Biden's plan to overhaul 401(k) tax breaks could force some companies to cut retirement benefits

'Tens of millions of people' could lose their plans as a result of the proposed change, one industry expert estimated

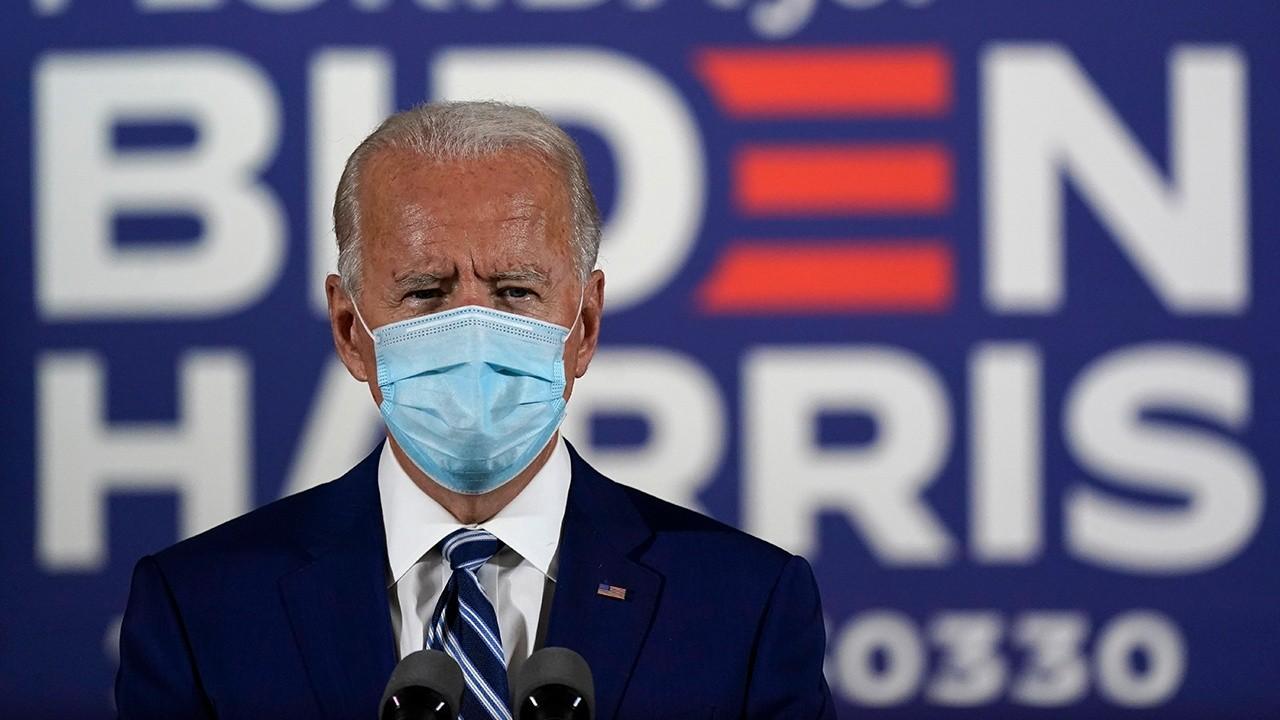

A frequently overlooked part of Democratic presidential nominee Joe Biden's platform would upend the traditional tax preferences of retirement accounts like 401(k) plans — a change that industry experts warned could force some small companies to cut those benefits.

Biden has vowed to convert the current deductibility of traditional retirement contributions into matching refundable credits for 401(k)s, IRAs and others.

The proposal from the former vice president is intended to level the playing field of tax deferral in traditional retirement accounts, with the intent of boosting saving among low-income earners. But industry experts cautioned that by reducing the benefits that higher earners receive, the Biden campaign may have increased the likelihood of businesses abandoning those retirement benefits altogether.

"If you take the tax deduction away and reduce the tax benefit, without also addressing the nondiscrimination rules, you've blown up the bargain," Brian Graff, the CEO of the American Retirement Association, told FOX Business.

