Biden called upon by pro-growth groups to withdraw CFPB’s late fees rule

The CFPB rule would cap the amount of fees financial institutions can charge for late credit card payments

Trillions in credit card debt is catching up to American consumers: Jeff Sica

Circle Squared Alternative Investments founder Jeff Sica explains why consumer spending will dramatically decline before the holidays on ‘Varney & Co.’

A coalition of groups is calling for the Biden administration to withdraw the new rule put forward by the Consumer Financial Protection Bureau (CFPB) to impose a stricter cap on credit card late fees, arguing the regulation will hurt consumers and economic growth.

In a letter sent to President Biden and CFPB Director Rohit Chopra, as well as Congress’ banking, financial services and small business committees, the 30 signatory groups outlined their "strong opposition" to the late fees rule. The Biden administration’s rule would reduce the safe harbor dollar amount that credit card issuers can charge in late fees from up to $41 to $8. The rule would also eliminate the automatic inflation adjustment to that amount and ban late fees amounting to more than 25% of the consumer’s required credit card payment.

"At the White House this month, President Biden touted the rule, alleging it would give the most vulnerable Americans among us a much-needed break," the groups wrote. "This isn’t true. A stricter price cap will harm not only small businesses and the economy at large but also the low-income workers that the administration is intending to help. History indicates that consumers are the ones who bear the brunt of regulations like this one because, to offset the resulting costs, financial institutions ultimately impose new fees and higher interest rates while reducing Main Street’s credit access."

SUPREME COURT TAKES UP CASE THAT COULD DETERMINE CFPB’S FATE

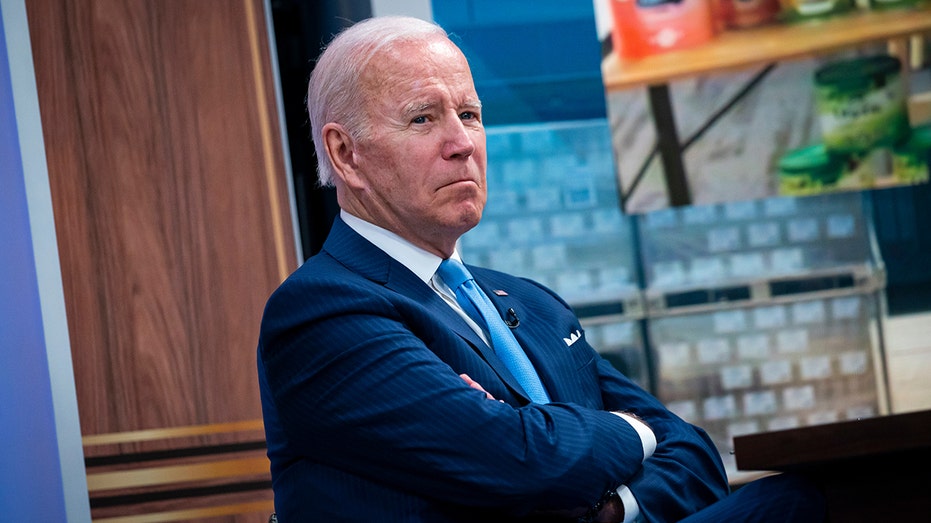

President Biden's Consumer Financial Protection Bureau is moving to cap late fees on credit cards. (Al Drago/Bloomberg via Getty Images / Getty Images)

The groups also raised concerns about the rule’s impact on smaller financial institutions that rely more heavily on fees to cover the costs of extending credit to consumers.

In its announcement of the proposed rule, the CFPB said that it "preliminarily found that late fee income exceeds associated collection costs by a factor of five" and that because credit card issuers can currently charge up to $41 for late fees, a "late fee of $8 would be sufficient for most issuers to cover collection costs incurred as a result of late payments."

"Over a decade ago, Congress banned excessive credit card late fees, but companies have exploited a regulatory loophole that has allowed them to escape scrutiny for charging an otherwise illegal junk fee," said Chopra. "Today’s proposed rule seeks to save families billions of dollars and ensure the credit card market is fair and competitive."

BIDEN ADMINISTRATION ANNOUNCES RULE TO REMOVE MEDICAL BILLS FROM CREDIT REPORTS

Consumer Financial Protection Bureau Director Rohit Chopra and President Biden argue the cap on credit card late fees will help consumers. (Anna Moneymaker/Getty Images / Getty Images)

Members of the groups critical of the CFPB’s rule argue that while it will provide financial relief to people who pay their credit card bills late, it will cause banks and credit unions to offset those costs by making financial services more costly for consumers who pay on time.

John Berlau, senior fellow and director of finance policy at the Competitive Enterprise Institute, told FOX Business, "As with Biden’s student loan bailout, this will punish responsible consumers. It’s almost certain — by the CFPB’s own admission — that this rule giving late-payers a break will lead to higher costs for responsible consumers who pay their credit card bills on time."

"Even by the president’s broad definition of ‘junk fees,’ charges for late payments do not fit the bill. There is nothing ‘hidden’ or ‘surprising’ about late fees," he added.

FEDERAL JUDGE RULES AGAINST CFPB’S ANTI-DISCRIMINATION EFFORT

Critics of the CFPB credit card late fees rule argue it will help late payers while making financial services less affordable and accessible for responsible consumers. (Samuel Corum/Bloomberg via Getty Images / Getty Images)

Grover Norquist, president of Americans for Tax Reform, told FOX Business, "In the realm of bad ideas, the Biden administration’s on deceptively named ‘junk fees’ is one of the worst. Biden, and Elizabeth Warren acolyte Rohit Chopra, have arbitrarily decided that credit card late fees charged by banks and credit unions are too high. What they fail to understand is that government-mandated price caps distort markets."

He went on to say that the CFPB is overstepping the authority it was granted by Congress on the issue and that additional regulations will ultimately raise costs for consumers.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"Congress never directed the CFPB to issue these new rules. In light of West Virginia v. EPA, the administrative state can no longer unilaterally issue rulemakings without Congressional imprimatur, or else risk costly litigation," Norquist explained. "More regulations on top of more regulations only leads to one thing: consumers paying more for goods and services. In this case, the CFPB’s new rules make it more costly to access credit via credit cards to pay for everyday expenses such as gas, utilities, and groceries."