Yellen says inflation is ‘likely’ to be 'very uncomfortably high' for another year

The Treasury secretary has amended her long-term inflation expectations

As consumers are squeezed by the highest inflation rate in 40 years, here's how to lessen the financial impact of rising prices. (iStock)

Inflation reached another 40-year high in February with consumer prices rising 7.9% annually. Although the Federal Reserve is planning to implement multiple benchmark rate hikes in 2022 to restrain soaring inflation, Treasury Secretary Janet Yellen predicts that price acceleration will continue to impact consumers throughout the year.

"We’re likely to see another year in which 12-month inflation numbers remain very uncomfortably high," Yellen said March 10 on CNBC's "Closing Bell."

Yellen previously told NPR that inflation would slow down in the second half of 2022, but "a lot of uncertainty" amid Russia's invasion of Ukraine has caused her to revise her prior forecast.

"We have seen a very meaningful increase in gas prices, and my guess is that next month we’ll see further evidence of an impact on U.S. inflation of Putin’s war on Ukraine," Yellen said.

In addition to the impact on gas prices, Yellen said that the Russia-Ukraine conflict could push food costs higher since both warring countries are major producers of wheat.

Keep reading to learn more about how the Fed plans to fight inflation, as well as how you can offset rising consumer prices. And if you’re looking to take advantage of current interest rates before the Fed’s predicted increases, you can visit Credible to lock in favorable rates on mortgages, student loans and personal loans.

MOST AMERICANS OPTIMISTIC ABOUT THEIR FINANCES IN 2022 DESPITE INFLATION, SURVEY SAYS

High inflation is likely to drive interest rates higher

The annual inflation rate is rising well above the Fed's 2% target, according to the Consumer Price Index (CPI). In an effort to rein in consumer prices, Federal Reserve Chair Jerome Powell expects the central bank to raise the federal funds rate multiple times in 2022.

This may drive interest rates higher on a number of financial products, such as mortgages, car loans, credit cards, personal loans and private student loans. Higher interest rates translate to less favorable borrowing terms, making financial products more expensive to repay over time.

The Federal Open Market Committee's (FOMC) economic policy has already caused interest rates to rise on some types of loans. For example, 30-year mortgage rates have risen from 3.11% at the end of 2021 to 3.85% for the week ending March 10, according to Freddie Mac. Fixed student loan refinancing rates also have risen to the highest point since 2020, Credible data shows.

As interest rates continue to rise, it's more important than ever to shop around for rate quotes when borrowing money. You can compare rates across multiple lenders at once on Credible and find the best possible offer for your financial situation.

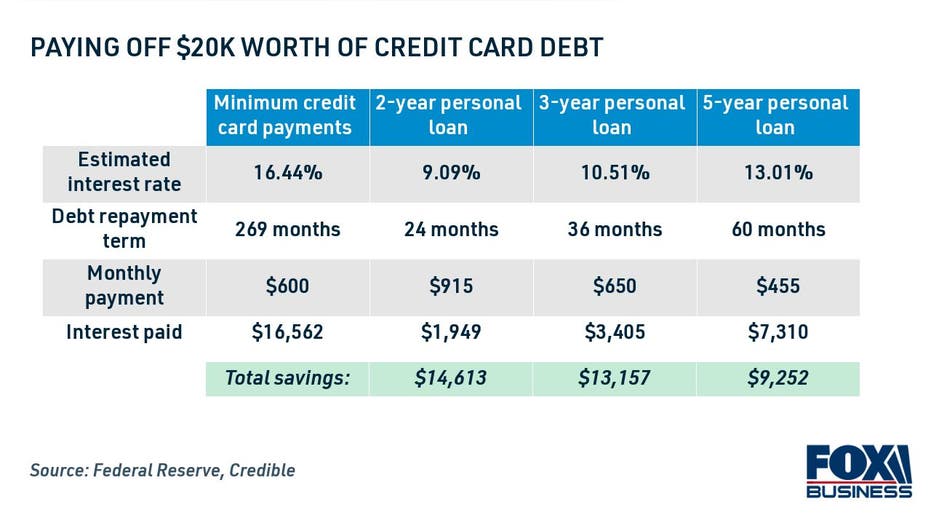

CREDIT CARD CONSOLIDATION MAY SAVE YOU THOUSANDS AS PERSONAL LOAN RATES ARE AT RECORD LOWS

How to offset the financial impact of rising prices

Inflation doesn't just result in higher prices — it lowers the value of your hard-earned money. While asking for a raise at work may help to offset rising prices, it's not always a viable option. Here are a few other ways to lessen the financial consequences of inflation:

- Keep a closer eye on your household budget

- Keep your money in diversified investments

- Pay down debt on more favorable terms

Read more about each strategy in the sections below.

Keep a closer eye on your household budget

Prices are rising quickly on a number of consumer goods, from gas to groceries. Inflation can make it difficult to balance your household budget, potentially causing some families to lean on high-interest credit card spending. During times of price inflation, it may be necessary to track your budget more closely to avoid racking up debt.

One way to simplify the process is by downloading a free budget app that connects to your bank accounts. Tracking your spending can help you identify savings opportunities so you don't need to take out revolving credit card debt to cover necessary expenses. You can search for free budgeting software on your smartphone's app store.

CAR INSURANCE RATES 'AREN'T SKYROCKETING' DESPITE 4% ANNUAL INFLATION: REPORT

Keep your money in diversified investments

Inflation can cause volatility in the stock market, directly impacting the value of your long-term investments. Many consumers get spooked by short-term market conditions, withdrawing money from their stock portfolios and index funds out of fear that they'll fall further. But this can be a risky move.

One way to protect your finances against inflation is to diversify your investments. Meet with your financial advisor to revisit your asset allocation so your investment portfolio is less vulnerable to inflation-related market downturns.

AVERAGE HOME INSURANCE RATES ARE RISING FASTER THAN INFLATION — AND THEY'RE NOT LIKELY TO SLOW DOWN

Pay down debt on more favorable terms

Data from the New York Fed suggests that Americans are becoming increasingly reliant on high-interest credit cards amid soaring inflation. But revolving credit card debt can trap borrowers in a cycle of repayment that's time-consuming and expensive — especially as Fed officials are poised to begin interest-rate hikes.

One way to pay down credit card debt is by consolidating into a personal loan with better terms. Personal loans typically offer lower interest rates than credit cards, and two-year personal loan rates are currently at historic lows. Plus, personal loans offer fixed interest rates and predictable monthly payments, which may allow you to pay off credit card balances faster while saving money on interest charges.

Personal loan lenders set interest rates based on the prime rate as well as a borrower's creditworthiness, including factors such as credit score and debt-to-income ratio. You can visit Credible to compare interest rates across multiple lenders for free without impacting your credit score. Then, you can use a personal loan calculator to estimate your potential savings.

POLL: EXPIRATION OF CHILD TAX CREDIT PAYMENTS REFLECTS POORLY ON DEMOCRATS

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.