Biden administration snoops around big banks to assess climate risk plans for investments and loans

The US Treasury Department has inquired how large banks are managing climate risk in their loan and investments strategies

ESG push is 'money grab' for major firms, not done for environmental interests: Luke Lloyd

Strategic Wealth Partners investment strategist Luke Lloyd discusses earnings growth projections, the ESG push among big firms and retail theft.

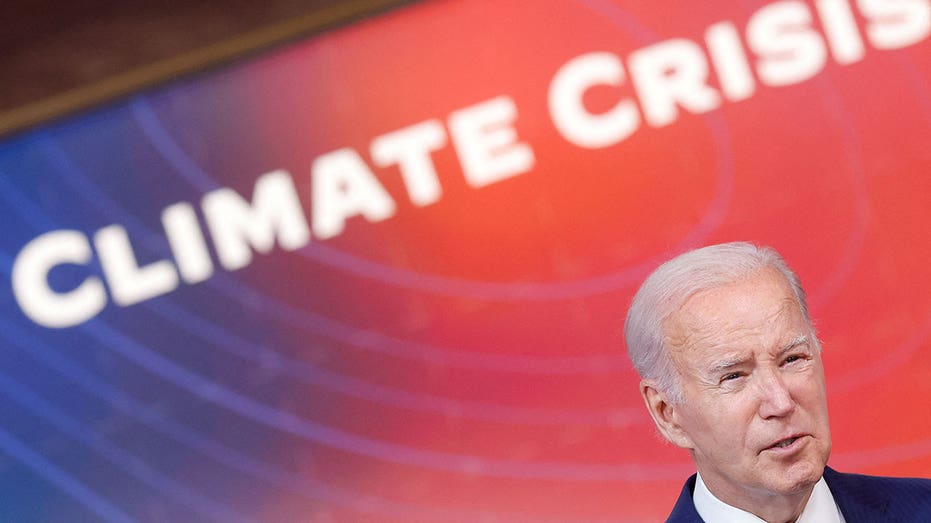

President Biden's administration has begun probing the nation's largest banks to assess their plans to mitigate climate risk with their loans and business.

A recent "discovery review" led by the U.S. Treasury Department's Office of the Comptroller of the Currency (OCC) looked into more than two dozen banks to determine how they are accounting for climate risk in their loans and investment strategies, in addition to investigating how they manage energy finance and greenhouse gas emissions, Reuters first reported.

The purpose of this review is to supervise bank activities and support the effective management of climate-related financial risks among institutions with more than $100 billion in assets, according to the Treasury.

"The OCC has been conducting supervision activities at its largest banks (those with over $100 billion in total assets) to understand the banks’ climate-related financial risk management programs," an OCC spokesperson told FOX Business.

WHAT IS ESG? INVESTING WITH ENVIRONMENTAL, SOCIAL AND GOVERNANCE IN MIND

A view of a sign board warning of extreme heat in Death Valley, California, July 15, 2023. (REUTERS/Jorge Garcia//File Photo / Reuters Photos)

"The OCC’s focus on and supervision of climate-related financial risk is firmly rooted in its mandate to ensure that national banks and federal savings associations operate in a safe and sound manner. The OCC’s approach is focused on banks’ risk management, not on setting industrial policy," the spokesperson emphasized.

President Biden has made identifying and acting on climate risk one of his administration's top priorities.

In October, the OCC, the Federal Reserve and the Federal Deposit Insurance Corporation jointly issued guidance for big banks to manage climate risk. More than 30 institutions met the regulator's $100 million asset threshold, Reuters reported.

The regulator used the discovery review to establish a baseline of banks' practices so it has a yardstick with which to assess their progress in implementing the guidance, sources told Reuters. The OCC may take disciplinary action as early as next year against banks that do not show progress, the sources added, requesting anonymity to discuss confidential regulatory matters.

BANKING REGULATOR WARNS FINANCIAL FIRMS ABOUT AI RISKS

President Biden delivers remarks on extreme heat conditions, from the South Court Auditorium on the White House campus, in Washington, D.C., July 27, 2023. (REUTERS/Jonathan Ernst/File Photo / Reuters Photos)

The OCC spokesperson did not discuss details of the discovery review.

According to Reuters, OCC conducted multiple information-gathering visits with banks mostly in the second half of 2023.

The meetings reportedly included specialists in risk management, operations and audit. Chief risk officers attended some of the meetings, Reuters reported.

OCC officials reportedly questioned banks about climate risk "to see if they responded coherently," the report said. Questions included how they would prepare for a transition to low-carbon energy and how they use data to monitor progress toward climate targets, among dozens of other topics.

WALL STREET BANKS WARN LAWMAKERS ABOUT NEW REGULATIONS

A former boat launch with the water much further away is seen on a beach at Salton Sea, California's largest inland lake, where the state's worst drought since 1977 has exacerbated an area already in decline, in Salton City, California, July 4, 2021. (REUTERS/Aude Guerrucci/File Photo / Reuters Photos)

The government is highly interested in whether banks' public comments on climate align with their investment plans and risk appetite, sources told Reuters.

OCC staff were at times joined by officials from the Federal Reserve Board, one source said, and in other cases by representatives of the Prudential Regulation Authority (PRA) of the Bank of England, another of the sources added. It is not unusual for the OCC to share information with the Bank of England and other foreign regulators through memorandums of understanding to better supervise global banks.

A PRA spokesperson did not comment to Reuters.

Acting OCC Comptroller Michael Hsu has said large banks should be proactive in managing climate risk.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"They should not wait for disaster to strike before they act. Prudence demands that regulators and the industry adapt as risks emerge," he told lawmakers in October, describing his agency's efforts to monitor how banks address climate change.

The OCC appointed its first-ever Chief Climate Risk Officer in July 2021. Former banker Nina Chen, who also worked at major non-profit The Nature Conservancy, has been serving in that role since September 2022.

Reuters contributed to this report.