN WILL CANCEL STUDENT LOANS IN 2022

Private lenders may offer more competitive student loan rates

Among all existing student loan borrowers, the average interest rate is 5.8%, according to the Education Data Initiative. The interest rate you pay depends on the type of student loans you have, such as Direct Program Loans or Parent PLUS Loans. These are the average federal interest rates by loan type between 2006 and 2022, per Credible data:

- Undergraduate Direct Loans: 4.60%

- Graduate Direct Loans: 6.16%

- Direct PLUS Loans: 7.20%

In comparison, well-qualified borrowers who refinanced their student loans on Credible during the week of Feb. 14 saw average rates of 3.75% for 10-year fixed-rate loans and 3.10% for 5-year variable-rate loans.

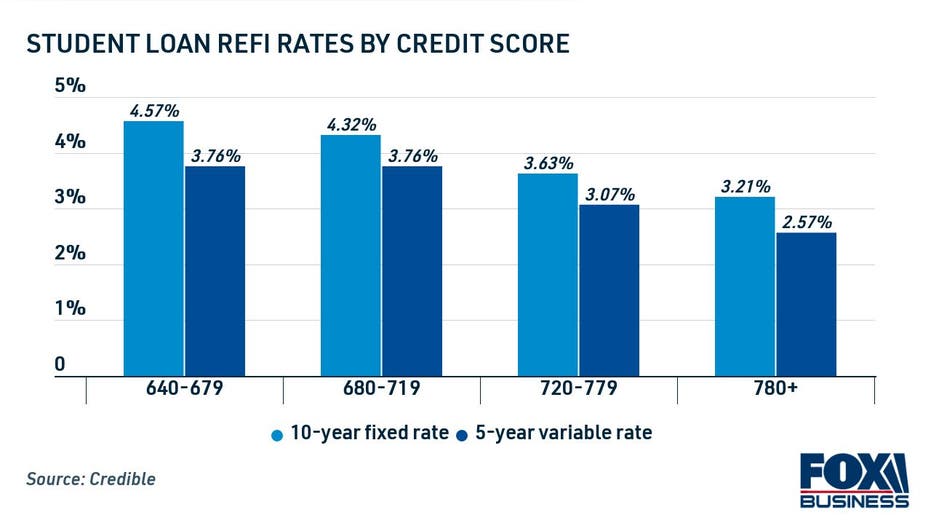

While federal student loan rates are based on when you originated the loan, private student loan rates tend to vary by credit score and debt-to-income ratio (DTI). Borrowers with fair or bad credit may consider enlisting the help of a creditworthy cosigner to increase their chances of getting a low rate.

Student loan refinancing has the potential to save borrowers thousands of dollars over time, but it may not be the right move for everyone. If you plan on applying for student loan forgiveness programs like Public Service Loan Forgiveness (PSLF), then refinancing to a private student loan would make you ineligible.

Borrowers who don't plan on utilizing federal student loan benefits may consider student loan refinancing while rates are low. Refinancing your student loan debt at a lower interest rate may help you reduce your monthly payments, pay off debt years faster and save money over the life of the loan.

As an added benefit, private student loan lenders are prohibited from charging refinancing fees. The interest rate you pay represents the total cost of borrowing the loan. A student loan refinance calculator can help you decide if this financial strategy is right for you.

You can browse current student loan refinancing rates across multiple online lenders in the table below. Then, you can visit Credible to see your estimated rate with a soft credit check, which won't harm your credit score.

BIDEN ADMINISTRATION CANCELS ANOTHER $415M IN STUDENT LOAN DEBT: DO YOU QUALIFY?

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.