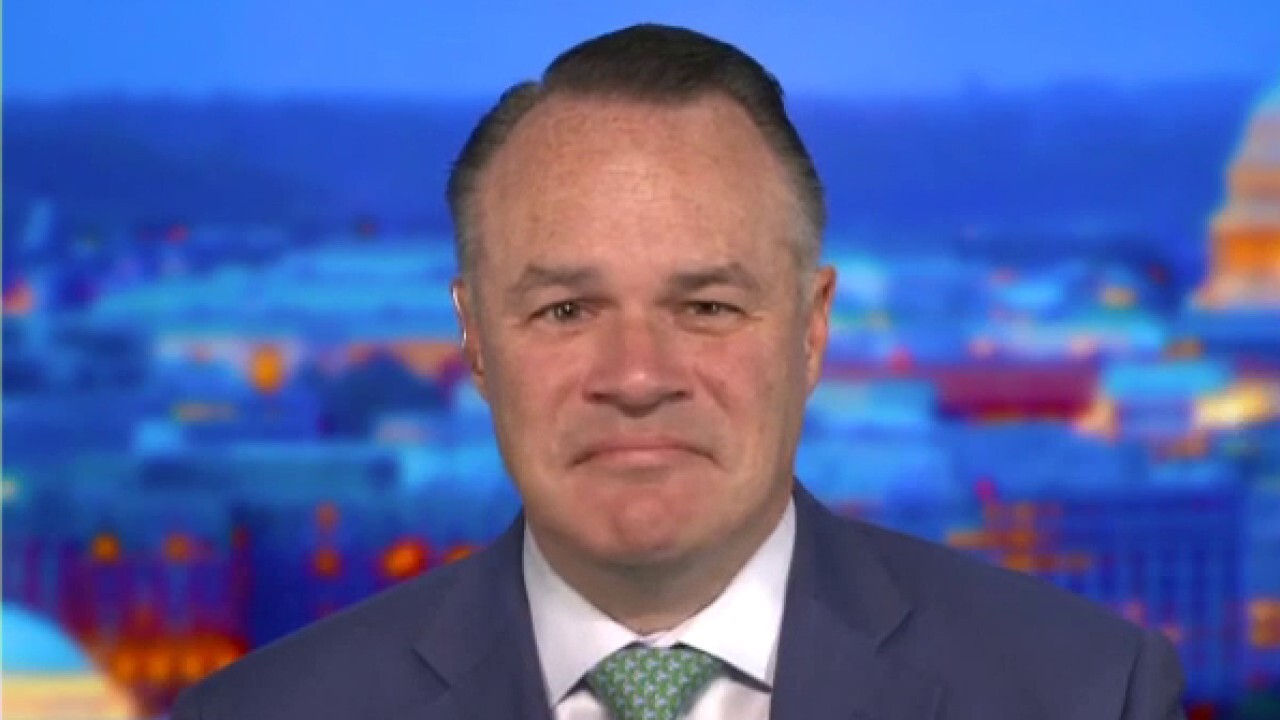

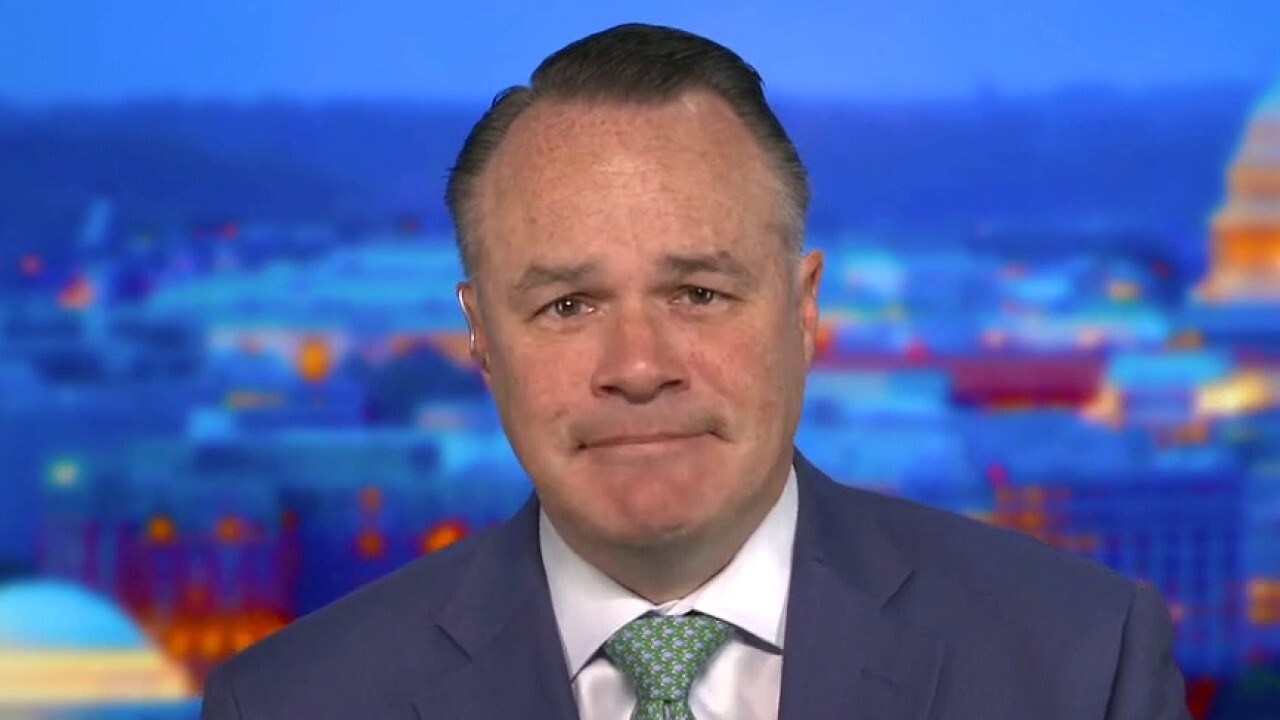

Democrats continue to 'browbeat' Big Oil: Energy exec

American Petroleum Institute CEO blasts Rep. Khanna for ‘thick’ irony on oil stance

Energy exec blasts Rep. Khanna for 'irony' on oil stance

American Petroleum Institute CEO Mike Sommers argues Democratic politicians are continuing to 'browbeat' U.S. oil companies.

American Petroleum Institute CEO Mike Sommers blasted Rep. Ro Khanna, D-Calif., for his "thick" irony regarding the congressman’s stance on oil production and argued that Democratic politicians are continuing to "browbeat" U.S. companies.

Sommers made the argument on "Mornings with Maria" on Wednesday, ahead of testimony on Capitol Hill regarding record-high gas prices from executives of some of the country’s largest oil companies.

The House Committee on Energy and Commerce said last week that executives from BP America, Chevron, Devon Energy Corp., ExxonMobil Corp., Pioneer Natural Resources Co., and Shell USA, will participate in the House hearing.

Host Maria Bartiromo noted on Wednesday that on Monday, when speaking on "Mornings with Maria," Rep. Khanna, shifted the blame for high oil prices away from the Biden administration and onto the oil companies.

Democratic congressman suspects oil companies are 'price gouging'

Rep. Rho Khanna, D-Calif., calls on oil companies to end stock buybacks and use profits to cushion gas prices on 'Cavuto: Coast to Coast.'

"Let’s move to investing in renewable energy and I think most people will agree that that’s a long-term solution," the democratic congressman told Bartiromo on Monday.

"I think what has happened is Wall Street has independently made an assessment that this is not a good long-term bet because they see the way the energy markets are going and that’s why these companies, the oil companies, are engaged in stock buybacks, they’re not engaged with their money with more production," he added.

On Wednesday, speaking with Bartiromo, Sommers reacted to Khanna’s comments two days before, pointing out his "irony."

"Let’s rewind to last October where I testified before the United States Congress with the same oil and gas executives and Ro Khanna actually went down the line of those executives and begged them to stop producing oil and natural gas," Sommers said.

Sommers was referring to the House Oversight and Reform Subcommittee on the Environment hearing in October where CEOs of ExxonMobil, BP, Chevron and Shell reportedly were on Capitol Hill facing a grilling about whether they deceived the public on climate perils.

