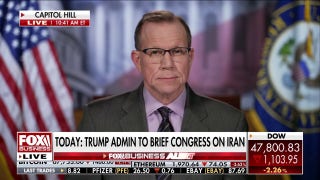

Administration won’t budge on 20% corporate tax rate: Tony Sayegh

Republican tax reform has made progress, with one bill passing in the House of Representatives last week. There are concerns, however, over a group of Republican senators that is still undecided on the tax reform plan – including Sen. Bob Corker, (R-TN), Sen. Jeff Flake (R-Ariz.) and Sen. Susan Collins (R-ME) – which may prevent the bill from being passed in the Senate. Despite some uncertainty, Tony Sayegh, assistant secretary for public affairs at the U.S. Treasury, remains confident a tax reform bill will be on President Trump’s desk to sign by the end of this year.

“We’ve done a lot of work between the administration and Congress throughout the year to get to the point we are now where I can tell you we are extraordinarily well positioned to get tax reform done…through both chambers and on the president’s desk for signature by Christmas,” Sayegh told Maria Bartiromo on the FOX Business Network’s “Mornings with Maria.”

Sen. Collins has proposed keeping state and local tax (SALT) deductions, as well as cutting the corporate tax rate from 35% to 22%, not 20%, which the administration has pushed for.

The Wall Street Journal Global Economics Editor Jon Hilsenrath asked if there was any room to negotiate or budge on the potential cut to the corporate tax rate.

“Twenty percent is the number, but the bottom line is, the Senate version has a delay of that rate for a year. We’re looking at that, clearly, and that’s something the administration and Congress is going to have to work through,” Sayegh said.

Calls to keep SALT deductions are based on concerns that removing them could lead to tax increases for some Americans in states such as New York, New Jersey and California.

“This does not affect middle- and upper middle-income families, this affects a very narrow group of millionaires. Believe me, we prefer obviously to have taxes go down for everybody, but the focus has always been middle-income tax cuts and that’s how you’re going to get it,” Sayegh added.