Will your $10K-$20K of student loan forgiveness come with a tax hit?

2021 federal legislation means you don’t have to pay federal income tax on your forgiven student loans, but a state income tax bill could still be in your future

Forgiven debt is usually considered taxable income, but the American Recovery Act excludes it from federal taxation through 2025. (Shutterstock)

If you’ll receive $10,000 or $20,000 in federal student loan forgiveness thanks to President Joe Biden’s announcement on Wednesday, Aug. 24, you won’t have to pay federal income taxes on that amount.

In March 2021, Congress approved the American Rescue Plan Act, COVID-relief legislation that — among other provisions — excludes forgiven federal student loans from taxable income through 2025.

Loan forgiveness doesn’t apply to private student loans, so borrowers who want to lower their loan costs will need to explore options like refinancing. Credible makes it easy to compare student loan interest rates from multiple lenders.

- How taxes and loan forgiveness usually work

- Why you won’t have to pay federal taxes on student loan forgiveness

- What to know about state income taxes and loan forgiveness

- Will forgiveness affect your student loan interest tax deduction?

How taxes and loan forgiveness usually work

Forgiven federal student loan amounts are generally considered taxable income under the federal Tax Code. This means you’re usually expected to include the canceled amount in your gross income that you report on your federal income tax return.

For example, if your 2020 household income was $75,000 and you received $10,000 in student loan forgiveness that year, you’d have to report your gross income as $85,000 on your Form 1040. Gross income is a starting point for calculating the amount of tax you owe. Increasing it can increase your tax bill.

BIDEN CANCELS $10K IN STUDENT LOAN DEBT PER BORROWER — WHAT TO KNOW

Why you won’t have to pay federal taxes on student loan forgiveness

The American Recovery Act excludes from gross income any amount of federal student loans forgiven for any reason between Dec. 31, 2020, and Dec. 31, 2025. That includes:

- Amounts forgiven under the Public Service Loan Forgiveness Program

- Teacher or healthcare loan forgiveness programs

- Income-driven repayment plans (after making 20 years of on-time payments)

The act also applies to the broad-scale forgiveness announced by the Biden administration. So if your 2022 gross income is $75,000, and you received $10,000 in forgiveness, when you file your federal taxes next year, you’ll only need to report (and pay taxes on) $75,000 of gross income — not $85,000.

What to know about state income taxes and loan forgiveness

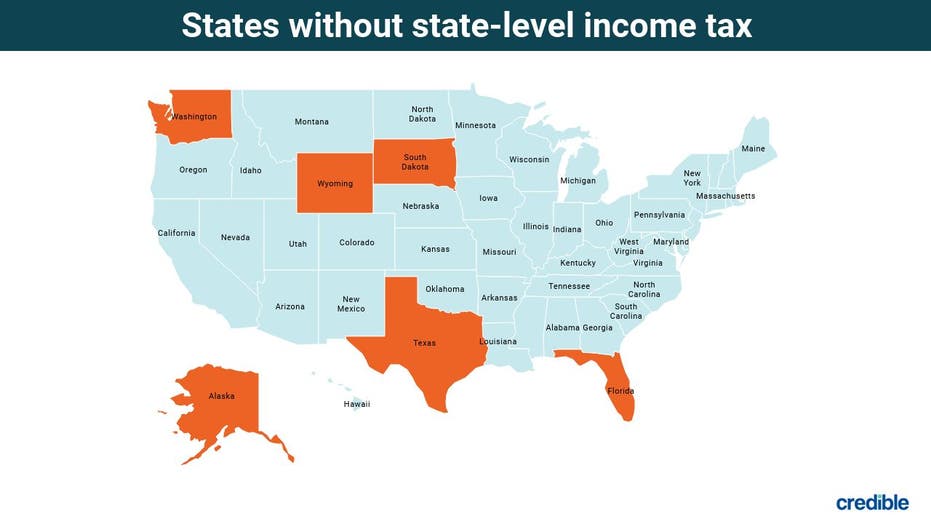

While you won’t have to pay federal income tax on your student loan forgiveness, you may still possibly face state income tax if you live in one of the 43 states that have a state-level income tax.

Each state has its own tax rules, and while states often follow the IRS code as a guideline for their own tax systems, they’re not required to. It’s possible your state will treat your forgiven amount differently. In fact, 13 states have the potential to tax student loan forgiveness, the nonprofit Tax Foundation says, with additional maximum tax amounts ranging from $500 to $1,100, depending on your income and which state you live in.

If you’re unsure whether your state taxes forgiven student loan debt, it may be a good idea to consult a tax professional in your state, or contact your state’s department of taxation for help.

HOW TO PROTECT YOUR TAX REFUND FROM STUDENT LOAN TAX GARNISHMENT

Will forgiveness affect your student loan interest tax deduction?

Student loan forgiveness shouldn’t affect your ability to claim a student loan interest tax deduction, providing you meet all other criteria for claiming the deduction. Keep in mind, interest on federal student loans has been set at 0% since the payment pause began in March 2020.

The deduction is also available for people with private student loans.

Refinancing can be a way to reduce interest costs or get a smaller monthly payment. With Credible, you can easily compare refinance rates from multiple student loan lenders.