States revolt against Biden's 'disaster' mortgage redistribution rule to subsidize risky loans

Biden's controversial policy is set to take effect today

Biden's electric military vehicle push makes no sense for anything 'tactical': Ex-Pentagon official

Former Pentagon official Brent Sadler reacts to President Biden bringing his climate agenda to the U.S. military on 'The Evening Edit.'

FIRST ON FOX – State treasurers and other top finance officials from 27 states on Monday urged President Biden to end what they said was his "unconscionable" policy of forcing people with good credit scores to subsidize mortgage loans of higher-risk borrowers, and warned Biden’s plan would be a "disaster."

Biden’s plan was outlined just a few weeks ago by the Federal Housing Agency (FHFA) and is set to take effect today. The plan is aimed at helping lower-income borrowers afford their monthly mortgage payments – it would do so by forcing people with good credit scores to pay more each month for their mortgages, extra payments that would be credited to the loans of higher-risk borrowers.

The controversial policy has been attacked by both Republicans and Democrats, including President Obama’s former Federal Housing Administrator. On Monday, financial officers from 27 states weighed in and said it was clear the policy was a mistake even before it takes effect.

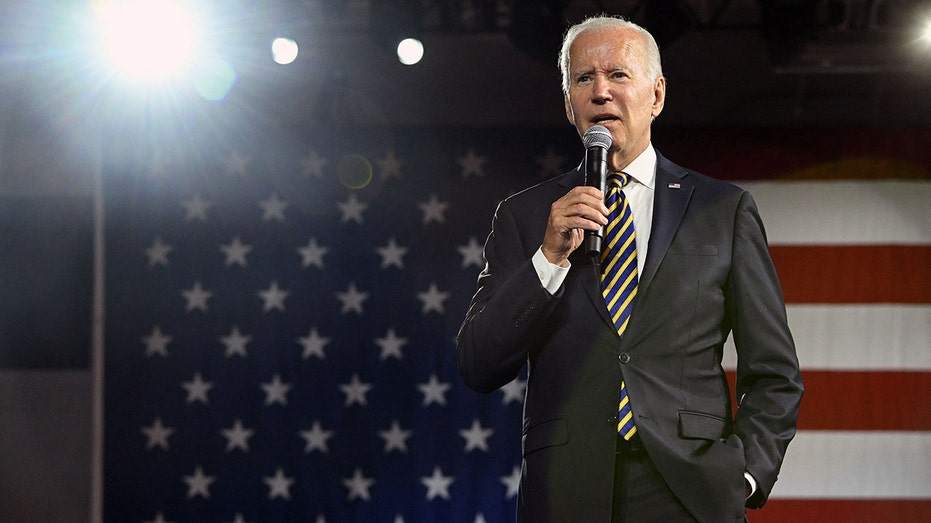

US President Joe Biden speaks about the economy and the final rule implementing the American Rescue Plans Special Financial Assistance program, protecting multiemployer pension plans, at Max S. Hayes High School in Cleveland, Ohio, July 6, 2022. (Pho ((Photo by SAUL LOEB/AFP via Getty Images) / Getty Images)

"It is already clear that this new policy will be a disaster," they wrote in a letter led by Pennsylvania Treasurer Stacy Garrity that was sent to Biden and FHFA Director Sandra Thompson. "It amounts to a middle-class tax hike that will unfairly cost American families millions upon millions of dollars. And – at a time when the real estate market has already slowed considerably due to high interest rates – it will further depress home sales."

"We urge you to take immediate action to end this unconscionable policy," they wrote.

The state finance officers blasted the plan for turning the normal system of home buying incentives "upside down" by hurting people who make sound financial decisions.

BIDEN RULE WILL REDISTRIBUTE HIGH-RISK LOAN COSTS TO HOMEOWNERS WITH GOOD CREDIT

The policy was proposed by Federal Housing Finance Agency Director Sandra L. Thompson, and it is set to take effect May 1, 2023. (Photo By Tom Williams/CQ-Roll Call, Inc via Getty Images) (Getty Images)

"[T]the policy will take money away from the people who played by the rules and did things right – including millions of hardworking, middle-class Americans who built a good credit score and saved enough to make a strong down payment," they wrote. "Incredibly, those who make down payments of 20 percent or more on their homes will pay the highest fees – one of the most backward incentives imaginable."

It noted that the forced extra payments will be used to hand out "better mortgage rates to people with lower credit ratings. Others have said the plan would make it easier for people with shaky credit histories to afford more expensive mortgages, a move that could put more people at financial risk.

The state officials said that while expanding homeownership is a worthy goal, the forced subsidization of risky loans isn’t the way to do it.

BIDEN RULE WILL REDISTRIBUTE HIGH-RISK LOAN COSTS TO HOMEOWNERS WITH GOOD CREDIT

Biden has promoted a series of ‘equity’ initiatives during his two years in office. ((Photo by Anna Moneymaker/Getty Images) / Getty Images)

"[T]he right way to solve that problem is not to use the power of the federal government to penalize hardworking, middle-class American families by confiscating their money and using it as a handout," they wrote. "The right way is to implement policies which will reduce inflation, cut energy costs and bring lower interest rates."

CLICK HERE TO GET THE FOX NEWS APP

The letter was signed by treasurers, auditors, commissioners of revenue and other top officials from Alabama, Alaska, Arizona, Arkansas, Florida, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Mississippi, Missouri, Nebraska, Nevada, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, South Dakota, Texas, Utah, West Virginia, Wisconsin and Wyoming.