97% of buyers shop for houses online, report finds: Tips for buying a home in the digital age

Homebuyers can also utilize technology to compare mortgage rates and home insurance offers

First-time homebuyers and seasoned homeowners alike are utilizing the internet to search for single-family homes, townhouses and condos in this seller's market. Here's how you can incorporate your technology-savvy lifestyle into the home buying proce (iStock)

Technology has made it easier than ever to shop for houses online — even if you're just window shopping for your million-dollar dream home.

The internet doesn't just make it easier to browse local housing inventory. You can utilize your smartphone or computer to compare properties, shop around for mortgages, find a real estate agent and so much more all without leaving the comfort of your home.

With that in mind, a new survey from the National Association of Realtors found that 97% of buyers used the internet during their home search. And more than half of buyers found the home they ultimately purchased online, compared with 28% who were shown that home by a real estate agent.

Keep reading to learn more about how technology can assist during the home searching process. You can determine how much home you can afford, monitor your credit and compare mortgage offers all in one place on Credible.

WHAT ARE THE NEW FHA LOAN LIMITS FOR 2021?

5 ways technology can help during the homebuying process

While there are plenty of house shopping apps that can help you search for the home you want, there are so many more ways you can utilize technology during the homebuying process. Here are a few:

- Use a mortgage payment calculator to determine how much home you can afford

- Check your credit report, and monitor your credit score online for free

- Compare mortgage offers across multiple lenders from the comfort of your home

- Secure your mortgage preapproval letter to show buyers you're serious

- Protect your investment by shopping around for home insurance

Once you've done the hard work of saving up for a down payment and preparing your finances for homeownership, here's how you can make the process of buying a home easier (and possibly cheaper) with a little internet research.

WHAT IS PRIVATE MORTGAGE INSURANCE (PMI) AND HOW DOES IT WORK?

1. Use a mortgage payment calculator to determine how much home you can afford

One of the first steps in the home shopping process is to determine your price range. You'll need to do some research about the median home price and value per square foot in your area, but the amount you spend on a house is more dependent on your personal finances.

You can use Credible's online mortgage calculator to determine your monthly payment, so you can compare that with local rent costs. Just plug in your estimated mortgage rate, the home's value and the length of the loan. Keep in mind that buying a home can come with more unexpected expenses than renting because you'll be responsible for making necessary upgrades and repairs.

CALCULATE YOUR DEBT-TO-INCOME RATIO AND FIND OUT WHERE YOU STAND

2. Check your credit report, and monitor your credit score online for free

Mortgage lenders will want to check your credit history when determining whether or not to extend an offer. Borrowers should aim to have a credit score of at least 620 to secure a mortgage, but having a higher credit score can be even more beneficial in the form of lower interest rates.

You can check your credit report from all three bureaus for free on www.AnnualCreditReport.com, that way you can look for mistakes and dispute errors. Once you have a good idea of where you stand, you can enroll in free credit monitoring through Credible to keep track of your credit score.

HOME APPRAISALS: EVERYTHING YOU NEED TO KNOW

3. Compare mortgage offers across multiple lenders from the comfort of your home

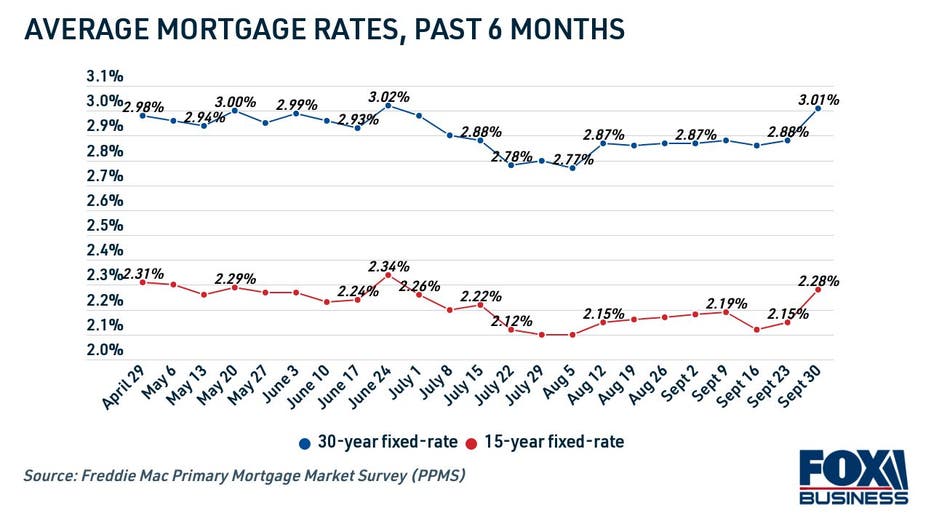

Mortgage rates can vary by lender, which is why it's important to compare offers across multiple lenders before you borrow a home loan. While mortgage rates are near historic lows, it's still important to make sure you get the lowest possible interest rate for your financial situation.

FIRST-TIME HOMEBUYERS PROGRAMS: WHAT NEW BUYERS NEED TO KNOW

You can compare mortgage rates for free, and without impacting your credit score, by using the online marketplace Credible. This way, you can explore multiple mortgage lenders by filling out a single form.

5 THINGS TO LOOK OUT FOR WHEN BUYING AN OLDER HOME, ACCORDING TO A HOME INSPECTOR

4. Secure your mortgage preapproval letter to show sellers you're serious

Before you can put a serious offer on a home, you need to get preapproved for a mortgage lender. This shows sellers you have the funding necessary to actually make a purchase, so they can accept your offer.

A preapproval letter is typically good for 90 days. The sooner you secure a mortgage preapproval, the better chance you have of locking in a competitive mortgage rate before they're expected to rise next year.

You can begin the mortgage preapproval process online with Credible. Once you choose a lender, you'll formally apply and they'll give you a preapproval letter that you can bring to the negotiation table.

AVERAGE MORTGAGE CLOSING COSTS TOP $6000, STUDY FINDS: HERE'S HOW TO PAY

5. Protect your investment by shopping around for home insurance

Once you've bought your home and made it through the closing process, the hard part is over. But before you get too comfortable, make sure you have enough home insurance to protect your new home.

It can seem easier to skip over the necessary paperwork when comparing your homeowners insurance options, but it doesn't have to be that way. It's simple to research home insurance companies and choose the right plan for you on Credible's online marketplace. You can even compare free quotes across multiple insurers, so you can reap the financial rewards with all the convenience of online shopping.

EVICTION MORATORIUM UPDATE: WARREN, PROGRESSIVES INTRODUCE BILL AIMED AT EXTENDING BAN

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.