Today’s mortgage rates: Shorter terms offer borrowers best opportunity for interest savings | Nov. 14, 2022

With three key rates rising since last Friday, homebuyers who want to lock in a rate will find the most savings with shorter repayment terms

Check out the mortgage rates for Nov. 14, 2022, which are largely up from last Friday. (Credible)

Based on data compiled by Credible, mortgage rates for home purchases have risen for three key terms and fallen for one other term since last Friday.

- 30-year fixed mortgage rates: 6.750%, up from 6.250%, +0.500

- 20-year fixed mortgage rates: 6.375%, up from 6.250%, +0.125

- 15-year fixed mortgage rates: 6.125%, up from 6.000%, +0.125

- 10-year fixed mortgage rates: 6.125%, down from 6.250%, -0.125

Rates last updated on Nov. 14, 2022. These rates are based on the assumptions shown here. Actual rates may vary. Credible, a personal finance marketplace, has 5,000+ Trustpilot reviews with an average star rating of 4.7 (out of a possible 5.0).

What this means: After falling to its lowest levels since September, 30-year mortgage rates surged half a point to hit 6.75% over the weekend. Meanwhile, rates for 15- and 20-year terms also edged up, and 10-year rates fell slightly. Rates for all repayment terms remain under 7%, meaning buyers may want to lock in a relatively low rate today, ahead of likely increases.

To find great mortgage rates, start by using Credible’s secured website, which can show you current mortgage rates from multiple lenders without affecting your credit score. You can also use Credible’s mortgage calculator to estimate your monthly mortgage payments.

Based on data compiled by Credible, mortgage refinance rates have risen for three key terms and fallen for one other term since last Friday.

- 30-year fixed-rate refinance: 6.750%, up from 6.250%, +0.500

- 20-year fixed-rate refinance: 6.375%, up from 6.250%, +0.125

- 15-year fixed-rate refinance: 6.125%, up from 6.000%, +0.125

- 10-year fixed-rate refinance: 6.125%, down from 6.250%, -0.125

Rates last updated on Nov. 14, 2022. These rates are based on the assumptions shown here. Actual rates may vary. With 5,000 reviews, Credible maintains an "excellent" Trustpilot score.

What this means: Three key mortgage refinance rates edged up today, with 30-year rates hitting 6.75%. Rates for 10- and 15-year refinance terms are currently more than half a percentage point lower than rates for longer terms. Homeowners looking to refinance may find that shorter terms offer the best opportunity for a lower interest rate and manageable monthly payment.

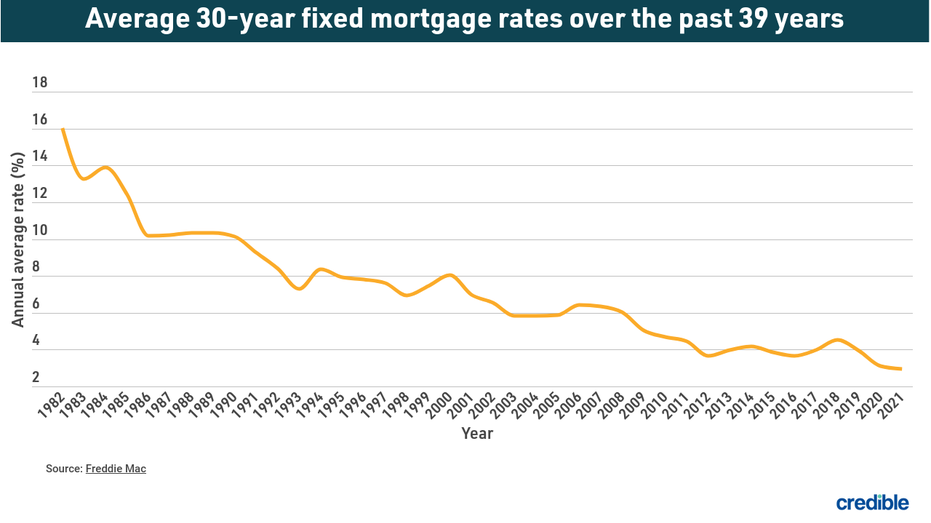

How mortgage rates have changed over time

Today’s mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac — 16.63% in 1981. A year before the COVID-19 pandemic upended economies across the world, the average interest rate for a 30-year fixed-rate mortgage for 2019 was 3.94%. The average rate for 2021 was 2.96%, the lowest annual average in 30 years.

The historic drop in interest rates means homeowners who have mortgages from 2019 and older could potentially realize significant interest savings by refinancing with one of today’s lower interest rates. When considering a mortgage refinance or purchase, it’s important to take into account closing costs such as appraisal, application, origination and attorney’s fees. These factors, in addition to the interest rate and loan amount, all contribute to the cost of a mortgage.

Are you looking to buy a home? Credible can help you compare current rates from multiple mortgage lenders at once in just a few minutes. Use Credible’s online tools to compare rates and get prequalified today.

Thousands of Trustpilot reviewers rate Credible "excellent."

How Credible mortgage rates are calculated

Changing economic conditions, central bank policy decisions, investor sentiment and other factors influence the movement of mortgage rates. Credible average mortgage rates and mortgage refinance rates reported in this article are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no (or very low) discount points and a down payment of 20%.

Credible mortgage rates reported here will only give you an idea of current average rates. The rate you actually receive can vary based on a number of factors.

Can I get a mortgage with bad credit?

Credit scores are a snapshot of your credit history, and they usually range from 300 to 850. FICO, a widely used credit-scoring model, breaks down credit scores this way:

- Poor: 579 or less

- Fair: 580 to 669

- Good: 670 to 739

- Very good: 740 to 799

- Exceptional: 800 or more

To qualify for a conventional loan — one that’s not backed by any government agency — you’ll usually need a fair credit score of at least 620. But it’s possible to qualify for FHA loans, which are insured by the Federal Housing Administration, with a poor credit score as low as 500.

And Veterans Administration loans, which are for veterans, active-duty service members, and their spouses, have no minimum credit score requirements. USDA loans, which help very low-income Americans buy in certain rural areas, also have no minimum credit score requirements.

If you’re trying to find the right mortgage rate, consider using Credible. You can use Credible's free online tool to easily compare multiple lenders and see prequalified rates in just a few minutes.

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.

As a Credible authority on mortgages and personal finance, Chris Jennings has covered topics that include mortgage loans, mortgage refinancing, and more. He’s been an editor and editorial assistant in the online personal finance space for four years. His work has been featured by MSN, AOL, Yahoo Finance, and more.