Is it still a good time to refinance a mortgage?

Here's how to determine if you should refinance your home loan

Mortgage interest rates are near all-time lows, but experts predict they'll rise soon. This is why now may still be a good time to refinance your mortgage. (iStock)

Millions of American homeowners have taken advantage of historically low mortgage rates in the past year to refinance their home loans. One Zillow survey found that many of them saved $300 to $500 or more on their monthly mortgage payments by doing so.

However, countless other homeowners still haven't refinanced their mortgages yet, and some may be wondering if they missed the opportunity altogether.

The good news is that it still may be worthwhile to refinance your home loan. Keep reading to learn why now is still a good time to refinance, and visit Credible to compare mortgage refinance rates across multiple lenders without impacting your credit score.

HOMEOWNERS CAN GAIN NEARLY $200K WORTH OF VALUE WITH HOME IMPROVEMENTS

Why it's still a good time to refinance your mortgage

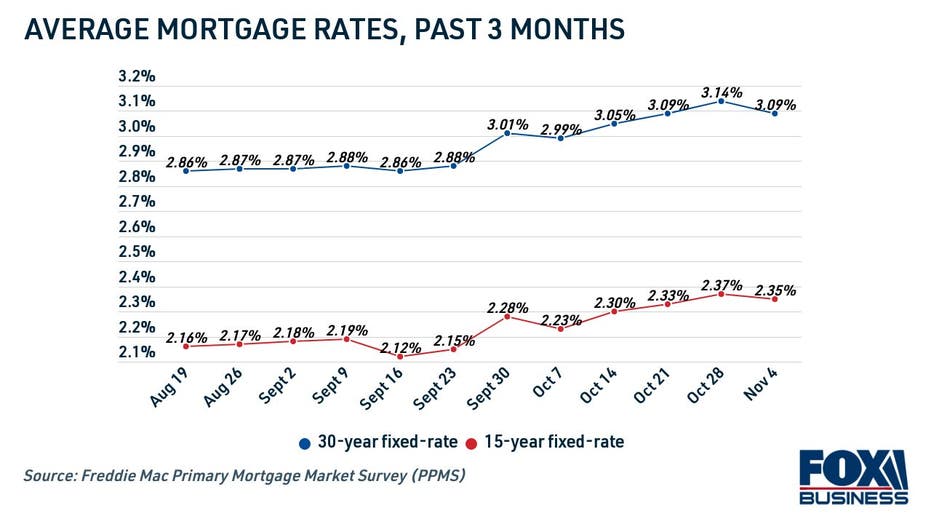

Despite news of rising interest rates amid economic uncertainty, mortgage rates are still hovering near all-time lows, according to Freddie Mac.

WHAT ARE THE NEW FHA LOAN LIMITS FOR 2021?

While 30-year mortgage rates bounced around 3% in October, that still may be a lower rate compared to what many homeowners are currently paying. For the 15-year mortgage, which is a popular refinancing term among homeowners who want to pay off their home loan faster, rates are still incredibly low at 2.35% as of Nov. 4.

But the environment of favorably low mortgage rates can't last forever, and it's inevitable that they'll begin to rise soon. A major factor impacting mortgage rates is the Federal Reserve's 0% interest rate, but the Fed is predicting a rate hike as early as 2022. The Mortgage Bankers Association (MBA) forecasts that 30-year loan rates will average 4% in 2022, further rising to 4.3% in 2023.

Don't wait to refinance your mortgage. Browse current interest rates for 10- and 15-year loans in the rate table below, and visit Credible to see mortgage loan offers tailored to you.

BORROWERS WHO CONSOLIDATED CREDIT CARD DEBT SAVED $2K+ ON AVERAGE, DATA SHOWS

How to decide if you should refinance

Mortgage refinancing can be a smart move under the right circumstances, but it can also be unwise for some homeowners. Follow these steps to determine if a new mortgage with better loan terms will save you money in the long run:

- Identify your refinancing goals. Do you want to refinance to a lower monthly payment, or do you want to pay off your mortgage faster? You may be able to save more money over the life of the loan by refinancing to a shorter mortgage term, but your monthly mortgage payment will be higher. You may also want to tap into record-high home values with a cash-out refinance.

- See what kind of mortgage interest rates you qualify for. You can get prequalified on Credible to see your estimated interest rates without impacting your credit score. This can help you determine if you can lock in a low enough rate to make refinancing worthwhile.

- Consider the upfront costs. Mortgage refinancing comes with appraisal fees, application fees and an origination fee, which are typically 2-5% of the loan amount and can be rolled into the new loan. You'll want to stay put in your current home for long enough to offset these closing costs.

- Take a look at your home's equity. You have to pay private mortgage insurance (PMI) until you've paid down 20% of your existing mortgage. If your new mortgage is larger than your current loan — due to closing costs or cash-out refinancing, for example — you might be below the 20% threshold. That could cause mortgage insurance premiums to offset your monthly savings.

- Use a mortgage refinance calculator to determine whether you'll save money. Once you have all the information you need about your estimated new interest rate and mortgage term, use Credible's mortgage calculator to estimate your monthly payments and overall loan interest. Compare that with your current mortgage terms to see which option is a better deal for your circumstances.

Still not sure if refinancing is right for you? Get in touch with an experienced loan officer at Credible who can help you decide whether it's a good time to take out a new mortgage with a lower interest rate.

HOME EQUITY LOAN VS. HOME EQUITY LINE OF CREDIT: WHICH IS BETTER?

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.