Baby-formula imports to face tariffs again in 2023

Temporary exemptions put in place during US shortage will expire soon, as supply improves

Baby formula-finder platform gains popularity as shortage pushes into spring

FOX Business' Lydia Hu speaks to mothers who say the baby formula shortage 'is only getting worse.'

Imported baby formula will be subject to tariffs again in the new year after the expiration of exemptions implemented amid a nationwide shortage.

Congress waived tariffs, which can be as high as 17.5%, to help families struggling to find formula after supply-chain problems and the closure of a crucial factory crimped supplies. A White House spokesman said the tariff waivers doubled the number of manufacturers selling baby formula in the U.S. Congress made the tariff waivers temporary as part of a deal to pass the measures quickly, said people familiar with the matter.

The availability of powdered baby formula in U.S. stores has improved in recent months. Out-of-stock levels fell to 14% in October from 30% in July, according to the most recent data from market-research company IRI.

Shelves for baby and toddler formula are partially empty, as the quantity a shopper can buy is limited amid continuing nationwide shortages, at a grocery store in Medford, Massachusetts, May 17, 2022. (Reuters/Brian Snyder / Reuters)

The U.S. dairy industry, which makes ingredients for baby formula, had urged lawmakers to let the tariff suspensions expire. Jim Mulhern, chief executive of the National Milk Producers Federation, wrote to lawmakers in November that the supply had improved enough to allow for a return of the tariffs.

BABY FORMULA SHORTAGE GETTING WORSE DESPITE WHITE HOUSE INTERVENTION

Some parents are still reporting empty shelves. Grocer Kroger Co. said on Dec. 1 that supply-chain problems remain. Families are finding fewer brands, sizes and formats of formula in stores. Manufacturers such as U.K.-based Reckitt Benckiser Group PLC, which produces formula in the U.S. and has been importing more supplies from overseas factories, said it has adjusted production to make more of a narrower product range. Supermarkets sold an average of 43% fewer formula products per store weekly as of Nov. 20, compared with the same period in the previous year, IRI data showed.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| KR | THE KROGER CO. | 67.63 | -1.23 | -1.78% |

| RBGLY | NO DATA AVAILABLE | - | - | - |

| NSRGY | NESTLÉ SA | 104.72 | +1.61 | +1.56% |

Reckitt’s Enfamil formula has picked up most of the market share Abbott Laboratories has lost since recalling its Similac and other formulas in February because of safety concerns, according to IRI. Nestlé SA’s Gerber and private-label brands have made smaller gains. Enfamil is the top brand by sales with about 43% of the market, IRI said.

Baby formula is seen on a shelf in a Target store on July 8, 2022, in Houston. (Brandon Bell/Getty Images / Getty Images)

Reimposing tariffs could make formula more expensive and harder to find, said Erik Peterson, managing director for consulting firm Kearney’s Global Policy Business Council think tank. "Neither is in the interest of the U.S. consumer," he said.

BABY FORMULA STILL HARD TO FIND NEARLY A YEAR AFTER SHORTAGE BEGAN

Formula maker Kendamil said it factored a return of the tariffs into its plans to send six times as much formula to the U.S. in 2023 than in 2022. Executives said the company would not raise prices commensurate with tariffs. "There’s no world in which we’ll be adjusting prices 20%," said Kendamil co-founder Will McMahon.

Special exemptions for importing baby formula are also set to expire on Jan. 6 unless companies pledge to work to meet full Food and Drug Administration requirements. If they do, they can stay in the U.S. market through 2025 while they work to comply with FDA rules. The FDA said some companies have set plans to work toward meeting U.S. standards. The agency did not name them or give an exact count.

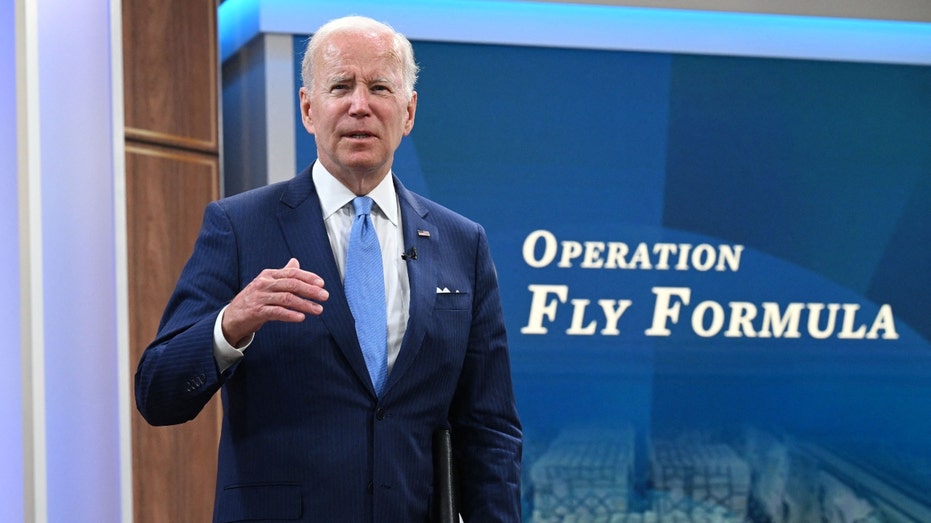

President Biden speaks following a virtual meeting with administration officials and major infant formula manufacturers to urge an increase in infant formula production and ramp up imports of formula through Operation Fly Formula, in the Eisenhower E (Saul Loeb/AFP via Getty Images / Getty Images)

Another flexible formula rule could go away in February. The Agriculture Department said in a recent letter that it might stop allowing families to use the Women, Infants and Children supplemental nutrition program, which provides formula at no cost, to buy brands that have not struck a contract with each state.

CLICK HERE TO GET THE FOX BUSINESS APP

"Every effort to ensure formula is on store shelves creates a compounding net positive," said Jamila Taylor, president of the National WIC Association, which represents providers to the federal program.

Families still struggle as baby formula shortage stretches into eighth month

FOX Business' Madison Alworth hears from a Pennsylvania mother of two, Jerri Janelle Rayburg, about having to resort to purchasing baby formula from Switzerland.