HOW A BIDEN PRESIDENCY COULD CHANGE YOUR TAX BILL

That's because employers who make contributions to a 401(k) must offer that same benefit to their workers. Under Biden's plan, business owners would have to reduce their own tax benefit, while continuing to contribute on behalf of their employees, which is expensive, particularly during a pandemic.

Some of those bosses — traditionally the higher-income earners — may lack the incentive to offer those retirement accounts if their tax benefit is slashed, Graff said.

"When you mess up that bargain, you're disincentivizing those small business owners from having that plan anymore," he said. "Not only is it unfair to those small business owners, it's going to reduce the likelihood that they're going to offer those benefits to their employees. And that's particularly acute in a challenging time like now."

"Tens of millions of people" could lose their plans as a result of the proposed change, Graff estimated. Small businesses, which would be the most affected by the new rules, employ roughly 58.9 million people, or 47.5% of the nation's workforce.

BIDEN PLEDGES TO ROLL BACK TRUMP'S TAX CUTS: 'A LOT OF YOU MAY NOT LIKE THAT'

That sentiment was echoed by Paul Swanson, the vice president and head of intermediary distribution at CUNA Mutual Retirement Solutions. Small businesses are typcally privately owned, and the individuals making decisions about what retirement benefits to offer are the highly compensated employees who will be most affected by the overhaul.

"If they don’t have as much of a personal incentive to offer the plan, if you take away the incentive, but leave the burden, they may very well decide it’s not worth it for them to offer the plan," Swanson told FOX Business. "So I think there is some risk there. "

Under current law, workers contribute pre-tax dollars to the accounts, reducing their annual taxable income. (When the funds are eventually withdrawn in retirement, then the money is taxed). But the system tends to disproportionately benefit wealthier earners since deductions are more valuable the higher one's income bracket is.

For instance, a taxpayer in the top income bracket would receive a $37 benefit for every $100 contributed to a retirement account. By comparison, a taxpayer in the bottom bracket would get just a $10 benefit in exchange for the same $100 contribution.

BIDEN PLEDGES TO HIKE TAXES ON AMERICANS EARNING MORE THAN $400K

The former vice president has pledged to eliminate such deductions and replace them with flat tax credits for each dollar saved. The campaign has not specified with the percentage would be, but the Tax Foundation estimated that a 26% credit would be roughly revenue-neutral, something the Biden campaign is aiming for. That would mean regardless of their income, any taxpayer who contributed $100 to a retirement account would receive a $26 benefit.

"When you boil it down, what this does is, it benefits the people in the lowest two tax brackets," Swanson, a CFA, told FOX Business. "It increases the efficiency with which they save; they get a bigger bang for their buck for participating in a 401(k) program."

Yet he said he unsure whether the plan would actually drive savings among low-income Americans — and would actually reduce their monthly paycheck.

"Lower-income workers, they operate on a shoestring budget," he said. "They live paycheck-to-paycheck. This proposal will actually decrease their takehome pay."

SOME RETIREES COULD SEE 5% SOCIAL SECURITY RAISE WITH BIDEN AS PRESIDENT

For instance, if a worker in the 10% tax bracket kicked in $100 to their 401(k), it would only cost them about $90 under the current system, thanks to the income tax deduction. But under the new one, it would cost them $100 to save $100.

"At the end of the year, they'll get a matching credit, and it will benefit them," Swanson said. "But next Friday, their paycheck's going down. Will that drive the desired behavior? I don't know."

Detractors of the proposal have also noted it would reduce the tax benefit of traditional retirement accounts for married couples earning above $80,250 and earning under $400,000 -- violating the former vice president's pledge to not hike taxes on earners below the $400,000 threshold.

"This increases federal tax on any married couple earning more than $80,000," Swanson said.

GET FOX BUSINESS ON THE GO BY CLICKING HERE