How to stop inflation from squeezing your wallet

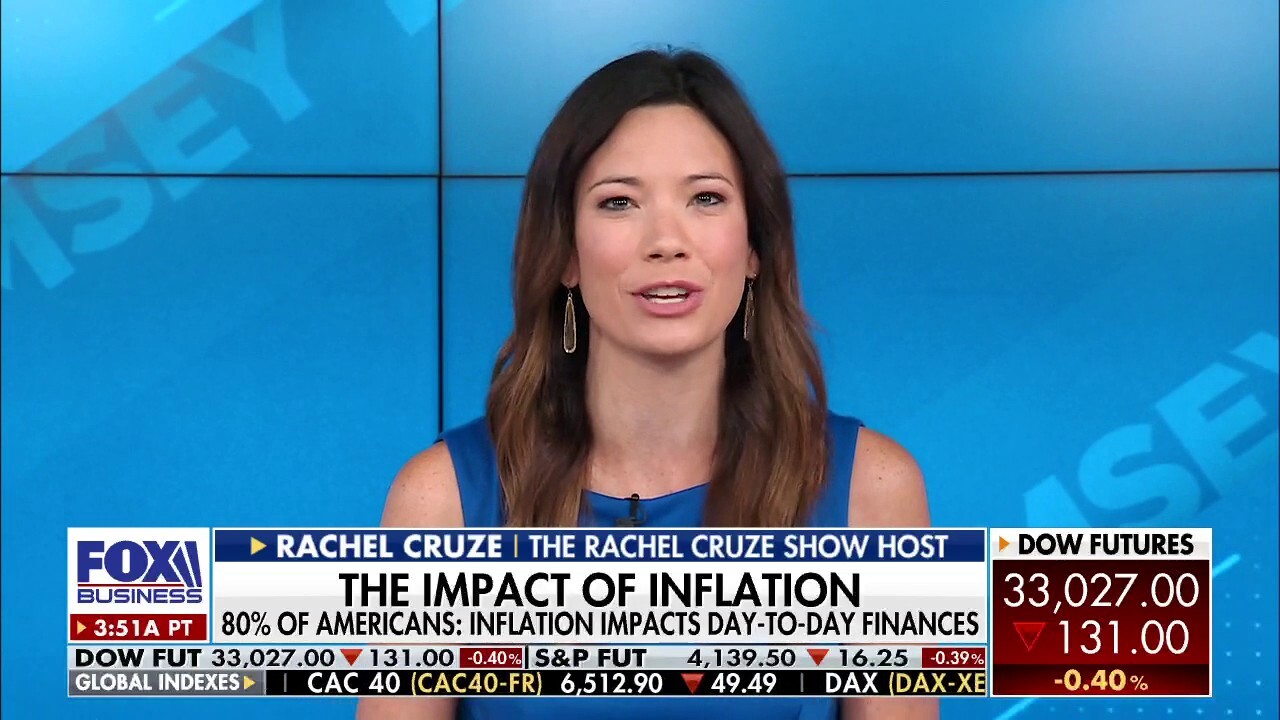

Personal finance expert Rachel Cruze says focus on facts, lean into a strict budget amid 40-year high inflation

Fear cannot be your financial advisor: Expert

‘The Rachel Cruze Show’ host encourages consumers to focus on the facts and control their budget to offset everyday inflation prices.

Although inflation is impacting a majority of Americans, one personal finance expert says it's no reason to panic.

"You have to remember that fear cannot be your financial advisor," bestselling author and podcast host Rachel Cruze said on FOX Business’ "Mornings with Maria" Tuesday. "When we hear words like inflation and recession and all of this, the fear can just rise up and you can make really bad decisions when fear takes over."

Her comments come on the heels of a recent survey that revealed an overwhelming 80% of Americans reported inflation impacts their daily lives.

Cruze then shared tips and tricks to stop surging prices from squeezing your wallet.

HOW TO MANAGE A ‘DILIGENT’ BUDGET AMID RECORD INFLATION

Recognizing inflationary pressures can be felt every day, "The Rachel Cruze Show" host encouraged consumers to focus on changing financial habits within their control and optimizing their budget.

"This is so, so key for people. If you are not being intentional with where your paycheck is going, then you're going to spend money that you don't tend to spend," Cruze explained. "And right now, holding every single dollar accountable to what your life needs is really crucial."

While breaking down how to budget, Cruz explained that your income minus total expenses should equal zero and every dollar should be accounted for.

Rachel Cruze shared best tips for fighting 40-year high inflation, which include not letting fear take over and setting a strict budget, on "Mornings with Maria" Tuesday, May 31, 2022. (iStock)

"You're going to put that income at the top of an Excel sheet, a sheet of paper, a budgeting app, it doesn't matter, and then you're going to look at all of your expenses and you're going to be really intentional to say, ‘Okay, housing is first. Food is second. Utilities is third. Transportation is fourth,’" Cruze advised.

"Really looking at your needs versus your wants, putting dollar amounts next to all the categories you spend money on," she continued. "So every dollar has an assignment, every dollar is being intentionally spent."

With regard to consumer confidence plunging along with Americans’ savings rate, Cruze noted the importance of replacing money taken from your savings.

"Money flows two ways – it flows in, and it flows out. And so if you are taking money from your savings, number one, thankfully you have it, but you want to replace that as soon as possible as well," she pointed out.

Inflationary prices mean ‘getting that income up’: Expert

Bestselling author and Ramsey podcast host Rachel Cruze reacts to consumers taking out more money from their savings amid 40-year high inflation.

As gas, grocery and other daily expenses continue to rise, Cruze said a good goal also includes getting income up.

"Whether that's getting a raise at your current job, or taking on a job or two after-hours, and I know that this is not ideal for people," Cruze said, "but in this moment you may have to get your income up just to be able to say, ‘Hey, I have my expenses covered and I'm not having to live off of my savings.’"