'Rich Dad, Poor Dad' Robert Kiyosaki talks wealth building and co-author former President Trump

Inflation has created two Americas - one rich and one poor

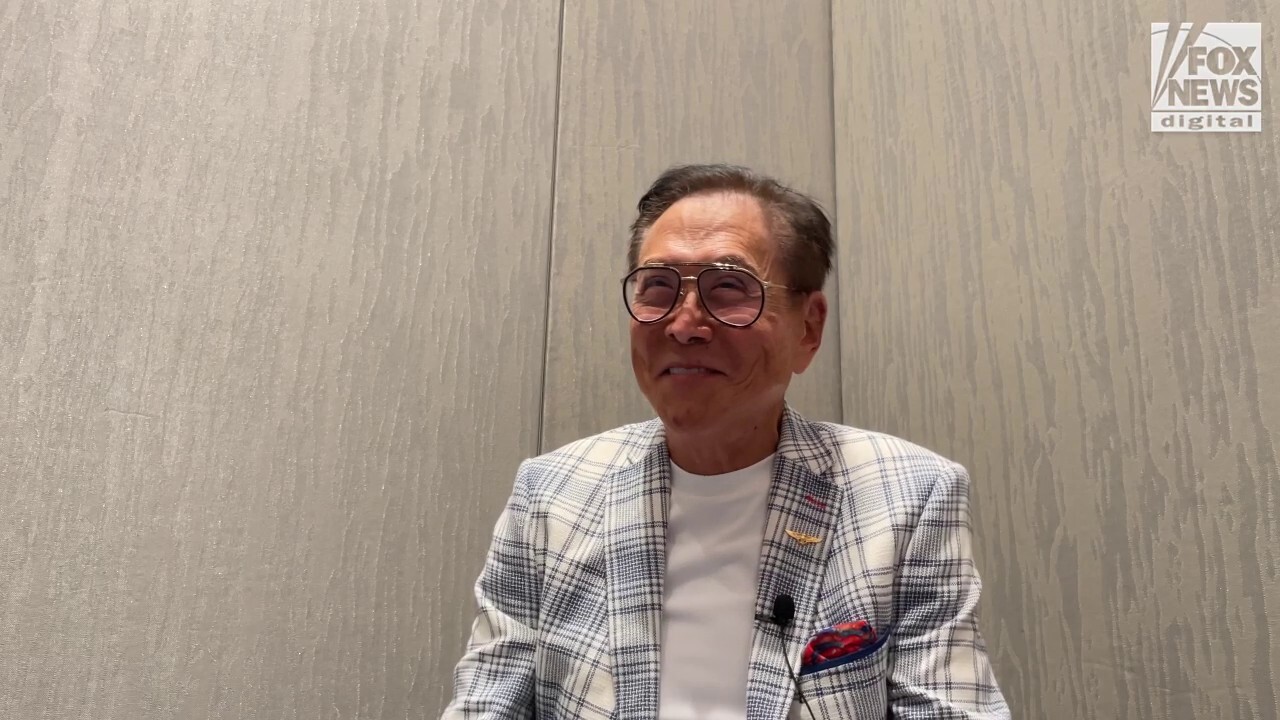

Robert Kiyosaki talks financial literacy, investments, politics

Investor and best-selling "Rich Dad Poor Dad" author Robert Kiyosaki discusses education, finances, investments, and his views on the current political situation.

Robert Kiyosaki is a businessman, investor, and best-selling author, whose book "Rich Dad Poor Dad" has sold over 32 million copies and launched a chain of seminars. The book emphasizes increasing one's financial literacy, investing in assets, and building wealth.

He also authored a book with former President Donald Trump, in 2006, titled "Why We Want You to Be Rich: Two men, One message," which emphasizes the importance of fathers teaching children about successful money management strategies from an early age and maintains a close relationship with him.

Kiyosaki sat down with FOX Business at FreedomFest in Las Vegas to discuss the American educational system, financial literacy and his perspective on the current political situation as the 2024 election kicks into high gear.

"The theme was the same. It was that we both had rich fathers. Mine was my rich Dad. His was his father, Fred Trump. And so we agreed on the importance of fathers teaching the sons or daughters, as the case may be. So when I met Donald, you know Don Jr., and Eric Trump, and the daughter, they have the greatest kids, really great kids, as compared to Joe Biden's son."

Donald Trump and Robert Kiyosaki attend Why We Want You to Be Rich: Two Men-One Message Authored by Donald Trump and Robert Kiyosaki New York City Launch Party at Trump Tower on October 12, 2006, in New York City. (Photo by Matt Carasella/Patrick McM

ROBERT KIYOSAKI: IT'S A TALE OF TWO AMERICAS

At the heart of Kiyosaki's philosophy is using debt responsibly as a tool to build wealth and buy assets. He believes that a lack of financial literacy is a considerable problem in today's society, and encourages Americans to learn to speak the language of money.

"You know, ‘Rich Dad Poor Dad’ was about financial literacy. It's very simple in the definition of words . . . If I was going to go to Japan, I better learn how to speak Japanese. And if I was going to speak capitalism, I need to speak money. I need to know the definition. So, the biggest mistake people make is they call their house an asset when it is really a liability. It goes to literacy. The definition of an asset is something that puts money in your pocket whether you work or not, and a liability takes money from your pocket forever," he said.

Rich Dad Company co-founder Robert Kiyosaki warns what global bank could be next to crash. (FOX Business / Fox News)

US IN 'SERIOUS TROUBLE,' FINANCIAL WORLD LEGEND WHO PREDICTED LEHMAN COLLAPSE WARNS

And so people borrow money, debt, to buy liabilities like a house and a car, and they go further and further into debt. Whereas I like debt, but I use it to buy assets. So let's say I buy an apartment house. The apartment house amortizes my debt, so I get richer, and I pay no taxes, because the government wants us to borrow money. When you borrow money, it's tax-free. But if you work for money, they tax you."

Welders work on a joint between two sections of pipe during construction of the Gulf Coast Project pipeline in Prague, Oklahoma, U.S., on Monday, March 11, 2013. The Gulf Coast Project, a 485-mile crude oil pipeline being constructed by TransCanada C (Getty Images / Getty Images)

As for the ongoing stubborn inflation the U.S. is grappling with, Kiyosaki, who owns oil wells in Louisana, North Dakota and Texas, says the root of inflation can be traced to Biden's shutdown of the Keystone Pipeline.

"When Biden cut the Keystone Pipeline, under Trump I was selling oil at $30 per barrel, the moment he cut that pipeline, oil went from $30 to $130. I knew exactly what Biden was doing, he was going to raise inflation, because everything runs on oil. By raising the prices of food and what not, it was going to cause two Americas: one rich, one poor" he said.