Environment Subcommittee Chairman Rep. Khanna was reportedly among those leading the hearing with testimony from Sommers, ExxonMobil CEO Darren Woods; BP America CEO David Lawler; Chevron CEO Michael K. Wirth; Shell Oil President Gretchen Watkins; and U.S. Chamber of Commerce President Suzanne Clark.

Sommers went on to note on Wednesday that Khanna asked those companies "to discontinue production here in the United States."

Oil execs to testify before House lawmakers about rising gas prices

American Petroleum Institute CEO Mike Sommers argues the U.S. is dealing with a supply and price 'crisis' because of the policies that were put in place by the Biden administration at the beginning of their term.

"So the irony is a little bit thick that he would now be saying that this industry needs to produce more when he has gotten exactly what he has wanted, which is high prices, which in his mind will hasten the transition to alternative fuels," Sommers told Bartiromo.

Sommers then argued that "the world is going to need more oil and gas for decades and decades to come."

"In fact, even if every country met its Paris Climate Accord agreement, … about 50% of our energy would be coming from oil and natural gas," he continued.

Sommers then argued that politicians "are going to continue to browbeat American companies who are supplying about 11 million Americans with the way that they get their employment every single day."

Silhouette of working oil pump on sunset background. (Reuters / Reuters)

In a statement sent to FOX Business, a spokeswoman for Khanna claimed the congressman "never said oil and gas production should be discontinued in the United States as Mr. Sommers claims. He believes in a short term increase in production to help bring down gas prices and a long term moonshot for renewable energy. Mr. Sommers continues to lie while helping Big Oil fleece Americans at the pump."

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Oil futures were trading higher Wednesday morning, clawing back from earlier losses.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| USO | UNITED STATES OIL FUND - USD ACC | 78.02 | +1.03 | +1.34% |

| BNO | UNITED STATES BRENT OIL FUND - USD ACC | 32.52 | +0.50 | +1.56% |

Traders are trying to measure how the threat of new sanctions on Russia will impact supply concerns.

U.S. West Texas Intermediate futures added $1.16 to $103.16 a barrel on Wednesday morning.

Brent futures gained 83 cents at $107.47 a barrel.

CLICK HERE TO READ MORE ON FOX BUSINESS

FOX Business’ Bradford Betz and Ken Martin contributed to this report.