Savings window opens: Today’s 30-year mortgage rates tumble a quarter of a percentage point | Jan. 24, 2023

With rates for this popular repayment term down since yesterday, borrowers may want to lock in a rate for a longer-term mortgage, ahead of likely upswings

Check out the mortgage rates for Jan. 24, 2023, which are largely down from yesterday. (Credible)

Based on data compiled by Credible, mortgage rates for home purchases have fallen for three key terms and remained unchanged for one term since yesterday.

- 30-year fixed mortgage rates: 6.625%, down from 6.875%, -0.250

- 20-year fixed mortgage rates: 6.500%, unchanged

- 15-year fixed mortgage rates: 6.250%, down from 6.375%, -0.125

- 10-year fixed mortgage rates: 6.500%, down from 6.625%, -0.125

Rates last updated on Jan. 24, 2023. These rates are based on the assumptions shown here. Actual rates may vary. Credible, a personal finance marketplace, has 5,000+ Trustpilot reviews with an average star rating of 4.7 (out of a possible 5.0).

What this means: Thirty-year mortgage rates fell a quarter of a percentage point today, offering a slight savings window for borrowers seeking a longer repayment term. Meanwhile, rates for 10- and 15-year terms edged down, and 20-year rates held steady. At 6.5%, homebuyers seeking a longer term and smaller monthly payments may want to consider 20-year rates. But borrowers who want to take advantage of interest savings should look to 15-year rates, which are the lowest available at 6.25%.

To find great mortgage rates, start by using Credible’s secured website, which can show you current mortgage rates from multiple lenders without affecting your credit score. You can also use Credible’s mortgage calculator to estimate your monthly mortgage payments.

Based on data compiled by Credible, mortgage refinance rates have risen for two key terms and remained unchanged for two other terms since yesterday.

- 30-year fixed-rate refinance: 6.500%, unchanged

- 20-year fixed-rate refinance: 6.375%, up from 6.125%, +0.250

- 15-year fixed-rate refinance: 6.125%, unchanged

- 10-year fixed-rate refinance: 6.375%, up from 6.250%, +0.125

Rates last updated on Jan. 24, 2023. These rates are based on the assumptions shown here. Actual rates may vary. With 5,000 reviews, Credible maintains an "excellent" Trustpilot score.

What this means: Rates for a 20-year mortgage refinance rose a quarter of a percentage point today, bringing this longer term to 6.375%. With today’s rate changes, homeowners may find 15-year rates particularly appealing, as they’re the lowest available at 6.125%. Shorter terms do come with higher monthly payments, but they offer homeowners the opportunity to be mortgage-free sooner.

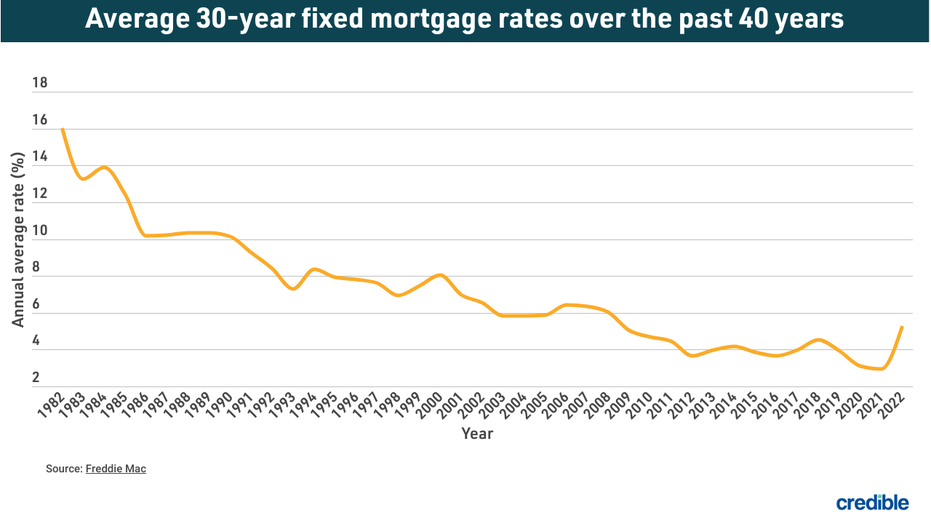

How mortgage rates have changed over time

Today’s mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac — 16.63% in 1981. A year before the COVID-19 pandemic upended economies across the world, the average interest rate for a 30-year fixed-rate mortgage for 2019 was 3.94%. The average rate for 2021 was 2.96%, the lowest annual average in 30 years.

The historic drop in interest rates means homeowners who have mortgages from 2019 and older could potentially realize significant interest savings by refinancing with one of today’s lower interest rates. When considering a mortgage refinance or purchase, it’s important to take into account closing costs such as appraisal, application, origination and attorney’s fees. These factors, in addition to the interest rate and loan amount, all contribute to the cost of a mortgage.

How Credible mortgage rates are calculated

Changing economic conditions, central bank policy decisions, investor sentiment and other factors influence the movement of mortgage rates. Credible average mortgage rates and mortgage refinance rates reported in this article are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no (or very low) discount points and a down payment of 20%.

Credible mortgage rates reported here will only give you an idea of current average rates. The rate you actually receive can vary based on a number of factors.

Can I get a mortgage with bad credit?

Credit scores are a snapshot of your credit history, and they usually range from 300 to 850. FICO, a widely used credit-scoring model, breaks down credit scores this way:

- Poor: 579 or less

- Fair: 580 to 669

- Good: 670 to 739

- Very good: 740 to 799

- Exceptional: 800 or more

To qualify for a conventional loan — one that’s not backed by any government agency — you’ll usually need a fair credit score of at least 620. But it’s possible to qualify for FHA loans, which are insured by the Federal Housing Administration, with a poor credit score as low as 500.

And Veterans Administration loans, which are for veterans, active-duty service members and their spouses, have no minimum credit score requirements. USDA loans, which help very low-income Americans buy in certain rural areas, also have no minimum credit score requirements.

If you’re trying to find the right mortgage rate, consider using Credible. You can use Credible's free online tool to easily compare multiple lenders and see prequalified rates in just a few minutes.

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.