Biden to those making $400K: I love you but I don't mind if your taxes go up

Biden wants to raise the top individual tax rate from 37% to 39.6%

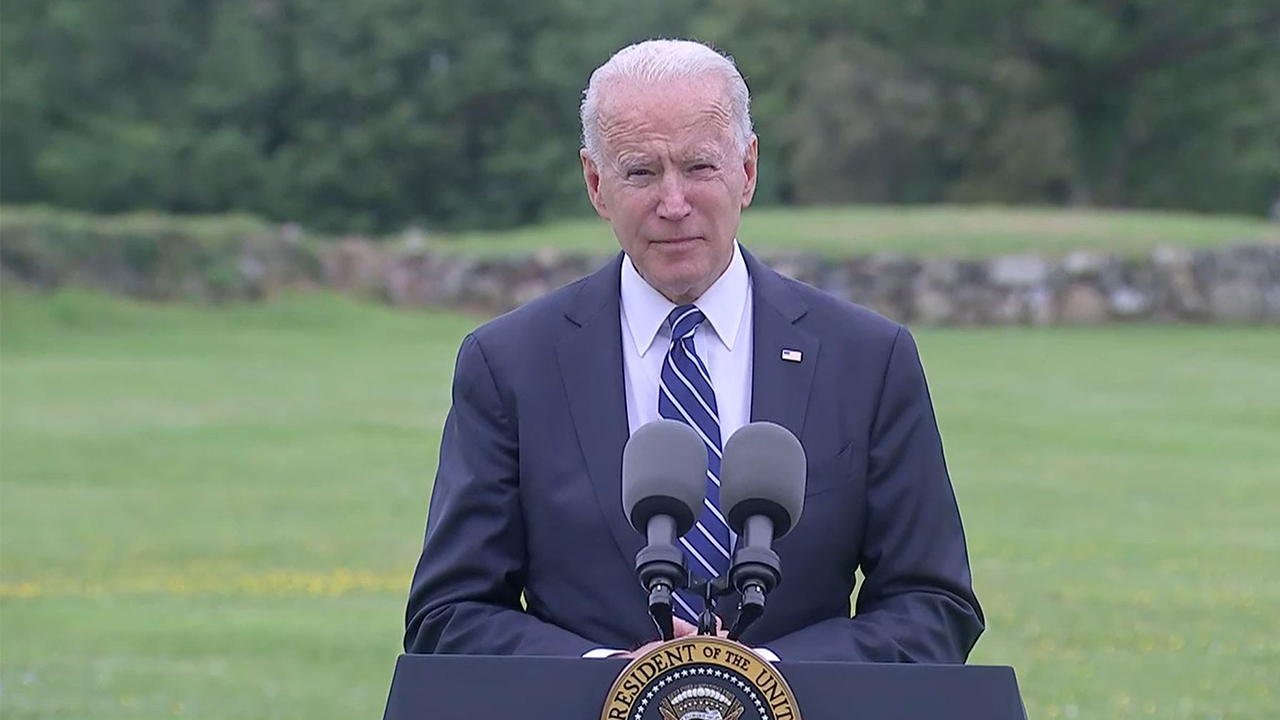

President Joe Biden delivers remarks on infrastructure in La Crosse, Wisconsin

President Joe Biden delivers remarks on infrastructure in La Crosse, Wisconsin

President Biden traveled to La Crosse, Wisconsin Tuesday to drum up support for a bipartisan infrastructure deal reached last week that he touted will only raise taxes on those earning more than $400,000.

"We’re going to get it all done without raising taxes on a single American making less than $400,000," Biden said. "Now all of you making over $400,000, I love you. But I don’t mind a little bit if your taxes go up a little bit."

The president said that his pledge not to raise taxes on those earning less than the $400,000 threshold meant that there would be no increase to the gas tax, a proposal a group of lawmakers had brought forward to pay for the infrastructure deal.

BIDEN TO SELL BIPARTISAN INFRASTRUCTURE DEAL IN WISCONSIN AFTER BOTCHED ROLLOUT

While there are no tax hikes proposed to pay for the $973 billion plan, Biden originally said he would not sign such a deal unless it was offered to him in tandem with a Democrat-only measure likely to contain programs related to what Biden calls "human infrastructure." Republicans threatened to walk away from their support of the infrastructure deal if it was linked to a second spending bill passed by reconciliation, or a simple majority.

Still, Biden’s push for tax hikes on high earners is likely to be linked to the second bill, the American Families Plan, which the White House price tagged at $1.8T in April.

Biden again pushed for a 15% minimum corporate tax rate, which would ensure dozens of the nation’s biggest companies don’t escape taxes in any given year but would also rein in tax breaks meant to spur innovation and hiring.

"I think you should be able to be a billionaire, I think you should be able to be a millionaire, but for Gods’ sake pay your fair share," the president said of the tax hikes.

WHAT'S IN THE BIPARTISAN INFRASTRUCTURE DEAL?

Other tax increases he’s proposed include raising the corporate tax rate from 21% to 28%. Sen. Joe Manchin, D-W.Va., whose vote no Democratic legislation passes without, has said 28% is too high, but he’d be satisfied with 25%. Biden also wants to raise the top individual tax rate from 37% to 39.6%, where it was before the 2017 tax cuts, which will be paid by families with joint taxable income of about $509,300 and individuals earning more than $452,700.

Biden has also proposed capital gains tax rate from a maximum of 20% to 39.6 for people earning more than $1 million each year.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

As for the bipartisan infrastructure plan, the White House said in a fact sheet that it would be funded with unused coronavirus relief funds, unused unemployment insurance, and sales from the strategic petroleum reserve, among other measures.

Fox Business' Meghan Henney contributed to this report.