Ex-Alameda CEO Caroline Ellison says she and Sam Bankman-Fried misled FTX investors in court plea

Bankman-Fried is charged with using use customer and investor money for personal gain

Sam Bankman-Fried is facing significant jail time: Bernie Madoff's former lawyer Ira Lee Sorkin

Mintz & Gold partner and former Madoff lawyer Ira Lee Sorkin discusses Sam Bankman-Fried's legal troubles and what's next for him and his cronies on 'The Claman Countdown.'

Former Alameda Research CEO Caroline Ellison said she and FTX co-founder Sam Bankman-Fried misled lenders about how much the company was borrowing from the cryptocurrency exchange.

Ellison revealed her actions in a Dec. 19 plea hearing in a Manhattan federal court, Bloomberg reported.

"I am truly sorry for what I did. I knew that it was wrong," she said, according to a transcript of the hearing in which she acknowledged the financial ties between her company and FTX.

JUDGE ALLOWS FTX FOUNDER SAM BANKMAN-FRIED TO BE RELEASED ON $250M BOND TO PARENTS' PALO ALTO HOME

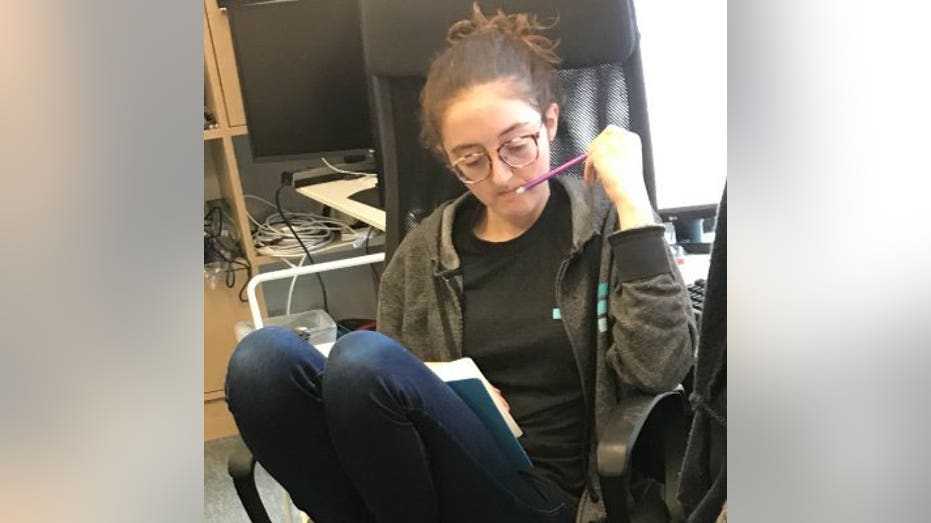

Alameda Research CEO Caroline Ellison reportedly admitted to knowingly misleading lenders the company's financial ties to FTX. (Twitter @carolinecapital / Fox News)

"From 2019 through 2022, I was aware that Alameda was provided access to a borrowing facility on FTX.com, the cryptocurrency exchange run by Mr. Bankman-Fried," Ellison said. "In practical terms, this arrangement permitted Alameda access to an unlimited line of credit without being required to post collateral, without having negative balances and without being subject to margin calls on FTX.com’s liquidation protocols."

Bankman-Fried, 30, the disgraced crypto exchange founder, faces multiple charges from the Southern District of New York and the Securities and Exchange Commission.

The charges include conspiracy to commit wire fraud, wire fraud, conspiracy to commit commodities fraud, conspiracy to commit securities fraud, conspiracy to commit money laundering, and conspiracy to defraud the Federal Election Commission and commit campaign finance violations.

He was released Thursday on $250 million bond after his arrest in the Bahamas earlier this month.

Sam Bankman-Fried leaves Federal Court in New York City on Thursday, December 22, 2022. The former CEO of FTX and Alameda has been released on $250M bail. (Charles Guerin/Abaca for Fox News Digital / Fox News)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Federal prosecutors said he used millions of dollars in customer funds to finance a lavish lifestyle through Alameda.

Ellison said that "if Alameda’s FTX accounts had significant negative balances in any particular currency, it meant that Alameda was borrowing funds that FTX’s customers had deposited on the exchange," the Bloomberg report said.