A new Fed head would expose Trump's empty promises on trade

President Trump spent much of his 2016 campaign shouting about the dangers of Chinese currency manipulation leading to trade deficits and U.S. job losses in manufacturing. He promised to take action. To date, he has taken no visible action against China over its currency policy. Furthermore, he is now actively considering candidates for Federal Reserve Chair whose policies would amplify currency misalignments, grow trade deficits and risk more job losses in manufacturing than any trade deal he can sign.

The administration’s choice on Federal Reserve chair will likely have more effect on trade flows than any trade deal. And if the administration risks going against precedent, financial markets’ and other central bankers’ advice and decides to not re-appoint Janet Yellen, the choice will almost certainly undercut Trump’s promises on trade and trade deficits. The finalists, with the exception of Janet Yellen, have views on monetary policy, financial regulation, and trade agreements at odds with Trump’s on his signature claim of protecting American jobs from trade.

Candidate Trump took a strong populist tone on trade. Indeed, he cited work on the costs of free trade deals and currency manipulation by the Economic Policy Institute, a group many conservatives are loathe to acknowledge, in part because it sticks up for workers. But managing the United States’ trade balance is more than the art of the deal. The administration’s enthusiasm for Kevin Warsh, in the face of criticism, even confusion, from Fed watchers of all stripes suggests Trump may not understand the import of this choice for trade policy, and the voters who elected him.

Direct currency management involves buying up another country’s currency. China did this to an enormous extent in the last decade, with its central bank acquiring trillions of dollars of U.S. assets. The effect of pushing up the dollar and the trade deficit to a high that approached 6.0 percent of GDP. The Chinese government made these asset trades as part of a deliberate policy.

Conversely, traditional expansionary monetary policy occurs when a central bank buys its own currency to push down interest rates. Lower interest rates lead to a weaker currency. While this affects exchange rates, it is distinct from currency manipulation, which specifically aims to weaken a currency.

A more hawkish Fed will choose rates that make U.S. assets more desirable to investors, both domestic and foreign. Rising demand for dollars resulting from this portfolio shift will raise the dollar’s value relative to other currencies, slowing U.S. exports and raising imports, driving up trade deficits and displacing U.S. manufacturing jobs

Tighter money and higher interest rates are exactly what John Taylor and Kevin Warsh have pushed since the Great Recessions—Taylor in public, and Warsh as a Fed governor—even with a weak economy and clear predictions that this would increase trade deficits. While the US financial sector—which sells assets and hates any outbreak of unexpected inflation—may benefit from tighter monetary policy, workers in trade-exposed industries from Trump’s base in the Midwest, whose votes were so critical to his victory last November, would not.

It’s simple to understand these effects in a manufacturing example—US-based companies must pay workers and suppliers in dollars, while Chinese-based companies pay these costs in yuan.

If neither country intentionally manages their currency values and 1 US dollar = 1 Chinese yuan, then a US-based company that can profitably sell for $.99, while a China-based competitor could only make a profit at $1, would take the entire market contested between the two firms.

If China’s central bank decides to depreciate the yuan 20%, it sells yuans and buys US dollars until currency markets balance with 1 yuan = 80 cents. Now, the Chinese manufacturer still pays its costs in yuans, but it can earn 1 yuan by selling in the US for $0.80, and take the entire market. Neither firm got more efficient or lowered costs, but when the central bank changed the relative money supplies, the higher cost firm took the market.

Overly tight monetary policy at the Fed can raise the value of the dollar and leave the world with unbalanced trade flows. If the Fed keeps interest rates, and therefore the dollar, too high, it will further bias the US economy towards selling more US financial assets, and fewer US goods. That means more jobs (or at least more fees) for Wall Street, but fewer jobs in manufacturing.

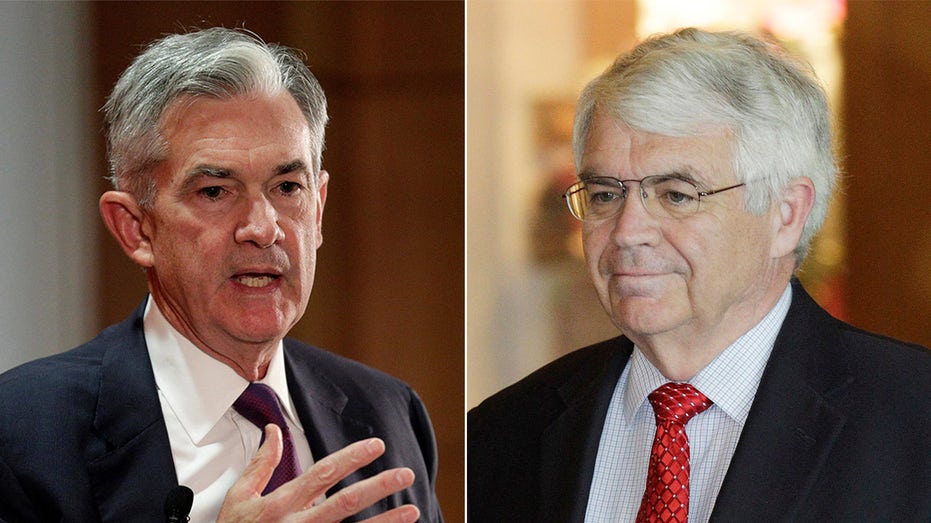

So, back to the short-list. Taylor, who advocates a rule-based pathway for interest rates (at least until the rule suggests negative rates) has argued for higher interest rates than the policymakers of the Fed have set and been hawkish and wrong during most of the current expansion. Another frontrunner, current Fed Governor Jerome Powell, does not have the reflexively hawkish and wrong track record of Taylor. He has been identified as Treasury Secretary Steve Mnuchin’s favored candidate, which is potentially worrisome given Mnuchin’s support for a stronger dollar. However, his willingness as a member of the Board of Governors in recent years to join Yellen in pursuing a gradual pathway to interest rate increases may portend an approach that is less disruptive to the trade deficit. Powell’s approach may resemble Yellen’s: measured, data-centric, cognizant of the current global dynamics of a declining neutral interest rates’ effect on global capital flows. This is an important contrast between Taylor and Powell. Unlike most economists, Taylor believes the so-called neutral interest rate should be 2 percent, meaning his default preference is for a stronger dollar and higher interest rates higher than those that have pervaded since the crisis. Taylor’s policies would have outsized impact on the trade deficit at a moment when the global economy is still showing huge sensitivity to changes in monetary policy.

There are many reasons that continuity at the Fed would be good for markets and good for the economy. There are reasons to be worried about an especially poor choice to head the Federal Reserve over the next four years. But on trade in particular, moving the Fed in a hawkish direction would be a powerful commitment to a policy that undercuts Trump’s economic promises on trade and manufacturing jobs for his first term.

Josh Bivens is Research Director at the Economic Policy Institute, Dean Baker is Co-Director at the Center for Economic and Policy Research, Michael Madowitz is an Economist at the Center for American Progress.

Opinion views are independent of Fox Business and Fox Business Network.

Opinion views are indepenent of Fox Business and Fox Business Network.