Renters 'feeling the strain' of housing affordability as inflation surges: Pew Research

Here's how you can offset the impact of rising rents

The cost of rental housing is outpacing wage growth and inflation, according to a new housing study by Pew Research Center. (iStock)

Scarce housing inventory and strong buyer demand have driven home sales prices to record highs in recent months, but dwindling housing affordability doesn't just impact homeowners. Renters are also "feeling the strain" of rising housing costs, Pew Research analyst Katherine Schaeffer wrote in a recent blog post.

"A variety of factors have set the stage for the financial challenges American homeowners and renters have been facing in the housing market, including incomes that haven’t kept pace with housing cost increases and a housing construction slowdown," Schaeffer said.

About half of Americans (49%) recently surveyed by Pew Research said the lack of affordable housing is a "major problem" in their neighborhood. What's more, inflation continues to outpace wage growth and exacerbate the high cost of living, particularly when it comes to monthly rent.

Keep reading to learn more about the state of housing affordability in the U.S., as well as how renters can offset the financial impact of soaring housing prices. And if you're in the market to refinance your current debts, boost your savings or buy your first home, you can visit Credible to compare rates on a variety of financial products for free without impacting your credit score.

READY TO REFINANCE A RENTAL PROPERTY? WHAT TO KNOW

Rent, energy and food costs soar amid record-pace inflation

The vacancy rate for rental units has dropped by nearly half over the past decade, per data from the Federal Reserve, which suggests an increase in demand from renters that's exacerbated by low available housing supply. During 2021 alone, the rental vacancy rate fell from 6.8% to 5.6%.

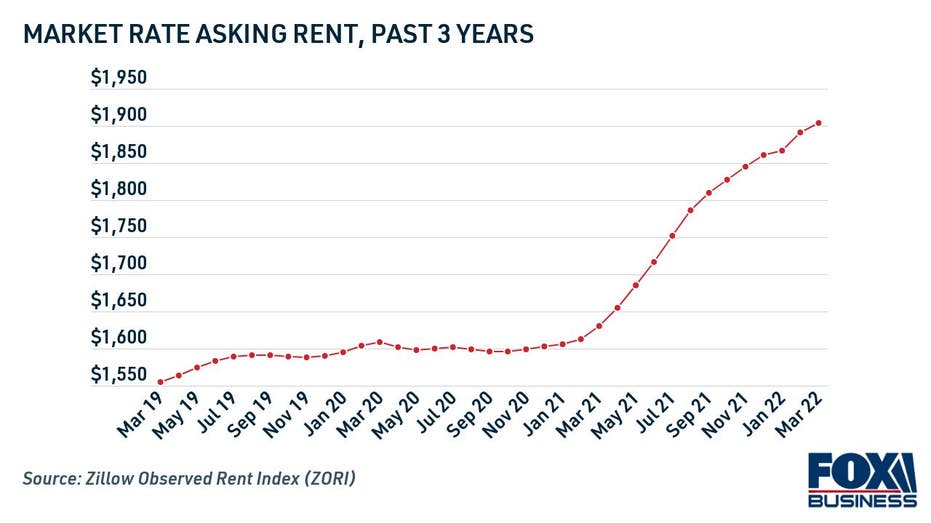

Consequentially, asking market rate rent has increased exponentially in the past year, Zillow research shows. Rental prices rose by 17% annually between March 2021 ($1,630) and March 2022 ($1,904) — meanwhile, average hourly earnings grew just 5.6% during the same period, according to the Bureau of Labor Statistics (BLS).

LANDLORDS CAN CONSIDER THESE ALTERNATIVES TO EVICTION AMID NEW MORATORIUM

Of concern, it's unclear when rent prices will go down, or if this upward trend will ever slow down. Freddie Mac forecasts rent increases in all U.S. metro areas in 2022. And Americans anticipate that average rents will rise by 10% this year, according to the New York Fed.

One way to protect your finances from rental inflation is to buy a home. While a landlord may increase your rent every time you renew your lease, monthly mortgage payments are locked in for a longer period of time, typically up to 30 years. Despite the challenges homebuyers face in the current real estate market, the long-term value of homebuying can offset higher rents for tenants.

If you're considering buying a home, be sure to compare mortgage offers across multiple lenders to find the lowest rate possible for your financial situation. You can begin the mortgage preapproval process on Credible.

RETIREES STRAINED BY HIGHER HOME INSURANCE RATES IN FLORIDA

About 1 in 4 renters spend half their income on housing

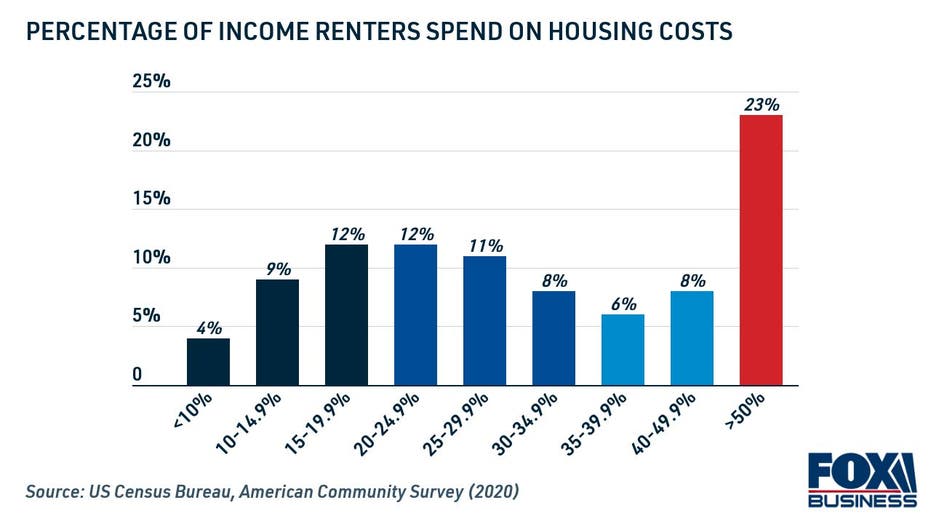

Housing affordability is a significant issue for renters, who "tend to skew toward the lower ends of the economic scale," Schaeffer said.

Almost half (46%) of renters are "cost burdened," spending 30% or more of their income on housing expenses, according to the most recent data available from the U.S. Census Bureau. This includes nearly a quarter (23%) who spent at least 50% of their income on housing.

FHFA EXTENDS COVID-RELATED MULTIFAMILY MORTGAGE FORBEARANCE

Skyrocketing rents have even outpaced record-high inflation, Schaeffer said. Consumer prices surged 8.5% annually in March, which is the highest rate of inflation since 1981. Costs rose sharply when it comes to energy (32%) and groceries (10%) — and when combined with rising rents, these high prices can make it even harder for renters to afford their monthly payments.

If you're struggling to keep up with the rising cost of apartment living, it may be possible to lower your monthly debt payments by consolidating into a personal loan. Credit card consolidation can potentially help borrowers save thousands of dollars over time while interest rates are near record lows. You can learn more about personal loans for debt consolidation on Credible.

MORTGAGE RATES INCREASE AS RISING INFLATION CAUSES CONCERN AMONG INVESTORS

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.