As workers delay retirement, younger employees get stuck

More Americans are delaying their retirement – and it’s making it harder for younger employees to get a promotion at work.

A little more than half of the companies surveyed in a new study by financial services company Fidelity Investments (55 percent) feel their employees aren't saving enough money to be able to retire when the time comes.

Fidelity kept track of company records since 2008 and found that a whopping nine out of 10 that offer retirement plans reported they have had employees work well past their desired retirement date leading to higher benefit costs, and lower productivity. And younger employees will stay stagnant longer because of it.

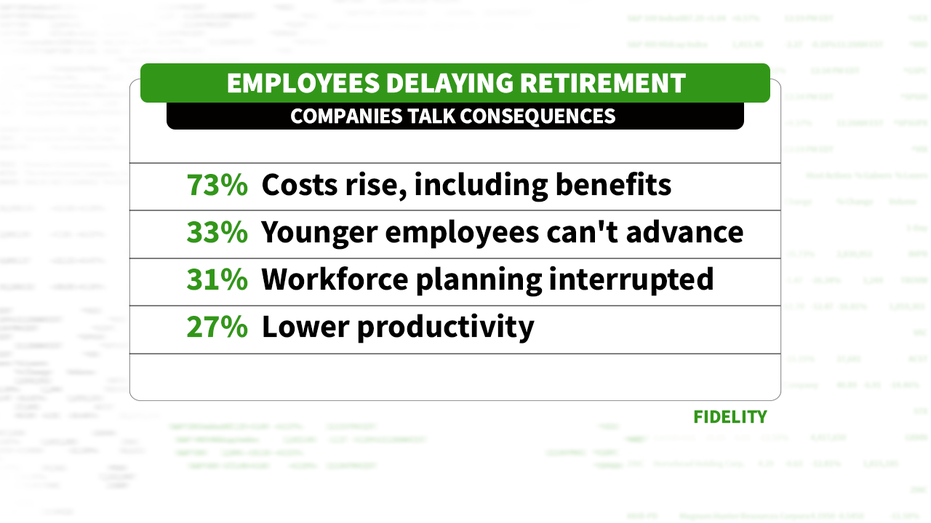

Indeed, 73 percent of employers said costs are rising, including benefits; 33 percent said younger employees are less likely to get promoted, 31 percent said companies can't implement strategic planning and 27 percent said delayed retirement leads to lower productivity.

As a result, companies are modifying retirement plans to incentivize employee participants to take greater advantage: 26 percent of companies surveyed said they would increase the company match; and 24 percent said they would add a match to plans, according to Fidelity.

Full retirement age varies from 65 to 67, depending on your year of birth. The earliest a person can start receiving Social Security retirement benefits is age 62. The full retirement age currently is 66 for those born between 1943 and 1954.

CLICK HERE TO READ MORE ON FOX BUSINESS

One way workers can make sure they’re on track for retirement is by having 2x their annual salary by age 35; 4x at 45; 6x at 55 and 10x by 67.

Those savings are unrealistic, however, for many Americans, considering just 40 percent say they have enough money to pay an unexpected $1,000 expense.