Americans expect rent hikes to outpace home price appreciation over the next year: NY Fed

Here's how you can offset rising housing costs in today's real estate market

As limited inventory continues to plague the housing market, rental prices are forecasted to surge at an all-time high, according to a New York Fed survey. (iStock)

Amid rising inflation and housing costs in the U.S., Americans predict rental values will continue to skyrocket while home purchase prices will level in the short term, according to a 2022 housing survey from the Federal Reserve Bank of New York.

Respondents said they expected home values to increase 7% by April 2023 and rent prices to surge by 11.5%. They also expect the average national mortgage rate to surpass 8% within the next three years, a spike that could put homeownership out of reach for many prospective buyers.

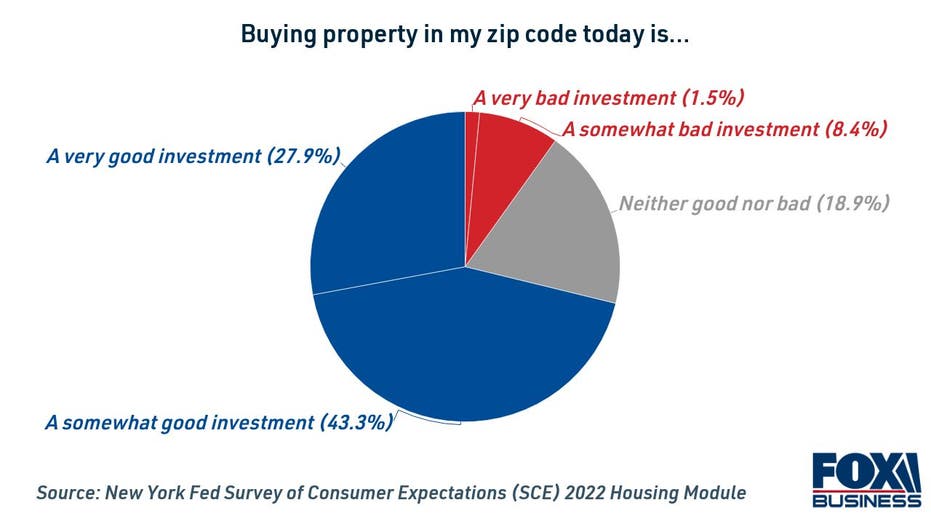

Anticipated rent hikes in the coming year may still continue to push some renters toward buying a home, since monthly mortgage payments are locked in for a longer period of time than apartment leases. What's more, most Americans (71%) still believe that buying a house in their zip code is a good investment.

Keep reading to learn more about the Fed's recent survey data, as well as what you should know for consumer housing expectations in the next year. And if you're thinking about purchasing a home in the current rate environment, it's important to compare estimated rate offers before you borrow a home loan. You can visit Credible's online marketplace to compare mortgage rates across multiple lenders at once.

LANDLORDS CAN CONSIDER THESE ALTERNATIVES TO EVICTIONS AMID RENTAL MARKET MORATORIUM

Consumers anticipate 12% rent increase by next year

Households surveyed by the New York Fed said they expected their rent payments to increase 11.5% by April 2023, which is much higher than the 6.6% increase expected in last year's survey. This indicates that many consumers anticipate rising rent prices will continue their swift upward trend.

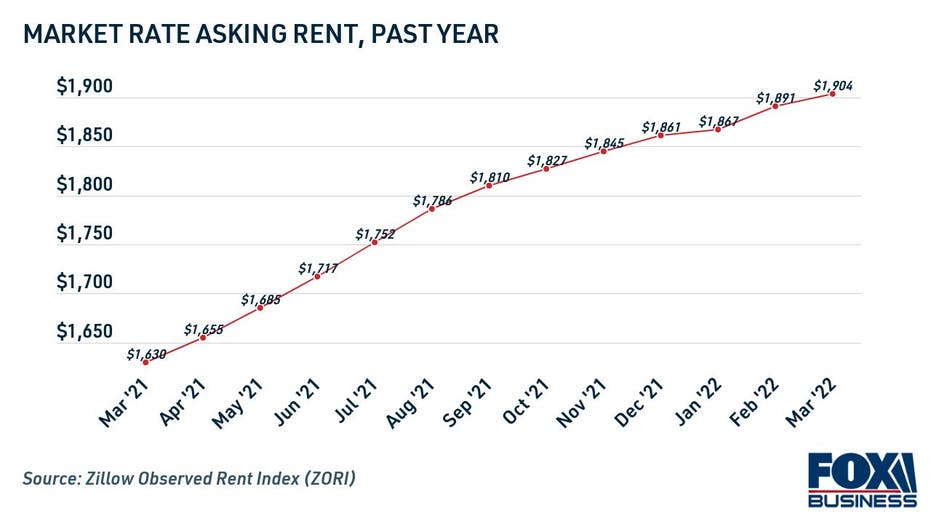

And data shows that Americans may even underestimate the pace of rent hikes. Asking median rent surged 16.8% annually in March, according to Zillow.

2020 CENSUS CONFIRMS NATIONAL HOUSING SHORTAGE, BUT SUBURBS MAY OFFER MORE FOR BUYERS

During the same time period, mortgage payments rose 38% due to quickly rising interest rates and home listing prices. Still, Zillow estimated that the typical mortgage payment in March was much lower than the median asking rent, at $1,316 compared to $1,904.

If you're considering buying a home, you should consider how rising mortgage rates are impacting affordability. Shopping around across multiple mortgage lenders ensures you can find the lowest possible rate for your financial situation. You can compare mortgage purchase rates on Credible for free without impacting your credit score.

RETIREES STRAINED BY HIGHER HOME INSURANCE RATES IN FLORIDA

Despite dwindling affordability, most think property is a good investment

Rising mortgage interest rates have caused housing payments to increase significantly in 2022 so far. The average 30-year mortgage rate surpassed 5% in April for the first time in more than a decade, according to Freddie Mac. And those surveyed by the New York Fed said they expected fixed mortgage rates to rise to 6.7% by April 2023 and 8.2% by April 2025.

Even though consumers said they anticipate rising rates will constrain affordability, about 71% still think that buying property in their zip code is a somewhat or very good investment.

Survey respondents predicted that home price growth will average 7% over the next year, with a 2.2% annual rate of home price appreciation in the next five years. This provides some first-time homebuyers with the opportunity to gain home equity while locking in their monthly mortgage payments as the cost of rent continues to rise.

If you're ready to make the transition from tenant to property owner, the first step in the homebuying process is to get a preapproval letter from a reputable mortgage lender. You can begin the mortgage preapproval process on Credible.

FED ECONOMISTS WARN OF 'BREWING US HOUSING BUBBLE' AS HOME VALUES CONTINUE TO SOAR

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.